About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 3 of 3 results role-playing games clear

Peer reviewed A Picit Jeu: an Agent-Based Model for role-playing game

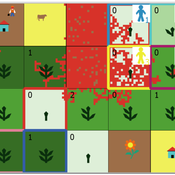

Ingrid Vigna James Millington | Published Friday, May 24, 2024A Picit Jeu is an agent-based model (ABM) developed as a supporting tool for a role-playing game of the same name. The game is intended for stakeholders involved in land management and fire prevention at a municipality level. It involves four different roles: farmers, forest technicians, municipal administrators and forest private owners. The model aims to show the long-term effects of their different choices about forest and pasture management on fire hazard, letting them test different management strategies in an economically constraining context. It also allows the players to explore different climatic and economic scenarios. A Picit Jeu ABM reproduces the ecological, social and economic characteristics and dynamics of an Alpine valley in north-west Italy. The model should reproduce a primary general pattern: the less players undertake landscape management actions, by thinning and cutting forests or grazing pastures, the higher the probability that a fire will burn a large area of land.

Kulayinjana

Christophe Le Page Arthur Perrotton Michel De Garine-Wichatitsky Barry Bitu Killion Koyisi Ferdinand Mwamba Cephus Ncube Victor Ncube Siphusisiwe Ndlovu Raphael Ngwenya Ambu Nyathi Fumbane Nyathi Patrick Sibanda Zenzo Sibanda | Published Monday, October 03, 2016a computer-based role-playing game simulating the interactions between farming activities, livestock herding and wildlife in a virtual landscape reproducing local socioecological dynamics at the periphery of Hwange National Park (Zimbabwe).

REHAB: A Role Playing Game to Explore the Influence of Knowledge and Communication on Natural Resources Management

Christophe Le Page Anne Dray Pascal Perez Claude Garcia | Published Monday, July 13, 2015 | Last modified Monday, July 13, 2015REHAB has been designed as an ice-breaker in courses dealing with ecosystem management and participatory modelling. It helps introducing the two main tools used by the Companion Modelling approach, namely role-playing games and agent-based models.