About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 2 of 2 results for "Adelinde Uhrmacher" clear search

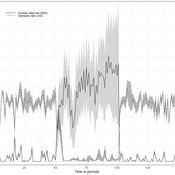

A basic macroeconomic agent-based model for analyzing monetary regime shifts

Oliver Reinhardt Florian Peters Doris Neuberger Adelinde Uhrmacher | Published Tuesday, May 03, 2022In macroeconomics, an emerging discussion of alternative monetary systems addresses the dimensions of systemic risk in advanced financial systems. Monetary regime changes with the aim of achieving a more sustainable financial system have already been discussed in several European parliaments and were the subject of a referendum in Switzerland. However, their effectiveness and efficacy concerning macro-financial stability are not well-known. This paper introduces a macroeconomic agent-based model (MABM) in a novel simulation environment to simulate the current monetary system, which may serve as a basis to implement and analyze monetary regime shifts. In this context, the monetary system affects the lending potential of banks and might impact the dynamics of financial crises. MABMs are predestined to replicate emergent financial crisis dynamics, analyze institutional changes within a financial system, and thus measure macro-financial stability. The used simulation environment makes the model more accessible and facilitates exploring the impact of different hypotheses and mechanisms in a less complex way. The model replicates a wide range of stylized economic facts, including simplifying assumptions to reduce model complexity.

InnovationGame

Madeline Tyson | Published Thursday, August 24, 2017This model includes an innovation search environment. Agents search and can share their findings. It’s implemented in Netlogo-Hubnet & a parallel Netlogo model. This allows for validation of search strategies against experimental findings.