About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1190 results for "Ian M Hamilton" clear search

WealthDistribRes

Romulus-Catalin Damaceanu | Published Friday, May 04, 2012 | Last modified Saturday, April 27, 2013This model WealthDistribRes can be used to study the distribution of wealth in function of using a combination of resources classified in two renewable and nonrenewable.

A model of circular migration

Anna Klabunde | Published Wednesday, August 07, 2013 | Last modified Wednesday, February 17, 2016An empirically validated agent-based model of circular migration

The Targeted Subsidies Plan Model

Hassan Bashiri | Published Thursday, September 21, 2023The targeted subsidies plan model is based on the economic concept of targeted subsidies.

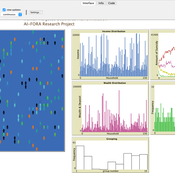

The targeted subsidies plan model simulates the distribution of subsidies among households in a community over several years. The model assumes that the government allocates a fixed amount of money each year for the purpose of distributing cash subsidies to eligible households. The eligible households are identified by dividing families into 10 groups based on their income, property, and wealth. The subsidy is distributed to the first four groups, with the first group receiving the highest subsidy amount. The model simulates the impact of the subsidy distribution process on the income and property of households in the community over time.

The model simulates a community of 230 households, each with a household income and wealth that follows a power-law distribution. The number of household members is modeled by a normal distribution. The model allocates a fixed amount of money each year for the purpose of distributing cash subsidies among eligible households. The eligible households are identified by dividing families into 10 groups based on their income, property, and wealth. The subsidy is distributed to the first four groups, with the first group receiving the highest subsidy amount.

The model runs for a period of 10 years, with the subsidy distribution process occurring every month. The subsidy received by each household is assumed to be spent, and a small portion may be saved and added to the household’s property. At the end of each year, the grouping of households based on income and assets is redone, and a number of families may be moved from one group to another based on changes in their income and property.

…

Managing ecological disturbances: Learning and the structure of social-ecological networks

Jacopo A. Baggio Vicken Hillis | Published Friday, March 03, 2017 | Last modified Thursday, August 02, 2018The aim of this model is to explore and understand the factors driving adoption of treatment strategies for ecological disturbances, considering payoff signals, learning strategies and social-ecological network structure

The Hawk-Dove Game

Kristin Crouse | Published Tuesday, November 05, 2019This model simulates the Hawk-Dove game as first described by John Maynard Smith, and further elaborated by Richard Dawkins in “The Selfish Gene”. In the game, two strategies, Hawks and Doves, compete against each other, and themselves, for reproductive benefits. A third strategy can be introduced, Retaliators, which act like either Hawks or Doves, depending on the context.

Fertility Tradeoffs

Kristin Crouse | Published Tuesday, November 05, 2019 | Last modified Thursday, April 06, 2023Fertility Tradeoffs is a NetLogo model that illustrates the emergent tradeoffs between the quality and quantity of offspring. Often, we associate high fitness with maximizing the number of offspring. However, under certain circumstances, it pays instead to optimize the number of offspring, having fewer offspring than is possible. When the number of offspring is reduced, more energy can be invested in each offspring, which can have fitness benefits.

Hominin ecodynamics v.2

C Michael Barton | Published Monday, September 19, 2011 | Last modified Friday, March 28, 2014Simulates biobehavioral interactions between 2 populations of hominins.

A Pastoral Stoking Strategy Model with Fodder Import and Loan Scenarios

Yanbo Li | Published Tuesday, December 24, 2019This model was built to estimate the impacts of exogenous fodder input and credit loans services on livelihood, rangeland health and profits of pastoral production in a small holder pastoral household in the arid steppe rangeland of Inner Mongolia, China. The model simulated the long-term dynamic of herd size and structure, the forage demand and supply, the cash flow, and the situation of loan debt under three different stocking strategies: (1) No external fodder input, (2) fodders were only imported when natural disaster occurred, and (3) frequent import of external fodder, with different amount of available credit loans. Monte-Carlo method was used to address the influence of climate variability.

Peer Review with Multiple Reviewers

Flaminio Squazzoni Federico Bianchi | Published Thursday, September 10, 2015This ABM looks at the effect of multiple reviewers and their behavior on the quality and efficiency of peer review. It models a community of scientists who alternatively act as “author” or “reviewer” at each turn.

Introductory SIR Model

Kit Martin Amber Cesare Matthew Johnson | Published Tuesday, September 28, 2021This is a basic Susceptible, Infected, Recovered (SIR) model. This model explores the spread of disease in a space. In particular, it explores how changing assumptions about the number of susceptible people, starting number of infected people, as well as the disease’s infection probability, and average duration of infection. The model shows that the interactions of agents can drastically affect the results of the model.

We used it in our course on COVID-19: https://www.csats.psu.edu/science-of-covid19

Displaying 10 of 1190 results for "Ian M Hamilton" clear search