About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 113 results market clear search

Peer reviewed Labor and environment in global value chains: An evolutionary policy study with a three-sector and two-region agent-based macroeconomic model

Lena Gerdes Manuel Scholz-Wäckerle Bernhard Rengs | Published Wednesday, December 22, 2021With this model, we investigate resource extraction and labor conditions in the Global South as well as implications for climate change originating from industry emissions in the North. The model serves as a testbed for simulation experiments with evolutionary political economic policies addressing these issues. In the model, heterogeneous agents interact in a self-organizing and endogenously developing economy. The economy contains two distinct regions – an abstract Global South and Global North. There are three interlinked sectors, the consumption good–, capital good–, and resource production sector. Each region contains an independent consumption good sector, with domestic demand for final goods. They produce a fictitious consumption good basket, and sell it to the households in the respective region. The other sectors are only present in one region. The capital good sector is only found in the Global North, meaning capital goods (i.e. machines) are exclusively produced there, but are traded to the foreign as well as the domestic market as an intermediary. For the production of machines, the capital good firms need labor, machines themselves and resources. The resource production sector, on the other hand, is only located in the Global South. Mines extract resources and export them to the capital firms in the North. For the extraction of resources, the mines need labor and machines. In all three sectors, prices, wages, number of workers and physical capital of the firms develop independently throughout the simulation. To test policies, an international institution is introduced sanctioning the polluting extractivist sector in the Global South as well as the emitting industrial capital good producers in the North with the aim of subsidizing innovation reducing environmental and social impacts.

Peer reviewed Price Evolution with Expectations

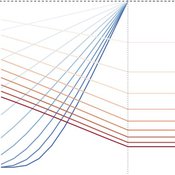

J M Applegate Gesine Steudel Armin Haas Carlo Jaeger | Published Friday, September 10, 2021The Price Evolution with Expectations model provides the opportunity to explore the question of non-equilibrium market dynamics, and how and under which conditions an economic system converges to the classically defined economic equilibrium. To accomplish this, we bring together two points of view of the economy; the classical perspective of general equilibrium theory and an evolutionary perspective, in which the current development of the economic system determines the possibilities for further evolution.

The Price Evolution with Expectations model consists of a representative firm producing no profit but producing a single good, which we call sugar, and a representative household which provides labour to the firm and purchases sugar.The model explores the evolutionary dynamics whereby the firm does not initially know the household demand but eventually this demand and thus the correct price for sugar given the household’s optimal labour.

The model can be run in one of two ways; the first does not include money and the second uses money such that the firm and/or the household have an endowment that can be spent or saved. In either case, the household has preferences for leisure and consumption and a demand function relating sugar and price, and the firm has a production function and learns the household demand over a set number of time steps using either an endogenous or exogenous learning algorithm. The resulting equilibria, or fixed points of the system, may or may not match the classical economic equilibrium.

Peer reviewed Small-Trade Model

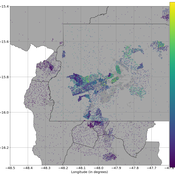

Emilie Lindkvist Maja Schlüter Blanca Gonzalez-Mon Örjan Bodin | Published Wednesday, July 28, 2021The purpose of this model is to understand the role of trade networks and their interaction with different fish resources, for fish provision. The model is developed based on a multi-methods approach, combining agent-based modeling, network analysis and qualitative data based on a small-scale fisheries study case. The model can be used to investigate both how trade network structures are embedded in a social-ecological context and the trade processes that occur within them, to analyze how they lead to emergent outcomes related to the resilience of fish provision. The model processes are informed by qualitative data analysis, and the social network analysis of an empirical fish trade network. The network analysis can be used to investigate diverse network structures to perform model experiments, and their influence on model outcomes.

The main outcomes we study are 1) the overexploitation of fish resources and 2) the availability and variability of fish provision to satisfy different market demands, and 3) individual traders’ fish supply at the micro-level. The model has two types of trader agents, seller and dealer. The model reveals that the characteristics of the trade networks, linked to different trader types (that have different roles in those networks), can affect the resilience of fish provision.

Knowledge Based Economy

Guido Fioretti Sirio Capizzi Ruggero Rossi Martina Casari Ala Jlif | Published Tuesday, May 18, 2021Knowledge Based Economy (KBE) is an artificial economy where firms placed in geographical space develop original knowledge, imitate one another and eventually recombine pieces of knowledge. In KBE, consumer value arises from the capability of certain pieces of knowledge to bridge between existing items (e.g., Steve Jobs illustrated the first smartphone explaining that you could make a call with it, but also listen to music and navigate the Internet). Since KBE includes a mechanism for the generation of value, it works without utility functions and does not need to model market exchanges.

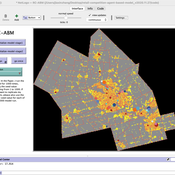

Peer reviewed PolicySpace2: modeling markets and endogenous public policies

Bernardo Furtado | Published Thursday, February 25, 2021 | Last modified Friday, January 14, 2022Policymakers decide on alternative policies facing restricted budgets and uncertain future. Designing public policies is further difficult due to the need to decide on priorities and handle effects across policies. Housing policies, specifically, involve heterogeneous characteristics of properties themselves and the intricacy of housing markets and the spatial context of cities. We propose PolicySpace2 (PS2) as an adapted and extended version of the open source PolicySpace agent-based model. PS2 is a computer simulation that relies on empirically detailed spatial data to model real estate, along with labor, credit, and goods and services markets. Interaction among workers, firms, a bank, households and municipalities follow the literature benchmarks to integrate economic, spatial and transport scholarship. PS2 is applied to a comparison among three competing public policies aimed at reducing inequality and alleviating poverty: (a) house acquisition by the government and distribution to lower income households, (b) rental vouchers, and (c) monetary aid. Within the model context, the monetary aid, that is, smaller amounts of help for a larger number of households, makes the economy perform better in terms of production, consumption, reduction of inequality, and maintenance of financial duties. PS2 as such is also a framework that may be further adapted to a number of related research questions.

CoComForest

Wuthiwong WIMOLSAKCHAROEN | Published Tuesday, February 02, 2021The name of the model, CoComForest, stands for COllaborative COMmunity FOREST management. The purposes of this model are to expose local resource harvesters to the competition with external resource harvesters, called outsiders, and to provide them the opportunity to collectively discuss on resource management. The model, which is made of a set of interconnected entities, including (i) community forest habitat, (ii) resource harvesters, (iii) market, and (iv) firebreak. More details about the CoComForest model are described based on the Overview, Design concept, and Details (ODD) protocol uploaded with the model.

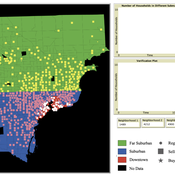

While the world’s total urban population continues to grow, not all cities are witnessing such growth, some are actually shrinking. This shrinkage causes several problems to emerge including population loss, economic depression, vacant properties and the contraction of housing markets. Such problems challenge efforts to make cities sustainable. While there is a growing body of work on study shrinking cities, few explore such a phenomenon from the bottom up using dynamic computational models. To overcome this issue this paper presents an spatially explicit agent-based model stylized on the Detroit Tri-county area, an area witnessing shrinkage. Specifically, the model demonstrates how through the buying and selling of houses can lead to urban shrinkage from the bottom up. The model results indicate that along with the lower level housing transactions being captured, the aggregated level market conditions relating to urban shrinkage are also captured (i.e., the contraction of housing markets). As such, the paper demonstrates the potential of simulation to explore urban shrinkage and potentially offers a means to test polices to achieve urban sustainability.

Retail Competition Agent-based Model

Derek Robinson Jiaxin Zhang | Published Sunday, January 03, 2021 | Last modified Wednesday, November 10, 2021The Retail Competition Agent-based Model (RC-ABM) is designed to simulate the retail competition system in the Region of Waterloo, Ontario, Canada, which which explicitly represents store competition behaviour. Through the RC-ABM, we aim to answer 4 research questions: 1) What is the level of correspondence between market share and revenue acquisition for an agent-based approach compared to a traditional location-allocation-based approach? 2) To what degree can the observed store spatial pattern be reproduced by competition? 3) To what degree are their path dependent patterns of retail success? 4) What is the relationship between retail survival and the endogenous geographic characteristics of stores and consumer expenditures?

Auctionsimulation

Deniz Kayar | Published Wednesday, August 12, 2020This repository the multi-agent simulation software for the paper “Comparison of Competing Market Mechanisms with Reinforcement Learning in a CarPooling Scenario”. It’s a mutlithreaded Javaapplication.

Behavioural parallel trading systems

Marcin Czupryna | Published Friday, June 26, 2020This model simulates the behaviour of the agents in 3 wine markets parallel trading systems: Liv-ex, Auctions and additionally OTC market (finally not used). Behavioural aspects (impatience) is additionally modeled. This is an extention of parallel trading systems model with technical trading (momentum and contrarian) and noise trading.

Displaying 10 of 113 results market clear search