About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 26 results for "Mauro Gallegati" clear search

The Effects of Fiscal Targets in a Currency Union: a Multi-Country Agent Based-Stock Flow Consistent Model

Ermanno Catullo Alessandro Caiani Mauro Gallegati | Published Saturday, March 11, 2017We present an Agent-Based Stock Flow Consistent Multi-Country model of a Currency Union to analyze the impact of changes in the fiscal regimes that is permanent changes in the deficit-to-GDP targets that governments commit to comply.

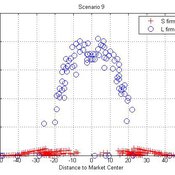

Micro-level Adaptation, Macro-level Selection, and the Dynamics of Market Partitioning

César García-Díaz | Published Monday, October 19, 2015 | Last modified Monday, October 19, 2015This model simulates the emergence of a dual market structure from firm-level interaction. Firms are profit-seeking, and demand is represented by a unimodal distribution of consumers along a set of taste positions.

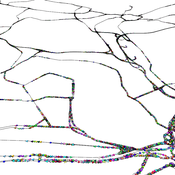

ABSOLUG - Agent-based simulation of land-use governance

Marius von Essen | Published Monday, January 10, 2022 | Last modified Tuesday, September 06, 2022The agent-based simulation of land-use governance (ABSOLUG) is a NetLogo model designed to explore the interactions between stakeholders and the impact of multi-stakeholder governance approaches on tropical deforestation. The purpose of ABSOLUG is to advance our understanding of land use governance, identify macro-level patterns of interaction among governments, commodity producers, and NGOs in tropical deforestation frontiers, and to set a foundation for generating middle-range theories for multi-stakeholder governance approaches. The model represents a simplified, generic, tropical commodity production system, as opposed to a specific empirical case, and as such aims to generate interpretable macro-level patterns that are based on plausible, micro-level behavioral rules. It is designed for scientists interested in land use governance of tropical commodity production systems, and for decision- and policy-makers seeking to develop or enhance governance schemes in multi-stakeholder commodity systems.

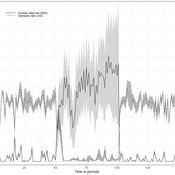

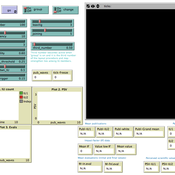

A basic macroeconomic agent-based model for analyzing monetary regime shifts

Oliver Reinhardt Florian Peters Doris Neuberger Adelinde Uhrmacher | Published Tuesday, May 03, 2022In macroeconomics, an emerging discussion of alternative monetary systems addresses the dimensions of systemic risk in advanced financial systems. Monetary regime changes with the aim of achieving a more sustainable financial system have already been discussed in several European parliaments and were the subject of a referendum in Switzerland. However, their effectiveness and efficacy concerning macro-financial stability are not well-known. This paper introduces a macroeconomic agent-based model (MABM) in a novel simulation environment to simulate the current monetary system, which may serve as a basis to implement and analyze monetary regime shifts. In this context, the monetary system affects the lending potential of banks and might impact the dynamics of financial crises. MABMs are predestined to replicate emergent financial crisis dynamics, analyze institutional changes within a financial system, and thus measure macro-financial stability. The used simulation environment makes the model more accessible and facilitates exploring the impact of different hypotheses and mechanisms in a less complex way. The model replicates a wide range of stylized economic facts, including simplifying assumptions to reduce model complexity.

Hybrid traffic model

Patrick Taillandier Arnaud Banos Nathalie Corson | Published Thursday, March 16, 2017The model aims at simulating the car traffic. It allows to use either a macro or a micro sub-model for the simulation of the flow on the roads.

Demographic microsimulation for individuals and couples

Sabine Zinn | Published Wednesday, January 14, 2015The simulation model conducts fine-grained population projection by specifying life course dynamics of individuals and couples by means of traditional demographic microsimulation and by using agent-based modeling for mate matching.

Peer reviewed From Individual Fuzzy Cognitive Maps to Agent Based Models: Modeling Multi-Factorial and Multi-stakeholder Decision-Making for Water Scarcity

Sara Mehryar | Published Monday, March 04, 2019 | Last modified Wednesday, August 28, 2019This model simulates different farmers’ decisions and actions to adapt to the water scarce situation. This simulation helps to investigate how farmers’ strategies may impact macro-behavior of the social-ecological system i.e. overall groundwater use change and emigration of farmers. The environmental variables’ behavior and behavioral rules of stakeholders are captured with Fuzzy Cognitive Map (FCM) that is developed with both qualitative and quantitative data, i.e. stakeholders’ knowledge and empirical data from studies. This model have been used to compare the impact of different water scarcity policies on overall groundwater use in a farming community facing water scarcity.

Agent-Based Model for Multiple Team Membership (ABMMTM)

Andrew Collins | Published Thursday, April 03, 2025The Agent-Based Model for Multiple Team Membership (ABMMTM) simulates design teams searching for viable design solutions, for a large design project that requires multiple design teams that are working simultaneously, under different organizational structures; specifically, the impact of multiple team membership (MTM). The key mechanism under study is how individual agent-level decision-making impacts macro-level project performance, specifically, wage cost. Each agent follows a stochastic learning approach, akin to simulated annealing or reinforcement learning, where they iteratively explore potential design solutions. The agent evaluates new solutions based on a random-walk exploration, accepting improvements while rejecting inferior designs. This iterative process simulates real-world problem-solving dynamics where designers refine solutions based on feedback.

As a proof-of-concept demonstration of assessing the macro-level effects of MTM in organizational design, we developed this agent-based simulation model which was used in a simulation experiment. The scenario is a system design project involving multiple interdependent teams of engineering designers. In this scenario, the required system design is split into three separate but interdependent systems, e.g., the design of a satellite could (trivially) be split into three components: power source, control system, and communication systems; each of three design team is in charge of a design of one of these components. A design team is responsible for ensuring its proposed component’s design meets the design requirement; they are not responsible for the design requirements of the other components. If the design of a given component does not affect the design requirements of the other components, we call this the uncoupled scenario; otherwise, it is a coupled scenario.

Perceived Scientific Value and Impact Factor

Davide Secchi Stephen J Cowley | Published Wednesday, April 12, 2017 | Last modified Monday, January 29, 2018The model explores the impact of journal metrics (e.g., the notorious impact factor) on the perception that academics have of an article’s scientific value.

Modeling The Transition to Public School Choice (Model II from paper)

Spiro Maroulis Eytan Bakshy Louis Gomez Uri Wilensky | Published Friday, March 22, 2013 | Last modified Tuesday, August 27, 2013This is an agent-based model that captures the dynamic processes related to moving from an educational system where the school a student attends is based on assignment to a neighborhood school, to one that gives households more choice among existing and newly formed public schools.

Displaying 10 of 26 results for "Mauro Gallegati" clear search