César García-Díaz

AffiliationsSchool of Economics and Business, Pontificia Universidad Javeriana (Colombia)

Personal homepagehttps://sites.google.com/site/cesaregarciadiaz/

Professional homepagehttp://www.researchgate.net/profile/Cesar_Garcia-Diaz

ORCID more infohttps://orcid.org/0000-0002-5395-5324

GitHub more infoNo associated GitHub account.

I am a computational social scientist, engineer, and systems researcher. I work in several aspects of modelling the dynamics of organisational, economic and social systems. I am interested in the link between micro-level rules, structural interdependence and macro-level outcomes in a variety of settings (e.g., organisational dynamics, industry evolution, competitive spatial location, agricultural markets). I am also interested in the use of computational models for better policy design (policy modelling).

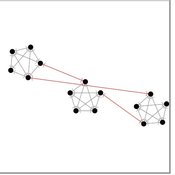

The influence of cognitive diversity on networked search and coordination

César García-Díaz | Published Wednesday, April 03, 2024Agent-based models of organizational search have long investigated how exploitative and exploratory behaviors shape and affect performance on complex landscapes. To explore this further, we build a series of models where agents have different levels of expertise and cognitive capabilities, so they must rely on each other’s knowledge to navigate the landscape. Model A investigates performance results for efficient and inefficient networks. Building on Model B, it adds individual-level cognitive diversity and interaction based on knowledge similarity. Model C then explores the performance implications of coordination spaces. Results show that totally connected networks outperform both hierarchical and clustered network structures when there are clear signals to detect neighbor performance. However, this pattern is reversed when agents must rely on experiential search and follow a path-dependent exploration pattern.

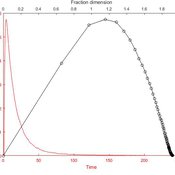

Reflexivity in a diffusion of innovations model

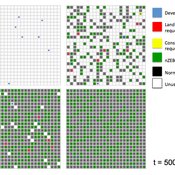

César García-Díaz Carlos Cordoba | Published Thursday, May 07, 2020In this agent-based model, agents decide to adopt a new product according to a utility function that depends on two kinds of social influences. First, there is a local influence exerted on an agent by her closest neighbors that have already adopted, and also by herself if she feels the product suits her personal needs. Second, there is a global influence which leads agents to adopt when they become aware of emerging trends happening in the system. For this, we endow agents with a reflexive capacity that allows them to recognize a trend, even if they can not perceive a significant change in their neighborhood.

Results reveal the appearance of slowdown periods along the adoption rate curve, in contrast with the classic stylized bell-shaped behavior. Results also show that network structure plays an important role in the effect of reflexivity: while some structures (e.g., scale-free networks) may amplify it, others (e.g., small-world structure) weaken such an effect.

The Coevolution of the Firm and the Product Attribute Space

César García-Díaz | Published Friday, May 22, 2020This model inspects the performance of firms as the product attribute space changes, which evolves as a consequence of firms’ actions. Firms may create new product variants by dragging demand from other existing variants. Firms decide whether to open new product variants, to invade existing ones, or to keep their variant portfolio. At each variant there is a Cournot competition each round. Competition is nested since many firms compete at many variants simultaneously, affecting firm composition at each location (variant).

After the Cournot outcomes, at each round firms decide whether to (i) keep their existing product variant niche, (ii) invade an existing variant, (iii) create a new variant, or (iv) abandon a variant. Firms’ profits across their niche take into consideration the niche-width cost and the cost of opening a new variant.

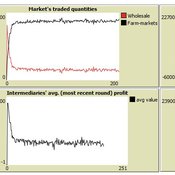

Market-level effects of firm-level adaptation and intermediation in networked markets of fresh foods: a case study in Colombia.

César García-Díaz | Published Sunday, April 12, 2020 | Last modified Sunday, April 12, 2020This a model developed as a part of the paper Mejía, G. & García-Díaz, C. (2018). Market-level effects of firm-level adaptation and intermediation in networked markets of fresh foods: a case study in Colombia. Agricultural Systems 160: 132-142.

It simulates the competition dynamics of the potato market in Bogotá, Colombia. The model explores the economic impact of intermediary actors on the potato supply chain.

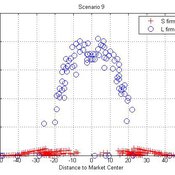

Micro-level Adaptation, Macro-level Selection, and the Dynamics of Market Partitioning

César García-Díaz | Published Monday, October 19, 2015 | Last modified Monday, October 19, 2015This model simulates the emergence of a dual market structure from firm-level interaction. Firms are profit-seeking, and demand is represented by a unimodal distribution of consumers along a set of taste positions.

Exploring Transitions towards Sustainable Construction

Jesus Rosales-Carreon César García-Díaz | Published Wednesday, October 30, 2013 | Last modified Saturday, January 31, 2015This model illustrates actor interaction in the construction sector, according to information gathered in NL. It offers a simple frame to represent diverse interests, interdependencies and effects on the number of built sustainable houses.

Under development.