About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1185 results for "Lee-Ann Sutherland" clear search

SimPLS - The PLS Agent

Iris Lorscheid Sandra Schubring Matthias Meyer Christian Ringle | Published Monday, April 18, 2016 | Last modified Tuesday, May 17, 2016The simulation model SimPLS shows an application of the PLS agent concept, using SEM as empirical basis for the definition of agent architectures. The simulation model implements the PLS path model TAM about the decision of using innovative products.

Peer reviewed FishCensus

Miguel Pais | Published Tuesday, December 06, 2016 | Last modified Thursday, February 09, 2017The FishCensus model simulates underwater visual census methods, where a diver estimates the abundance of fish. A separate model is used to shape species behaviours and save them to a file that can be shared and used by the counting model.

Soil microbe-predator model with enzymes

Randall Boone John C Moore Akihiro Koyama Kirstin Holfelder | Published Thursday, November 21, 2013We seek to improve understanding of roles enzyme play in soil food webs. We created an agent-based simulation of a simple food web that includes enzymatic activity. The model was used in a publication, Moore et al. (in press; Biochemistry).

Roman Amphora reuse

Tom Brughmans | Published Wednesday, August 07, 2019 | Last modified Wednesday, March 15, 2023UPDATE in V1.1.0: missing input data files added; relative paths to input data files changed to “../data/FILENAME”

A model that allows for representing key theories of Roman amphora reuse, to explore the differences in the distribution of amphorae, re-used amphorae and their contents.

This model generates simulated distributions of prime-use amphorae, primeuse contents (e.g. olive oil) and reused amphorae. These simulated distributions will differ between experiments depending on the experiment’s variable settings representing the tested theory: variations in the probability of reuse, the supply volume, the probability of reuse at ports. What we are interested in teasing out is what the effect is of each theory on the simulated amphora distributions.

…

Social Innovation Model

Jiin Jung | Published Monday, April 28, 2025This research aims to uncover the micro-mechanisms that drive the macro-level relationship between cultural tolerance and innovation. We focus on the indirect influence of minorities—specifically, workers with diverse domain expertise—within collaboration networks. We propose that minority influence from individuals with different expertise can serve as a key driver of organizational innovation, particularly in dynamic market environments, and that cultural tolerance is critical for enabling such minority-induced innovation. Our model demonstrates that seemingly conflicting empirical patterns between cultural tightness/looseness and innovation can emerge from the same underlying micro-mechanisms, depending on parameter values. A systematic simulation experiment revealed an optimal cultural configuration: a medium level of tolerance (t = 0.6) combined with low consistency (κ = 0.05) produced the fastest adaptation to abrupt market changes. These findings provide evidence that indirect minority influence is a core micro-mechanism linking cultural tolerance to innovation.

Peer reviewed SIM-VOLATILE: Adoption of emerging circular technologies in the waste-treatment sector

Siavash Farahbakhsh | Published Wednesday, December 14, 2022The SIM-VOLATILE model is a technology adoption model at the population level. The technology, in this model, is called Volatile Fatty Acid Platform (VFAP) and it is in the frame of the circular economy. The technology is considered an emerging technology and it is in the optimization phase. Through the adoption of VFAP, waste-treatment plants will be able to convert organic waste into high-end products rather than focusing on the production of biogas. Moreover, there are three adoption/investment scenarios as the technology enables the production of polyhydroxyalkanoates (PHA), single-cell oils (SCO), and polyunsaturated fatty acids (PUFA). However, due to differences in the processing related to the products, waste-treatment plants need to choose one adoption scenario.

In this simulation, there are several parameters and variables. Agents are heterogeneous waste-treatment plants that face the problem of circular economy technology adoption. Since the technology is emerging, the adoption decision is associated with high risks. In this regard, first, agents evaluate the economic feasibility of the emerging technology for each product (investment scenarios). Second, they will check on the trend of adoption in their social environment (i.e. local pressure for each scenario). Third, they combine these two economic and social assessments with an environmental assessment which is their environmental decision-value (i.e. their status on green technology). This combination gives the agent an overall adaptability fitness value (detailed for each scenario). If this value is above a certain threshold, agents may decide to adopt the emerging technology, which is ultimately depending on their predominant adoption probabilities and market gaps.

Intra-Organizational Bandwagon

Davide Secchi | Published Sunday, October 18, 2015The model simulates the process of widespread diffusion of something due to popularity (i.e., bandwagon) within an organization.

MoPAgrIB: simulating savannah landscape mosaic under shifting cultivation

Nicolas Becu Marc Deconchat Eric Garine Kouami Kokou Christine Raimond | Published Monday, May 27, 2013 | Last modified Tuesday, January 21, 2014MoPAgrIB model simulates the movement of cultivated patches in a savannah vegetation mosaic ; how they move and relocate through the landscape, depending on farming practices, population growth, social rules and vegetation growth.

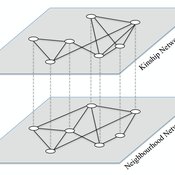

Diffusion of Innovations on Social Networks

Hang Xiong | Published Saturday, April 16, 2016This is model that simulates how multiple kinds of peer effects shape the diffusion of innovations through different types of social relationships.

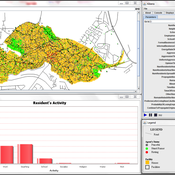

Modeling the Emergence of Riots

Andrew Crooks Bianica Pires | Published Wednesday, January 20, 2016 | Last modified Wednesday, September 21, 2016The purpose of the model is to explore how the unique socioeconomic variables underlying Kibera, local interactions, and the spread of a rumor, may trigger a riot.

Displaying 10 of 1185 results for "Lee-Ann Sutherland" clear search