About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 259 results for "Carlos Andrés Chiale" clear search

Wolf-sheep predation Netlogo model, extended, with foresight

Guido Fioretti Andrea Policarpi | Published Wednesday, September 16, 2020 | Last modified Tuesday, April 13, 2021This model is an extension of the Netlogo Wolf-sheep predation model by U.Wilensky (1997). This extended model studies several different behavioural mechanisms that wolves and sheep could adopt in order to enhance their survivability, and their overall impact on global equilibrium of the system.

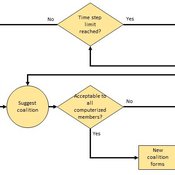

Heuristic Algorithm for Generating Strategic Coalition Structures

Andrew Collins Daniele Vernon-Bido | Published Monday, October 12, 2020The purpose of the model is to generate coalition structures of different glove games, using a specially designed algorithm. The coalition structures can be are later analyzed by comparing them to core partitions of the game used. Core partitions are coalition structures where no subset of players has an incentive to form a new coalition.

The algorithm used in this model is an advancement of the algorithm found in Collins & Frydenlund (2018). It was used used to generate the results in Vernon-Bido & Collins (2021).

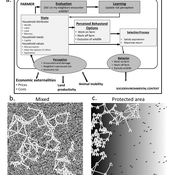

Wildlife-Human Interactions in Shared Landscapes (WHISL)

Nicholas Magliocca Neil Carter Andres Baeza-Castro | Published Friday, May 22, 2020This model simulates a group of farmers that have encounters with individuals of a wildlife population. Each farmer owns a set of cells that represent their farm. Each farmer must decide what cells inside their farm will be used to produce an agricultural good that is self in an external market at a given price. The farmer must decide to protect the farm from potential encounters with individuals of the wildlife population. This decision in the model is called “fencing”. Each time that a cell is fenced, the chances of a wildlife individual to move to that cell is reduced. Each encounter reduces the productive outcome obtained of the affected cell. Farmers, therefore, can reduce the risk of encounters by exclusion. The decision of excluding wildlife is made considering the perception of risk of encounters. In the model, the perception of risk is subjective, as it depends on past encounters and on the perception of risk from other farmers in the community. The community of farmers passes information about this risk perception through a social network. The user (observer) of the model can control the importance of the social network on the individual perception of risk.

Peer reviewed Family Herd Demography

Mark Moritz Ian M Hamilton Andrew Yoak Rebecca Garabed Abigail Buffington | Published Monday, August 15, 2016 | Last modified Saturday, January 06, 2018The model examines the dynamics of herd growth in African pastoral systems. We used it to examine the role of scale (herd size) stochasticity (in mortality, fertility, and offtake) on herd growth.

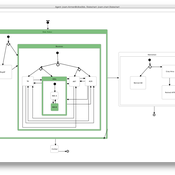

Life Cycle Cost of Military Manpower Model

Jonathan Ozik Todd Combs | Published Monday, January 05, 2015We demonstrate how Repast Simphony statecharts can efficiently encapsulate the deep classification hierarchy of the U.S. Air Force for manpower life cycle costing.

Peter Diamond's Coconut Model (Heterogeneity and Learning)

Sven Banisch Eckehard Olbrich | Published Monday, May 30, 2016Agent-based version of the simple search and barter economy conceived by Peter Diamond in 1982. The model is also known as Coconut Model.

An Agent-Based Model of an Insurance Market driven by Supply and Demand with Imperfectly Estimated Strategies in C#

Rei England | Published Sunday, September 24, 2023This is a simulation of an insurance market where the premium moves according to the balance between supply and demand. In this model, insurers set their supply with the aim of maximising their expected utility gain while operating under imperfect information about both customer demand and underlying risk distributions.

There are seven types of insurer strategies. One type follows a rational strategy within the bounds of imperfect information. The other six types also seek to maximise their utility gain, but base their market expectations on a chartist strategy. Under this strategy, market premium is extrapolated from trends based on past insurance prices. This is subdivided according to whether the insurer is trend following or a contrarian (counter-trend), and further depending on whether the trend is estimated from short-term, medium-term, or long-term data.

Customers are modelled as a whole and allocated between insurers according to available supply. Customer demand is calculated according to a logit choice model based on the expected utility gain of purchasing insurance for an average customer versus the expected utility gain of non-purchase.

ABM Simulation of Transition from Late Longshan Cultures to Early Erlitou Culture

Carmen Iasiello | Published Sunday, November 26, 2023Within the archeological record for Bronze Age Chinese culture, there continues to be a gap in our understanding of the sudden rise of the Erlitou State from the previous late Longshan chiefdoms. In order to examine this period, I developed and used an agent-based model (ABM) to explore possible socio-politically relevant hypotheses for the gap between the demise of the late Longshan cultures and rise of the first state level society in East Asia. I tested land use strategy making and collective action in response to drought and flooding scenarios, the two plausible environmental hazards at that time. The model results show cases of emergent behavior where an increase in social complexity could have been experienced if a catastrophic event occurred while the population was sufficiently prepared for a different catastrophe, suggesting a plausible lead for future research into determining the life of the time period.

The ABM published here was originally developed in 2016 and its results published in the Proceedings of the 2017 Winter Simulation Conference.

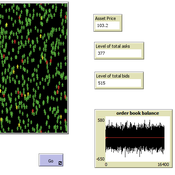

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

Exploring Creativity and Urban Development with Agent-Based Modeling

Ammar Malik Andrew Crooks Hilton Root Melanie Swartz | Published Thursday, October 30, 2014An agent-based model which explores Creativity and Urban Development

Displaying 10 of 259 results for "Carlos Andrés Chiale" clear search