About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 185 results reviewed clear search

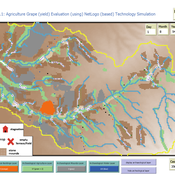

Peer reviewed Agriculture.Grape.yield.Evaluation.using.NetLogo.based.Technology.Simulation (AGENTS): A NetLogo agent-based model developed to assess viticulture efficiency in Byzantine Shivta.

Barak Garty Gil Gambash Guy BarOz Sharona T Levy | Published Friday, December 06, 2024AGENTS model is an agent-based computational framework designed to explore the socio-ecological and economic dynamics of agricultural production in the Byzantine Negev Highlands, with a focus on viticulture. It integrates historical, environmental, and social factors to simulate settlement sustainability, crop yields, and the impacts of varying climate conditions. The model is built in NetLogo and incorporates GIS-based topographical and hydrological data. Key features include the ability to assess climate impacts on crop profitability and settlement strategies, evaluate economic outputs of ancient vineyards, and simulate agent decision-making processes under diverse scenarios.

The AGENTS model is highly flexible, enabling users to simulate agricultural regimes with any two crops: one cash crop (a crop grown for profit, e.g., grapevines) and one staple crop (a crop grown for subsistence, e.g., wheat). While the default setup models viticulture and wheat cultivation in the Byzantine Negev Highlands, users can adapt the model to different environmental and socio-ecological contexts worldwide—both past and present.

Users can load external files to customize precipitation, evaporation, topography, and labor costs (measured as man-days per 0.1ha, converted to kg of wheat per model patch size area), and can also edit key parameters related to yield calculations. This includes modifying crop-specific yield formulas, soil and runoff indices, and any factors influencing crop performance. The model inherently simulates cash crops grown in floodplain regions and staple crops cultivated along riverbanks, providing a powerful tool to investigate societal resilience and responses to climate stressors across diverse environments.

…

Peer reviewed NoD-Neg: A Non-Deterministic model of affordable housing Negotiations

Aya Badawy Nuno Pinto Richard Kingston | Published Sunday, September 08, 2024The Non-Deterministic model of affordable housing Negotiations (NoD-Neg) is designed for generating hypotheses about the possible outcomes of negotiating affordable housing obligations in new developments in England. By outcomes we mean, the probabilities of failing the negotiation and/or the different possibilities of agreement.

The model focuses on two negotiations which are key in the provision of affordable housing. The first is between a developer (DEV) who is submitting a planning application for approval and the relevant Local Planning Authority (LPA) who is responsible for reviewing the application and enforcing the affordable housing obligations. The second negotiation is between the developer and a Registered Social Landlord (RSL) who buys the affordable units from the developer and rents them out. They can negotiate the price of selling the affordable units to the RSL.

The model runs the two negotiations on the same development project several times to enable agents representing stakeholders to apply different negotiation tactics (different agendas and concession-making tactics), hence, explore the different possibilities of outcomes.

The model produces three types of outputs: (i) histograms showing the distribution of the negotiation outcomes in all the simulation runs and the probability of each outcome; (ii) a data file with the exact values shown in the histograms; and (iii) a conversation log detailing the exchange of messages between agents in each simulation run.

Peer reviewed HUMLAND2: HUMan impact on LANDscapes agent-based model

Fulco Scherjon Anastasia Nikulina Anhelina Zapolska Maria Antonia Serge Marco Davoli Dave van Wees Katharine MacDonald Elena A. Pearce | Published Friday, August 30, 2024The HUMan Impact on LANDscapes (HUMLAND) 2.0.0 is an enhanced version of HUMLAND 1.0.0, developed to track and quantify the intensity of various impacts on landscapes at a continental scale. The model is designed to identify the most influential factors in the transformation of interglacial vegetation, with a particular focus on the burning practices of hunter-gatherers. HUMLAND 2.0.0 incorporates a wide range of spatial datasets as both inputs and targets (expected modelling results) for simulations across Last Interglacial (~130,000–116,000 BP) and Early Holocene (~11,700–8,000 BP).

Peer reviewed Behavior changes through influence

Daria Soboleva | Published Friday, August 30, 2024The model is designed to simulate the behavior and decision-making processes of individuals (agents) in a social network. It aims to represent the changes in individual probability to take any action based on changes in attributes. The action is anything that can be reasonably influenced by the three influencing methods implemented in this model: peer pressure, social media, and state campaigns, and for which the user has a decision-making model. The model is implemented in the multi-agent programmable environment NetLogo 6.3.0.

Peer reviewed Agent-Based Insight into Eco-Choices: Simulating the Fast Fashion Shift

Daria Soboleva Angel Sánchez | Published Wednesday, August 07, 2024 | Last modified Wednesday, June 11, 2025The present model was created and used for the study titled ``Agent-Based Insight into Eco-Choices: Simulating the Fast Fashion Shift.” The model is implemented in the multi-agent programmable environment NetLogo 6.3.0. The model is designed to simulate the behavior and decision-making processes of individuals (agents) in a social network. It focuses on how agents interact with their peers, social media, and government campaigns, specifically regarding their likelihood to purchase fast fashion.

Peer reviewed FISHCODE - FIsheries Simulation with Human COmplex DEcision-making

Birgit Müller Gunnar Dressler Jonas Letschert Christian Möllmann Vanessa Stelzenmüller | Published Monday, August 05, 2024FIsheries Simulation with Human COmplex DEcision-making (FISHCODE) is an agent-based model to depict and analyze current and future spatio-temporal dynamics of three German fishing fleets in the southern North Sea. Every agent (fishing vessel) makes daily decisions about if, what, and how long to fish. Weather, fuel and fish prices, as well as the actions of their colleagues influence agents’ decisions. To combine behavioral theories and enable agents to make dynamic decision, we implemented the Consumat approach, a framework in which agents’ decisions vary in complexity and social engagement depending on their satisfaction and uncertainty. Every agent has three satisfactions and two uncertainties representing different behavioral aspects, i.e. habitual behavior, profit maximization, competition, conformism, and planning insecurity. Availability of extensive information on fishing trips allowed us to parameterize many model parameters directly from data, while others were calibrated using pattern oriented modelling. Model validation showed that spatial and temporal aggregated ABM outputs were in realistic ranges when compared to observed data. Our ABM hence represents a tool to assess the impact of the ever growing challenges to North Sea fisheries and provides insight into fisher behavior beyond profit maximization.

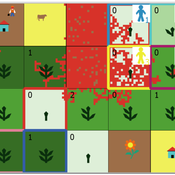

Peer reviewed A Picit Jeu: an Agent-Based Model for role-playing game

James Millington Ingrid Vigna | Published Friday, May 24, 2024A Picit Jeu is an agent-based model (ABM) developed as a supporting tool for a role-playing game of the same name. The game is intended for stakeholders involved in land management and fire prevention at a municipality level. It involves four different roles: farmers, forest technicians, municipal administrators and forest private owners. The model aims to show the long-term effects of their different choices about forest and pasture management on fire hazard, letting them test different management strategies in an economically constraining context. It also allows the players to explore different climatic and economic scenarios. A Picit Jeu ABM reproduces the ecological, social and economic characteristics and dynamics of an Alpine valley in north-west Italy. The model should reproduce a primary general pattern: the less players undertake landscape management actions, by thinning and cutting forests or grazing pastures, the higher the probability that a fire will burn a large area of land.

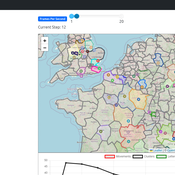

Peer reviewed Historical Letters

Bernardo Buarque Malte Vogl Jascha Merijn Schmitz Aleksandra Kaye | Published Thursday, May 16, 2024 | Last modified Friday, May 24, 2024A letter sending model with historically informed initial positions to reconstruct communication and archiving processes in the Republic of Letters, the 15th to 17th century form of scholarship.

The model is aimed at historians, willing to formalize historical assumptions about the letter sending process itself and allows in principle to set heterogeneous social roles, e.g. to evaluate the role of gender or social status in the formation of letter exchange networks. The model furthermore includes a pruning process to simulate the loss of letters to critically asses the role of biases e.g. in relation to gender, geographical regions, or power structures, in the creation of empirical letter archives.

Each agent has an initial random topic vector, expressed as a RGB value. The initial positions of the agents are based on a weighted random draw based on data from [2]. In each step, agents generate two neighbourhoods for sending letters and potential targets to move towards. The probability to send letters is a self-reinforcing process. After each sending the internal topic of the receiver is updated as a movement in abstract space by a random amount towards the letters topic.

…

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

Peer reviewed The Viability of the Social-Ecological Agroecosystem (ViSA) Spatial Agent-based Model

Mostafa Shaaban | Published Monday, March 25, 2024ViSA 2.0.0 is an updated version of ViSA 1.0.0 aiming at integrating empirical data of a new use case that is much smaller than in the first version to include field scale analysis. Further, the code of the model is simplified to make the model easier and faster. Some features from the previous version have been removed.

It simulates decision behaviors of different stakeholders showing demands for ecosystem services (ESS) in agricultural landscape. It investigates conditions and scenarios that can increase the supply of ecosystem services while keeping the viability of the social system by suggesting different mixes of initial unit utilities and decision rules.

Displaying 10 of 185 results reviewed clear search