About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 36 results firms clear search

Peer reviewed Green Consumption Tipping Point

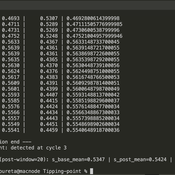

Mario | Published Thursday, February 26, 2026This model is a minimal agent-based model (ABM) of green consumption and market tipping dynamics in a stylised two-firm economy. It is designed as an existence proof to illustrate how weak individual preferences, when combined with habit formation, social influence, and firm price adaptation, can generate non-linear transitions (tipping points) in market outcomes.

The economy consists of:

1) Two firms, each supplying a differentiated consumption bundle that differs in its fixed green share (one relatively greener, one less green).

2) Many households, each consuming a unit mass per period and allocating consumption between the two firms.

…

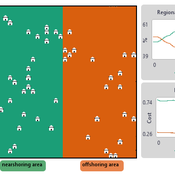

NOMAD: Near–Off Mobility under Aspiration Dynamics

Alejandro Platas López | Published Wednesday, December 17, 2025NOMAD is an agent-based model of firm location choice between two aggregate regions (“near” and “off”) under logistics uncertainty. Firms occupy sites characterised by attractiveness and logistics risk, earn a risk-adjusted payoff that depends on regional costs (wages plus congestion) and an individual risk-tolerance trait, and update location choices using aspiration-based satisficing rules with switching frictions. Logistics risk evolves endogenously on occupied sites through a region-specific absorption mechanism (good/bad events that reduce/increase risk), while congestion feeds back into regional costs via regional shares and local crowding. Runs stop endogenously once the near-region share becomes quasi-stable after burn-in, and the model records time series and quasi-stable outcomes such as near/off composition, switching intensity, costs, average risk, and average risk tolerance.

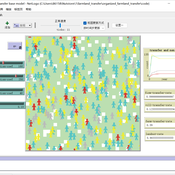

An Agent-Based Model of Farmland Trading Partners Selection

Hang Xiong Chen Yuxin Xinfan Wang | Published Tuesday, August 19, 2025This base model uses an agent-based approach to represent heterogeneous farmers’ trading partners selection among multiple recipients (other farmers, village collectives, and firms). Each period, a potential transfer-out farmer decides whether to transfer based on a net-return versus transaction-cost trade-off; if transferring, the farmer selects the counterparty with the highest expected profit. Meanwhile, social learning—operationalized as logistic accumulation of neighborhood experience—continuously updates uncertainty, which in turn shapes transaction costs and subsequent decisions.

Finance and Market Concentration Using Agent-Based Modeling: Evidence from South Korea

Yunkyeong Seo Zeynep Elif Altiner Sumin Lee Ilchul Moon Taesub Yun | Published Friday, March 28, 2025Amidst the global trend of increasing market concentration, this paper examines the role of finance

in shaping it. Using Agent-Based Modeling (ABM), we analyze the impact of financial policies on market concentration

and its closely related variables: economic growth and labor income share. We extend the Keynes

meets Schumpeter (K+S) model by incorporating two critical assumptions that influence market concentration.

Policy experiments are conducted with a model validated against historical trends in South Korea. For policy

variables, the Debt-to-Sales Ratio (DSR) limit and interest rate are used as levers to regulate the quantity and

…

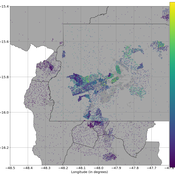

Peer reviewed A Simple Agent-Based Spatial Model of the Economy: Tools for Policy

Bernardo Furtado Isaque Daniel Rocha Eberhardt | Published Tuesday, July 05, 2022This study simulates the evolution of artificial economies in order to understand the tax relevance of administrative boundaries in the quality of life of its citizens. The modeling involves the construction of a computational algorithm, which includes citizens, bounded into families; firms and governments; all of them interacting in markets for goods, labor and real estate. The real estate market allows families to move to dwellings with higher quality or lower price when the families capitalize property values. The goods market allows consumers to search on a flexible number of firms choosing by price and proximity. The labor market entails a matching process between firms (given its location) and candidates, according to their qualification. The government may be configured into one, four or seven distinct sub-national governments, which are all economically conurbated. The role of government is to collect taxes on the value added of firms in its territory and invest the taxes into higher levels of quality of life for residents. The results suggest that the configuration of administrative boundaries is relevant to the levels of quality of life arising from the reversal of taxes. The model with seven regions is more dynamic, but more unequal and heterogeneous across regions. The simulation with only one region is more homogeneously poor. The study seeks to contribute to a theoretical and methodological framework as well as to describe, operationalize and test computer models of public finance analysis, with explicitly spatial and dynamic emphasis. Several alternatives of expansion of the model for future research are described. Moreover, this study adds to the existing literature in the realm of simple microeconomic computational models, specifying structural relationships between local governments and firms, consumers and dwellings mediated by distance.

Peer reviewed Labor and environment in global value chains: An evolutionary policy study with a three-sector and two-region agent-based macroeconomic model

Lena Gerdes Manuel Scholz-Wäckerle Bernhard Rengs | Published Wednesday, December 22, 2021With this model, we investigate resource extraction and labor conditions in the Global South as well as implications for climate change originating from industry emissions in the North. The model serves as a testbed for simulation experiments with evolutionary political economic policies addressing these issues. In the model, heterogeneous agents interact in a self-organizing and endogenously developing economy. The economy contains two distinct regions – an abstract Global South and Global North. There are three interlinked sectors, the consumption good–, capital good–, and resource production sector. Each region contains an independent consumption good sector, with domestic demand for final goods. They produce a fictitious consumption good basket, and sell it to the households in the respective region. The other sectors are only present in one region. The capital good sector is only found in the Global North, meaning capital goods (i.e. machines) are exclusively produced there, but are traded to the foreign as well as the domestic market as an intermediary. For the production of machines, the capital good firms need labor, machines themselves and resources. The resource production sector, on the other hand, is only located in the Global South. Mines extract resources and export them to the capital firms in the North. For the extraction of resources, the mines need labor and machines. In all three sectors, prices, wages, number of workers and physical capital of the firms develop independently throughout the simulation. To test policies, an international institution is introduced sanctioning the polluting extractivist sector in the Global South as well as the emitting industrial capital good producers in the North with the aim of subsidizing innovation reducing environmental and social impacts.

Knowledge Based Economy

Guido Fioretti Sirio Capizzi Ruggero Rossi Martina Casari Ala Jlif | Published Tuesday, May 18, 2021Knowledge Based Economy (KBE) is an artificial economy where firms placed in geographical space develop original knowledge, imitate one another and eventually recombine pieces of knowledge. In KBE, consumer value arises from the capability of certain pieces of knowledge to bridge between existing items (e.g., Steve Jobs illustrated the first smartphone explaining that you could make a call with it, but also listen to music and navigate the Internet). Since KBE includes a mechanism for the generation of value, it works without utility functions and does not need to model market exchanges.

Peer reviewed PolicySpace2: modeling markets and endogenous public policies

Bernardo Furtado | Published Thursday, February 25, 2021 | Last modified Friday, January 14, 2022Policymakers decide on alternative policies facing restricted budgets and uncertain future. Designing public policies is further difficult due to the need to decide on priorities and handle effects across policies. Housing policies, specifically, involve heterogeneous characteristics of properties themselves and the intricacy of housing markets and the spatial context of cities. We propose PolicySpace2 (PS2) as an adapted and extended version of the open source PolicySpace agent-based model. PS2 is a computer simulation that relies on empirically detailed spatial data to model real estate, along with labor, credit, and goods and services markets. Interaction among workers, firms, a bank, households and municipalities follow the literature benchmarks to integrate economic, spatial and transport scholarship. PS2 is applied to a comparison among three competing public policies aimed at reducing inequality and alleviating poverty: (a) house acquisition by the government and distribution to lower income households, (b) rental vouchers, and (c) monetary aid. Within the model context, the monetary aid, that is, smaller amounts of help for a larger number of households, makes the economy perform better in terms of production, consumption, reduction of inequality, and maintenance of financial duties. PS2 as such is also a framework that may be further adapted to a number of related research questions.

SimPioN - Simulating Path dependence in inter-organisational Networks

Nanda Wijermans Frithjof Stöppler | Published Monday, January 11, 2021The SimPioN model aims to abstractly reproduce and experiment with the conditions under which a path-dependent process may lead to a (structural) network lock-in in interorganisational networks.

Path dependence theory is constructed around a process argumentation regarding three main elements: a situation of (at least) initially non-ergodic (unpredictable with regard to outcome) starting conditions in a social setting; these become reinforced by the workings of (at least) one positive feedback mechanism that increasingly reduces the scope of conceivable alternative choices; and that process finally results in a situation of lock-in, where any alternatives outside the already adopted options become essentially impossible or too costly to pursue despite (ostensibly) better options theoretically being available.

The purpose of SimPioN is to advance our understanding of lock-ins arising in interorganisational networks based on the network dynamics involving the mechanism of social capital. This mechanism and the lock-ins it may drive have been shown above to produce problematic consequences for firms in terms of a loss of organisational autonomy and strategic flexibility, especially in high-tech knowledge-intensive industries that rely heavily on network organising.

…

Peer reviewed Industrial Symbiosis Network implementation ABM

Igor Nikolic Kasper Pieter Hendrik Lange Gijsbert Korevaar Paulien Herder | Published Tuesday, December 01, 2020 | Last modified Wednesday, June 16, 2021The purpose of the model is to explore the influence of actor behaviour, combined with environment and business model design, on the survival rates of Industrial Symbiosis Networks (ISN), and the cash flows of the agents. We define an ISN to be robust, when it is able to run for 10 years, without falling apart due to leaving agents.

The model simulates the implementation of local waste exchange collaborations for compost production, through the ISN implementation stages of awareness, planning, negotiation, implementation, and evaluation.

One central firm plays the role of waste processor in a local composting initiative. This firm negotiates with other firms to become a supplier of their organic residual streams. The waste suppliers in the model can decide to join the initiative, or to have the waste brought to the external waste incinerator. The focal point of the model are the company-level interactions during the implementation or ending of synergies.

…

Displaying 10 of 36 results firms clear search