Peter Gerbrands

Affiliations Personal homepage Professional homepagehttps://www.uu.nl/staff/PGerbrands

ORCID more infohttps://orcid.org/0000-0002-1205-823X

GitHub more infoNo associated GitHub account.

Peter Gerbrands is a Post-Doctoral Researcher at the of Utrecht University School of Economics, where is develops the data infrastructure for FIRMBACKBONE. He teaches data science courses: “Applied Data Analysis and Visualization” and “Introduction to R”. His research interests are agent-based simulations, social network analysis, complex systems, big data analysis, statistical learning, and computational social science. He applies his skills primarily for policy analysis, especially related to illicit financial flows, i.e. tax evasion, tax avoidance and money laundering and has published in Regulation & Governance, and EPJ Data Science. Prior to becoming an academic, Peter had a long career in IT consulting. In Fall 2023, he is a Visiting Research Scholar at SUNY Binghamton in NY.

Research Interests

agent-based simulations

social network analysis

complex systems

big data analysis

statistical learning

computational social science

Agent-Based Simulation for International Tax Compliance

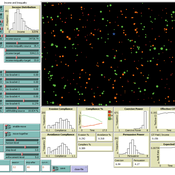

Peter Gerbrands | Published Tuesday, July 18, 2023Country-by-Country Reporting and Automatic Exchange of Information have recently been implemented in European Union (EU) countries. These international tax reforms increase tax compliance in the short term. In the long run, however, taxpayers will continue looking abroad to avoid taxation and, countries, looking for additional revenues, will provide opportunities. As a result, tax competition intensifies and the initial increase in compliance could reverse. To avoid international tax reforms being counteracted by tax competition, this paper suggests bilateral responsive regulation to maximize compliance. This implies that countries would use different tax policy instruments toward other countries, including tax and secrecy havens.

To assess the effectiveness of fully or partially enforce tax policies, this agent based model has been ran many times under different enforcement rules, which influence the perceived enforced- and voluntary compliance, as the slippery-slope model prescribes. Based on the dynamics of this perception and the extent to which agents influence each other, the annual amounts of tax evasion, tax avoidance and taxes paid are calculated over longer periods of time.

The agent-based simulation finds that a differentiated policy response could increase tax compliance by 6.54 percent, which translates into an annual increase of €105 billion in EU tax revenues on income, profits, and capital gains. Corporate income tax revenues in France, Spain, and the UK alone would already account for €35 billion.

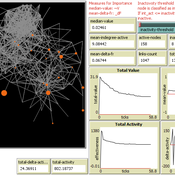

Simulating Sustainability of Collective Awareness Platform for Sustainability and Social Innovation (CAPS)

Peter Gerbrands | Published Friday, May 08, 2020In an associated paper which focuses on analyzing the structure of several egocentric networks of collective awareness platforms for sustainable innovation (CAPS), this model is developed. It answers the question whether the network structure is determinative for the sustainability of the created awareness. Based on a thorough literature review a model is developed to explain and operationalize the concept of sustainability of a social network in terms of importance, effectiveness and robustness. By developing this agent-based model, the expected outcomes after the dissolution of the CAPS are predicted and compared with the results of a network with the same participants but with different ties. Twitter data from different CAPS is collected and used to feed the simulation. The results show that the structure of the network is of key importance for its sustainability. With this knowledge and the ability to simulate the results after network changes have taken place, CAPS can assess the sustainability of their legacy and actively steer towards a longer lasting potential for social innovation. The retrieved knowledge urges organizations like the European Commission to adopt a more blended approach focusing not only on solving societal issues but on building a community to sustain the initiated development.

Under development.