About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 15 results china clear search

Geospatial Agent-Based Model of Immigrant Settlement Dynamics in Metro Vancouver

Liliana Perez Navid Mahdizadeh Gharakhanlou Maryam Yousefi | Published Wednesday, December 03, 2025This agent-based model simulates how new immigrant households choose where to live in Metro Vancouver under the origins diversity scenario. The model begins with 16,000 household agents, reflecting an expected annual population increase of about 42,500 people based on an average household size of 2.56. Each agent is assigned four characteristics: one of ten origin categories, income level (adjusted using NOC data and recent immigrant earnings), likelihood of having children, and preferred mode of commuting. The ten origin groups are drawn from Census patterns, including six subgroups within the broader Asian category (China, India, the Philippines, Iran, South Korea, and Other Asian countries) and two categories for immigrants from the Americas. This refined classification better captures the diversity of newcomers arriving in the region.

An agent-based model of school enrollment process under educational competition

Yao Tong | Published Sunday, August 04, 2024Due to the role of education in promoting social status and facilitating upward social mobility, individuals and their families spare no effort to pursue better educational opportunities, especially in countries where education is highly competitive.

In China, the enrollment of senior high schools and universities mainly follows a ranking system based on students’ scores in national entrance exams (Zhongkao and Gaokao). Typically, students with higher scores have priority in choosing schools and endeavor to get into better senior high schools to increase their chances of entering a prestigious university.

However, students can only select “better” senior high schools based on their average Gaokao grades, which are strongly influenced by the initial performance (Zhongkao grades) of enrolled students. The true quality indicator of school education (schooling effect, defined as the grade improvement achieved through education at the senior high school) is unknowable. This raises the first question: will school rankings reflect the real educational quality of schools over decades of educational competition, or merely the initial quality of the students they enroll?

…

Simulation of Dual Information Exposure Networks: An Agent-Based Model of Panic Buying Behavior in China

dachenga | Published Thursday, April 11, 2024The main function of this simulation model is to simulate the onset of individual panic in the context of a public health event, and in particular to simulate how an individual’s panic develops and dies out in the context of a dual information contact network of online social media information and offline in-person perception information. In this model, eight different scenarios are set up by adjusting key parameters according to the difference in the amount and nature of information circulating in the dual information network, in order to observe how the agent’s panic behavior will change under different information exposure situations.

ABM Simulation of Transition from Late Longshan Cultures to Early Erlitou Culture

Carmen Iasiello | Published Sunday, November 26, 2023Within the archeological record for Bronze Age Chinese culture, there continues to be a gap in our understanding of the sudden rise of the Erlitou State from the previous late Longshan chiefdoms. In order to examine this period, I developed and used an agent-based model (ABM) to explore possible socio-politically relevant hypotheses for the gap between the demise of the late Longshan cultures and rise of the first state level society in East Asia. I tested land use strategy making and collective action in response to drought and flooding scenarios, the two plausible environmental hazards at that time. The model results show cases of emergent behavior where an increase in social complexity could have been experienced if a catastrophic event occurred while the population was sufficiently prepared for a different catastrophe, suggesting a plausible lead for future research into determining the life of the time period.

The ABM published here was originally developed in 2016 and its results published in the Proceedings of the 2017 Winter Simulation Conference.

A Data-Driven Approach of Layout Evaluation for Electric Vehicle Charging Infrastructure Using Agent-Based Simulation and GIS

yue zhang | Published Thursday, September 21, 2023The development and popularisation of new energy vehicles have become a global consensus. The shortage and unreasonable layout of electric vehicle charging infrastructure (EVCI) have severely restricted the development of electric vehicles. In the literature, many methods can be used to optimise the layout of charging stations (CSs) for producing good layout designs. However, more realistic evaluation and validation should be used to assess and validate these layout options. This study suggested an agent-based simulation (ABS) model to evaluate the layout designs of EVCI and simulate the driving and charging behaviours of electric taxis (ETs). In the case study of Shenzhen, China, GPS trajectory data were used to extract the temporal and spatial patterns of ETs, which were then used to calibrate and validate the actions of ETs in the simulation. The ABS model was developed in a GIS context of an urban road network with travelling speeds of 24 h to account for the effects of traffic conditions. After the high-resolution simulation, evaluation results of the performance of EVCI and the behaviours of ETs can be provided in detail and in summary. Sensitivity analysis demonstrates the accuracy of simulation implementation and aids in understanding the effect of model parameters on system performance. Maximising the time satisfaction of ET users and reducing the workload variance of EVCI were the two goals of a multiobjective layout optimisation technique based on the Pareto frontier. The location plans for the new CS based on Pareto analysis can significantly enhance both metrics through simulation evaluation.

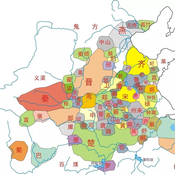

Urban waterlogging disaster evaluation based on complex network a case study of Zhengzhou, China

Chao Ding Jia Xu | Published Monday, April 17, 2023The model constructs a complex network of traffic based on the main urban area of Zhengzhou, China, and simulates the urban rainfall process using the ABM model to analyse the real-time risk of flooding hazards in the nodes of the complex network.

Evolutionary Dynamics of the Warring States Period: Initial Unification in Ancient China (475 BC to 221 BC)

zhuo zhang | Published Sunday, August 07, 2022If you have any questions about the model run, please send me an email and I will respond as soon as possible.

Under complex system perspectives, we build the multi-agent system to back-calculate this unification process of the Warring State period, from 32 states in 475 BC to 1 state (Qin) in 221 BC.

Unification-Conditions-of-Civilization-Patterns-Multi-Agent-Modeling-of-Human-History

zhuo zhang | Published Friday, May 27, 2022 | Last modified Sunday, May 29, 2022The model of Chinese and Western civilization patterns can help understand how civilizations formed, how they evolved by themselves, and the difference between the unity of China and the disunity of the Western. The previous research had examined historical phenomena about civilization patterns with subjective, static, local, and inductive methods. Therefore, we propose a general model of history dynamics for civilizations pattern, which contains both China and the West, to improve our understanding of civilization formation and the factors influencing the pattern of civilization. And at the same time, the model is used to find the boundary conditions of two different patterns.

A Pastoral Stoking Strategy Model with Fodder Import and Loan Scenarios

Yanbo Li | Published Tuesday, December 24, 2019This model was built to estimate the impacts of exogenous fodder input and credit loans services on livelihood, rangeland health and profits of pastoral production in a small holder pastoral household in the arid steppe rangeland of Inner Mongolia, China. The model simulated the long-term dynamic of herd size and structure, the forage demand and supply, the cash flow, and the situation of loan debt under three different stocking strategies: (1) No external fodder input, (2) fodders were only imported when natural disaster occurred, and (3) frequent import of external fodder, with different amount of available credit loans. Monte-Carlo method was used to address the influence of climate variability.

We construct a new type of agent-based model (ABM) that can simultaneously simulate land-use changes at multiple distant places (namely TeleABM, telecoupled agent-based model). We use soybean trade between Brazil and China as an example, where Brazil is the sending system and China is the receiving system because they are the world’s largest soybean exporter and importer respectively. We select one representative county in each country to calibrate and validate the model with spatio-temporal analysis of historical land-use changes and the empirical analysis of household survey data. The whole model is programmed on RePast Simphony. The most unique features of TeleABM are that it can simulate a telecoupled system and the flows between sending and receiving systems in this telecoupled system.

Displaying 10 of 15 results china clear search