About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 29 results capital clear search

We provide a theory-grounded, socio-geographic agent-based model to present a possible explanation for human movement in the Adriatic region within the Cetina phenomenon.

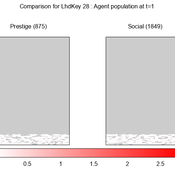

Focusing on ideas of social capital theory from Piere Bordieu (1986), we implement agent mobility in an abstract geography based on cultural capital (prestige) and social capital (social position). Agents hold myopic representations of social (Schaff, 2016) and geographical networks and decide in a heuristic way on moving (and where) or staying.

The model is implemented in a fork of the Laboratory for Simulation Development (LSD), appended with GIS capabilities (Pereira et. al. 2020).

Peer reviewed Agent-Based Ramsey growth model with Brown and Green capital (ABRam-BG)

Sarah Wolf Aida Sarai Figueroa Alvarez | Published Monday, December 09, 2024The purpose of the ABRam-BG model is to study belief dynamics as a potential driver of green (growth) transitions and illustrate their dynamics in a closed, decentralized economy populated by utility maximizing agents with an environmental attitude. The model is built using the ABRam-T model (for model visit: https://doi.org/10.25937/ep45-k084) and introduces two types of capital – green (low carbon intensity) and brown (high carbon intensity) – with their respective technological progress levels. ABRam-BG simulates a green transition as an emergent phenomenon resulting from well-known opinion dynamics along the economic process.

Agent-based model of power dynamics in agri-food systems

Tim Williams | Published Sunday, October 27, 2024 | Last modified Thursday, June 12, 2025This is a stylised agent-based model designed to explore the conditions that lead to lock-ins and transitions in agri-food systems.

The model represents interactions between four different types of agents: farmers, consumers, markets, and the state. Farmers and consumers are heterogeneous, and at each time step decide whether to trade with one of two market agents: the conventional or alternative. The state agent provides subsidies to the farmers at each time step.

The key emergent outcome is the fraction of trade in each time step that flows through the alternative market agent. This arises from the distributed decisions of farmer and consumer agents. A “sustainability transition” is defined as a shift in the dominant practices (and associated balance of power) towards the alternative paradigm.

…

An Agent-Based Model of an Insurer's Estimated Capital Requirement in a Simple Insurance Market with Imperfect Information in C#

Rei England | Published Sunday, September 24, 2023This is an agent-based model of a simple insurance market with two types of agents: customers and insurers. Insurers set premium quotes for each customer according to an estimation of their underlying risk based on past claims data. Customers either renew existing contracts or else select the cheapest quote from a subset of insurers. Insurers then estimate their resulting capital requirement based on a 99.5% VaR of their aggregate loss distributions. These estimates demonstrate an under-estimation bias due to the winner’s curse effect.

U-TRANS Modelling Urban Transition with Coupled Housing and Labour Markets

Bernardo Furtado Jiaqi Ge | Published Monday, July 31, 2023We develop an agent-based model (U-TRANS) to simulate the transition of an abstract city under an industrial revolution. By coupling the labour and housing markets, we propose a holistic framework that incorporates the key interacting factors and micro processes during the transition. Using U-TRANS, we look at five urban transition scenarios: collapse, weak recovery, transition, enhanced training and global recruit, and find the model is able to generate patterns observed in the real world. For example, We find that poor neighbourhoods benefit the most from growth in the new industry, whereas the rich neighbourhoods do better than the rest when the growth is slow or the situation deteriorates. We also find a (subtle) trade-off between growth and equality. The strategy to recruit a large number of skilled workers globally will lead to higher growth in GDP, population and human capital, but it will also entail higher inequality and market volatility, and potentially create a divide between the local and international workers. The holistic framework developed in this paper will help us better understand urban transition and detect early signals in the process. It can also be used as a test-bed for policy and growth strategies to help a city during a major economic and technological revolution.

Agent-Based Simulation for International Tax Compliance

Peter Gerbrands | Published Tuesday, July 18, 2023Country-by-Country Reporting and Automatic Exchange of Information have recently been implemented in European Union (EU) countries. These international tax reforms increase tax compliance in the short term. In the long run, however, taxpayers will continue looking abroad to avoid taxation and, countries, looking for additional revenues, will provide opportunities. As a result, tax competition intensifies and the initial increase in compliance could reverse. To avoid international tax reforms being counteracted by tax competition, this paper suggests bilateral responsive regulation to maximize compliance. This implies that countries would use different tax policy instruments toward other countries, including tax and secrecy havens.

To assess the effectiveness of fully or partially enforce tax policies, this agent based model has been ran many times under different enforcement rules, which influence the perceived enforced- and voluntary compliance, as the slippery-slope model prescribes. Based on the dynamics of this perception and the extent to which agents influence each other, the annual amounts of tax evasion, tax avoidance and taxes paid are calculated over longer periods of time.

The agent-based simulation finds that a differentiated policy response could increase tax compliance by 6.54 percent, which translates into an annual increase of €105 billion in EU tax revenues on income, profits, and capital gains. Corporate income tax revenues in France, Spain, and the UK alone would already account for €35 billion.

An Agent Based Model of International Capital Flows

Harvey Baldovino | Published Thursday, April 06, 2023This is a preliminary attempt in creating an Agent-Based Model of capital flows. This is based on the theory of capital flows based on interest-rate differentials. Foreign capital flows to a country with higher interest rates relative to another. The model shows how capital volatilty and wealth concentration are affected by the speed of capital flow, number of investors, magnitude of changes in interest rate due to capital flows and the interest differential threshold that investors set in deciding whether to move capital or not. Investors in the model are either “regional” investors (only investing in neighboring countries) and “global” investors (those who invest anywhere in the world).

In the future, the author hopes to extend this model to incorporate capital flow based on changes in macroeconomic fundamentals, exchange rate volatility, behavioral finance (for instance, herding behavior) and the presence of capital controls.

A model of the emergence of intersectional life course inequalities through transitions in the workplace. It explores LGBTQ citizens’ career outcomes and trajectories in relation to several mediating factors: (i) workplace discrimination; (ii) social capital; (iii) policy interventions (i.e., workplace equality, diversity, and inclusion policies); (iv) and LGBTQ employees’ behaviours in response to discrimination (i.e., moving workplaces and/or different strategies for managing the visibility of their identity).

Peer reviewed Labor and environment in global value chains: An evolutionary policy study with a three-sector and two-region agent-based macroeconomic model

Lena Gerdes Manuel Scholz-Wäckerle Bernhard Rengs | Published Wednesday, December 22, 2021With this model, we investigate resource extraction and labor conditions in the Global South as well as implications for climate change originating from industry emissions in the North. The model serves as a testbed for simulation experiments with evolutionary political economic policies addressing these issues. In the model, heterogeneous agents interact in a self-organizing and endogenously developing economy. The economy contains two distinct regions – an abstract Global South and Global North. There are three interlinked sectors, the consumption good–, capital good–, and resource production sector. Each region contains an independent consumption good sector, with domestic demand for final goods. They produce a fictitious consumption good basket, and sell it to the households in the respective region. The other sectors are only present in one region. The capital good sector is only found in the Global North, meaning capital goods (i.e. machines) are exclusively produced there, but are traded to the foreign as well as the domestic market as an intermediary. For the production of machines, the capital good firms need labor, machines themselves and resources. The resource production sector, on the other hand, is only located in the Global South. Mines extract resources and export them to the capital firms in the North. For the extraction of resources, the mines need labor and machines. In all three sectors, prices, wages, number of workers and physical capital of the firms develop independently throughout the simulation. To test policies, an international institution is introduced sanctioning the polluting extractivist sector in the Global South as well as the emitting industrial capital good producers in the North with the aim of subsidizing innovation reducing environmental and social impacts.

SimPioN - Simulating Path dependence in inter-organisational Networks

Nanda Wijermans Frithjof Stöppler | Published Monday, January 11, 2021The SimPioN model aims to abstractly reproduce and experiment with the conditions under which a path-dependent process may lead to a (structural) network lock-in in interorganisational networks.

Path dependence theory is constructed around a process argumentation regarding three main elements: a situation of (at least) initially non-ergodic (unpredictable with regard to outcome) starting conditions in a social setting; these become reinforced by the workings of (at least) one positive feedback mechanism that increasingly reduces the scope of conceivable alternative choices; and that process finally results in a situation of lock-in, where any alternatives outside the already adopted options become essentially impossible or too costly to pursue despite (ostensibly) better options theoretically being available.

The purpose of SimPioN is to advance our understanding of lock-ins arising in interorganisational networks based on the network dynamics involving the mechanism of social capital. This mechanism and the lock-ins it may drive have been shown above to produce problematic consequences for firms in terms of a loss of organisational autonomy and strategic flexibility, especially in high-tech knowledge-intensive industries that rely heavily on network organising.

…

Displaying 10 of 29 results capital clear search