About the CoMSES Model Library more info

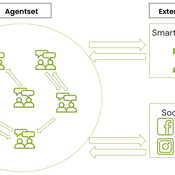

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 199 results network clear search

Simple models with different types of complexity

Michael Roos | Published Tuesday, September 17, 2024 | Last modified Saturday, March 01, 2025Hierarchical problem-solving model

The model simulates a hierarchical problem-solving process in which a manager delegates parts of a problem to specialists, who attempt to solve specific aspects based on their unique skills. The goal is to examine how effectively the hierarchical structure works in solving the problem, the total cost of the process, and the resulting solution quality.

Problem-solving random network model

The model simulates a network of agents (generalists) who collaboratively solve a fixed problem by iterating over it and using their individual skills to reduce the problem’s complexity. The goal is to study the dynamics of the problem-solving process, including agent interactions, work cycles, total cost, and solution quality.

GODS: Gossip-Oriented Dilemma Simulator

Jan Majewski | Published Wednesday, September 04, 2024Model of influence of access to social information spread via social network on decisions in a two-person game.

Peer reviewed Behavior changes through influence

Daria Soboleva | Published Friday, August 30, 2024The model is designed to simulate the behavior and decision-making processes of individuals (agents) in a social network. It aims to represent the changes in individual probability to take any action based on changes in attributes. The action is anything that can be reasonably influenced by the three influencing methods implemented in this model: peer pressure, social media, and state campaigns, and for which the user has a decision-making model. The model is implemented in the multi-agent programmable environment NetLogo 6.3.0.

Peer reviewed Agent-Based Insight into Eco-Choices: Simulating the Fast Fashion Shift

Daria Soboleva Angel Sánchez | Published Wednesday, August 07, 2024 | Last modified Wednesday, June 11, 2025The present model was created and used for the study titled ``Agent-Based Insight into Eco-Choices: Simulating the Fast Fashion Shift.” The model is implemented in the multi-agent programmable environment NetLogo 6.3.0. The model is designed to simulate the behavior and decision-making processes of individuals (agents) in a social network. It focuses on how agents interact with their peers, social media, and government campaigns, specifically regarding their likelihood to purchase fast fashion.

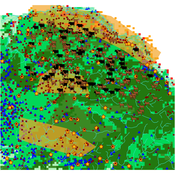

Agent-Based Model of Transhumant Decision-Making Processes in Senegal

Cheick Amed Diloma Gabriel TRAORE Etienne DELAY Alassane Bah Djibril Diop | Published Wednesday, July 03, 2024Sahelian transhumance is a type of socio-economic and environmental pastoral mobility. It involves the movement of herds from their terroir of origin (i.e., their original pastures) to one or more host terroirs, followed by a return to the terroir of origin. According to certain pastoralists, the mobility of herds is planned to prevent environmental degradation, given the continuous dependence of these herds on their environment. However, these herds emit Greenhouse Gases (GHGs) in the spaces they traverse. Given that GHGs contribute to global warming, our long-term objective is to quantify the GHGs emitted by Sahelian herds. The determination of these herds’ GHG emissions requires: (1) the artificial replication of the transhumance, and (2) precise knowledge of the space used during their transhumance.

This article presents the design of an artificial replication of the transhumance through an agent-based model named MSTRANS. MSTRANS determines the space used by transhumant herds, based on the decision-making process of Sahelian transhumants.

MSTRANS integrates a constrained multi-objective optimization problem and algorithms into an agent-based model. The constrained multi-objective optimization problem encapsulates the rationality and adaptability of pastoral strategies. Interactions between a transhumant and its socio-economic network are modeled using algorithms, diffusion processes, and within the multi-objective optimization problem. The dynamics of pastoral resources are formalized at various spatio-temporal scales using equations that are integrated into the algorithms.

The results of MSTRANS are validated using GPS data collected from transhumant herds in Senegal. MSTRANS results highlight the relevance of integrated models and constrained multi-objective optimization for modeling and monitoring the movements of transhumant herds in the Sahel. Now specialists in calculating greenhouse gas emissions have a reproducible and reusable tool for determining the space occupied by transhumant herds in a Sahelian country. In addition, decision-makers, pastoralists, veterinarians and traders have a reproducible and reusable tool to help them make environmental and socio-economic decisions.

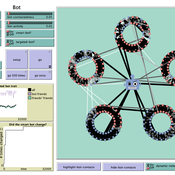

How do bots influence beliefs on social media? Why do beliefs propagated by social bots spread far and wide, yet does their direct influence appear to be limited?

This model extends Axelrod’s model for the dissemination of culture (1997), with a social bot agent–an agent who only sends information and cannot be influenced themselves. The basic network is a ring network with N agents connected to k nearest neighbors. The agents have a cultural profile with F features and Q traits per feature. When two agents interact, the sending agent sends the trait of a randomly chosen feature to the receiving agent, who adopts this trait with a probability equal to their similarity. To this network, we add a bot agents who is given a unique trait on the first feature and is connected to a proportion of the agents in the model equal to ‘bot-connectedness’. At each timestep, the bot is chosen to spread one of its traits to its neighbors with a probility equal to ‘bot-activity’.

The main finding in this model is that, generally, bot activity and bot connectedness are both negatively related to the success of the bot in spreading its unique message, in equilibrium. The mechanism is that very active and well connected bots quickly influence their direct contacts, who then grow too dissimilar from the bot’s indirect contacts to quickly, preventing indirect influence. A less active and less connected bot leaves more space for indirect influence to occur, and is therefore more successful in the long run.

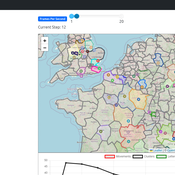

Agent-Based Model for Analyzing the Impact of Movement Factors of Sahelian Transhumant Herds

Cheick Amed Diloma Gabriel TRAORE | Published Tuesday, May 28, 2024Transhumants move their herds based on strategies simultaneously considering several environmental and socio-economic factors. There is no agreement on the influence of each factor in these strategies. In addition, there is a discussion about the social aspect of transhumance and how to manage pastoral space. In this context, agent-based modeling can analyze herd movements according to the strategy based on factors favored by the transhumant. This article presents a reductionist agent-based model that simulates herd movements based on a single factor. Model simulations based on algorithms to formalize the behavioral dynamics of transhumants through their strategies. The model results establish that vegetation, water outlets and the socio-economic network of transhumants have a significant temporal impact on transhumance. Water outlets and the socio-economic network have a significant spatial impact. The significant impact of the socio-economic factor demonstrates the social dimension of Sahelian transhumance. Veterinarians and markets have an insignificant spatio-temporal impact. To manage pastoral space, water outlets should be at least 15 km

from each other. The construction of veterinary centers, markets and the securitization of transhumance should be carried out close to villages and rangelands.

Peer reviewed Historical Letters

Bernardo Buarque Malte Vogl Jascha Merijn Schmitz Aleksandra Kaye | Published Thursday, May 16, 2024 | Last modified Friday, May 24, 2024A letter sending model with historically informed initial positions to reconstruct communication and archiving processes in the Republic of Letters, the 15th to 17th century form of scholarship.

The model is aimed at historians, willing to formalize historical assumptions about the letter sending process itself and allows in principle to set heterogeneous social roles, e.g. to evaluate the role of gender or social status in the formation of letter exchange networks. The model furthermore includes a pruning process to simulate the loss of letters to critically asses the role of biases e.g. in relation to gender, geographical regions, or power structures, in the creation of empirical letter archives.

Each agent has an initial random topic vector, expressed as a RGB value. The initial positions of the agents are based on a weighted random draw based on data from [2]. In each step, agents generate two neighbourhoods for sending letters and potential targets to move towards. The probability to send letters is a self-reinforcing process. After each sending the internal topic of the receiver is updated as a movement in abstract space by a random amount towards the letters topic.

…

Critical Sustainability Transitions: Relaunching local agriculture after decline (Model code and description)

Pedro Lopez-Merino | Published Tuesday, April 30, 2024This model simulates the dynamics of agricultural land use change, specifically the transition between agricultural and non-agricultural land use in a spatial context. It explores the influence of various factors such as agricultural profitability, path dependency, and neighborhood effects on land use decisions.

The model operates on a grid of patches representing land parcels. Each patch can be in one of two states: exploited (green, representing agricultural land) or unexploited (brown, representing non-agricultural land). Agents (patches) transition between these states based on probabilistic rules. The main factors affecting these transitions are agricultural profitability, path dependency, and neighborhood effects.

-Agricultural Profitability: This factor is determined by the prob-agri function, which calculates the probability of a non-agricultural patch converting to agricultural based on income differences between agriculture and other sectors. -Path Dependency: Represented by the path-dependency parameter, it influences the likelihood of patches changing their state based on their current state. It’s a measure of inertia or resistance to change. -Neighborhood Effects: The neighborhood function calculates the number of exploited (agricultural) neighbors of a patch. This influences the decision of a patch to convert to agricultural land, representing the influence of surrounding land use on the decision-making process.

Simulation of Dual Information Exposure Networks: An Agent-Based Model of Panic Buying Behavior in China

dachenga | Published Thursday, April 11, 2024The main function of this simulation model is to simulate the onset of individual panic in the context of a public health event, and in particular to simulate how an individual’s panic develops and dies out in the context of a dual information contact network of online social media information and offline in-person perception information. In this model, eight different scenarios are set up by adjusting key parameters according to the difference in the amount and nature of information circulating in the dual information network, in order to observe how the agent’s panic behavior will change under different information exposure situations.

Displaying 10 of 199 results network clear search