Birgit Müller

AffiliationsHelmholtz Centre for Environmental Research UFZ, Brandenburg University of Technology Cottbus-Senftenberg

Personal homepagehttps://www.ufz.de/index.php?en=15522

Professional homepage ORCID more infohttps://orcid.org/0000-0001-8780-4420

GitHub more infoNo associated GitHub account.

Senior Researcher at Helmholtz Centre for Environmental Research - UFZ in Leipzig, Germany

Since 2022 Professorship for Modelling of Human-Environment Systems, Joint appointment of Brandenburg University of Technology Cottbus-Senftenberg and UFZ

PhD in Applied System Science, University of Osnabrück

Diploma in Business Mathematics, University of Leipzig

Research Interests

I am currently head of the Working Group POLISES which uses agent-based models to study the impact of policies on land user behavior and consequences on the social-ecological system. This includes agri-environmental schemes for European agriculture and climate related policies such as insurance. In prior projects we investigated intended and unintended effects of global policy instruments on the social-ecological resilience of smallholders. We focused on the impact of policies targeting climate risk in common property regimes of pastoralists in Africa (Morocco and Kenya/Ethiopia).

On a conceptual level, I work in an international team of modellers, psychologists, agroeconomists and natural scientists on adequate representations of human behaviour in agent-based models. Furthermore, I am interested in how to describe models in an appropriate and standardised manner to increase their comprehensibility and comparison and how to foster model reuse and building up on each others work.

BESTMAP-ABM-DE is an agent-based model to determine the adoption and spatial allocation of selected agri-environmental schemes (AES) by individual farmers in the Mulde River Basin located in Western Saxony, Germany. The selected AES are buffer areas, cover crops, maintaining permanent grassland and conversion of arable land to permanent grassland. While the first three schemes have already been offered in the case study area, the latter scheme is a hypothetical scheme designed to test the impact of potential policy changes. For the first model analyses, only the currently offered schemes are considered. With the model, the effect of different scenarios of policy design on patterns of adoption can be investigated. In particular, the model can be used to study the social-ecological consequences of agricultural policies at different spatial and temporal scales and, in combination with biophysical models, test the ecological implications of different designs of the EU’s Common Agricultural Policy. The model was developed in the BESTMAP project.

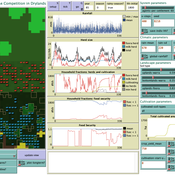

Peer reviewed LUCID: Land Use Competition In Drylands

Birgit Müller Gunnar Dressler Lance Robinson | Published Wednesday, April 12, 2023The Land Use Competition in Drylands (LUCID) model is a stylized agent-based model of a smallholder farming system. Its main purpose is to illustrate how competition between pastoralism and crop cultivation can affect livelihoods of households, specifically their food security. In particular, the model analyzes whether the expansion of crop cultivation may contribute to a vicious circle where an increase in cultivated area leads to higher grazing pressure on the remaining pastureland, which in turn may cause forage shortages and livestock loss for households which are then forced to further expand their cultivated area in order to increase their food security. The model does not attempt to replicate a particular case study but to generate a general understanding of mechanisms and drivers of such vicious circles and to identify possible scenarios under which such circles may be prevented.

The model is inspired by observations of the Borana land use system in Southern Ethiopia. The climatic and ecological conditions of the Borana zone favor pastoralism, and traditionally livelihoods have been based mainly on livestock keeping. Recent years, however, have seen an advancement of crop cultivation as a coping strategy, e.g., to compensate the loss of livestock, even though crop yields are low on average and successful harvests are infrequent.

In the model, it is possible to evaluate patterns of individual (single household) as well as overall (across all households) consumption and food security, depending on a range of ecological, climatic and management parameters.

Peer reviewed FISHCODE - FIsheries Simulation with Human COmplex DEcision-making

Birgit Müller Gunnar Dressler Jonas Letschert Christian Möllmann Vanessa Stelzenmüller | Published Monday, August 05, 2024FIsheries Simulation with Human COmplex DEcision-making (FISHCODE) is an agent-based model to depict and analyze current and future spatio-temporal dynamics of three German fishing fleets in the southern North Sea. Every agent (fishing vessel) makes daily decisions about if, what, and how long to fish. Weather, fuel and fish prices, as well as the actions of their colleagues influence agents’ decisions. To combine behavioral theories and enable agents to make dynamic decision, we implemented the Consumat approach, a framework in which agents’ decisions vary in complexity and social engagement depending on their satisfaction and uncertainty. Every agent has three satisfactions and two uncertainties representing different behavioral aspects, i.e. habitual behavior, profit maximization, competition, conformism, and planning insecurity. Availability of extensive information on fishing trips allowed us to parameterize many model parameters directly from data, while others were calibrated using pattern oriented modelling. Model validation showed that spatial and temporal aggregated ABM outputs were in realistic ranges when compared to observed data. Our ABM hence represents a tool to assess the impact of the ever growing challenges to North Sea fisheries and provides insight into fisher behavior beyond profit maximization.

RiskNetABM

Birgit Müller Jürgen Groeneveld Karin Frank Meike Will Friederike Lenel | Published Monday, July 20, 2020 | Last modified Monday, May 03, 2021The fight against poverty is an urgent global challenge. Microinsurance is promoted as a valuable instrument for buffering income losses due to health or climate-related risks of low-income households in developing countries. However, apart from direct positive effects they can have unintended side effects when insured households lower their contribution to traditional arrangements where risk is shared through private monetary support.

RiskNetABM is an agent-based model that captures dynamics between income losses, insurance payments and informal risk-sharing. The model explicitly includes decisions about informal transfers. It can be used to assess the impact of insurance products and informal risk-sharing arrangements on the resilience of smallholders. Specifically, it allows to analyze whether and how economic needs (i.e. level of living costs) and characteristics of extreme events (i.e. frequency, intensity and type of shock) influence the ability of insurance and informal risk-sharing to buffer income shocks. Two types of behavior with regard to private monetary transfers are explicitly distinguished: (1) all households provide transfers whenever they can afford it and (2) insured households do not show solidarity with their uninsured peers.

The model is stylized and is not used to analyze a particular case study, but represents conditions from several regions with different risk contexts where informal risk-sharing networks between smallholder farmers are prevalent.

…

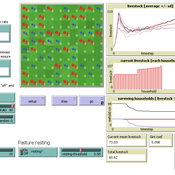

RAGE RAngeland Grazing Model

Carsten M Buchmann Jule Thober Birgit Müller Karin Frank Cheng Guo Jürgen Groeneveld Gunnar Dressler Niklas Hase | Published Monday, July 17, 2017 | Last modified Friday, October 26, 2018RAGE models a stylized common property grazing system. Agents follow a certain behavioral type. The model allows analyzing how household behavior with respect to a social norm on pasture resting affects long-term social-ecological system dynamics.

Livestock drought insurance model

Birgit Müller Felix John Jürgen Groeneveld Karin Frank Russell Toth | Published Tuesday, December 19, 2017 | Last modified Saturday, April 14, 2018The model analyzes the economic and ecological effects of a provision of livestock drought insurance for dryland pastoralists. More precisely, it yields qualitative insights into how long-term herd and pasture dynamics change through insurance.

Under development.