About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 19 results equilibrium clear search

Cultural transmission in structured populations

Luke Premo | Published Wednesday, November 13, 2024This structured population model is built to address how migration (or intergroup cultural transmission), copying error, and time-averaging affect regional variation in a single selectively neutral discrete cultural trait under different mechanisms of cultural transmission. The model allows one to quantify cultural differentiation between groups within a structured population (at equilibrium) as well as between regional assemblages of time-averaged archaeological material at two different temporal scales (1,000 and 10,000 ticks). The archaeological assemblages begin to accumulate only after a “burn-in” period of 10,000 ticks. The model includes two different representations of copying error: the infinite variants model of copying error and the finite model of copying error. The model also allows the user to set the variant ceiling value for the trait in the case of the finite model of copying error.

Using Agent-Based Modelling and Reinforcement Learning to Study Hybrid Threats

kpadur | Published Friday, September 20, 2024Hybrid attacks coordinate the exploitation of vulnerabilities across domains to undermine trust in authorities and cause social unrest. Whilst such attacks have primarily been seen in active conflict zones, there is growing concern about the potential harm that can be caused by hybrid attacks more generally and a desire to discover how better to identify and react to them. In addressing such threats, it is important to be able to identify and understand an adversary’s behaviour. Game theory is the approach predominantly used in security and defence literature for this purpose. However, the underlying rationality assumption, the equilibrium concept of game theory, as well as the need to make simplifying assumptions can limit its use in the study of emerging threats. To study hybrid threats, we present a novel agent-based model in which, for the first time, agents use reinforcement learning to inform their decisions. This model allows us to investigate the behavioural strategies of threat agents with hybrid attack capabilities as well as their broader impact on the behaviours and opinions of other agents.

How do bots influence beliefs on social media? Why do beliefs propagated by social bots spread far and wide, yet does their direct influence appear to be limited?

This model extends Axelrod’s model for the dissemination of culture (1997), with a social bot agent–an agent who only sends information and cannot be influenced themselves. The basic network is a ring network with N agents connected to k nearest neighbors. The agents have a cultural profile with F features and Q traits per feature. When two agents interact, the sending agent sends the trait of a randomly chosen feature to the receiving agent, who adopts this trait with a probability equal to their similarity. To this network, we add a bot agents who is given a unique trait on the first feature and is connected to a proportion of the agents in the model equal to ‘bot-connectedness’. At each timestep, the bot is chosen to spread one of its traits to its neighbors with a probility equal to ‘bot-activity’.

The main finding in this model is that, generally, bot activity and bot connectedness are both negatively related to the success of the bot in spreading its unique message, in equilibrium. The mechanism is that very active and well connected bots quickly influence their direct contacts, who then grow too dissimilar from the bot’s indirect contacts to quickly, preventing indirect influence. A less active and less connected bot leaves more space for indirect influence to occur, and is therefore more successful in the long run.

Peer reviewed A Bayesian Nash Equilibrium (BNE)-informed ABM for pedestrian evacuation in different constricted spaces

Jiaqi Ge Yiyu Wang Alexis Comber | Published Wednesday, October 11, 2023This BNE-informed ABM ultimately aims to provide a more realistic description of complicated pedestrian behaviours especially in high-density and life-threatening situations. Bayesian Nash Equilibrium (BNE) was adopted to reproduce interactive decision-making process among rational and game-playing agents. The implementations of 3 behavioural models, which are Shortest Route (SR) model, Random Follow (RF) model, and BNE model, make it possible to simulate emergent patterns of pedestrian behaviours (e.g. herding and self-organised queuing behaviours, etc.) in emergency situations.

According to the common features of previous mass trampling accidents, a series of simulation experiments were performed in space with 3 types of barriers, which are Horizontal Corridors, Vertical Corridors, and Random Squares, standing for corridors, bottlenecks and intersections respectively, to investigate emergent behaviours of evacuees in varied constricted spatial environments. The output of this ABM has been available at https://data.mendeley.com/datasets/9v4byyvgxh/1.

Peer reviewed Dynamic Equilibria Prediction: Experience-Weighted Attraction (EWA), Python Implementation

Vinicius Ferraz | Published Friday, December 02, 2022This project is based on a Jupyter Notebook that describes the stepwise implementation of the EWA model in bi-matrix ( 2×2 ) strategic-form games for the simulation of economic learning processes. The output is a dataset with the simulated values of Attractions, Experience, selected strategies, and payoffs gained for the desired number of rounds and periods. The notebook also includes exploratory data analysis over the simulated output based on equilibrium, strategy frequencies, and payoffs.

Peer reviewed An agent-based simulation model of pedestrian evacuation based on Bayesian Nash Equilibrium

Jiaqi Ge Yiyu Wang Alexis Comber | Published Wednesday, July 06, 2022This ABM aims to introduce a new individual decision-making model, BNE into the ABM of pedestrian evacuation to properly model individual behaviours and motions in emergency situations. Three types of behavioural models has been developed, which are Shortest Route (SR) model, Random Follow (RF) model, and BNE model, to better reproduce evacuation dynamics in a tunnel space. A series of simulation experiments were conducted to evaluate the simulating performance of the proposed ABM.

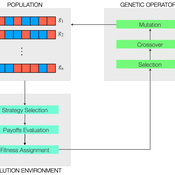

Peer reviewed Evolutionary Economic Learning Simulation: A Genetic Algorithm for Dynamic 2x2 Strategic-Form Games in Python

Vinicius Ferraz Thomas Pitz | Published Friday, April 08, 2022This project combines game theory and genetic algorithms in a simulation model for evolutionary learning and strategic behavior. It is often observed in the real world that strategic scenarios change over time, and deciding agents need to adapt to new information and environmental structures. Yet, game theory models often focus on static games, even for dynamic and temporal analyses. This simulation model introduces a heuristic procedure that enables these changes in strategic scenarios with Genetic Algorithms. Using normalized 2x2 strategic-form games as input, computational agents can interact and make decisions using three pre-defined decision rules: Nash Equilibrium, Hurwicz Rule, and Random. The games then are allowed to change over time as a function of the agent’s behavior through crossover and mutation. As a result, strategic behavior can be modeled in several simulated scenarios, and their impacts and outcomes can be analyzed, potentially transforming conflictual situations into harmony.

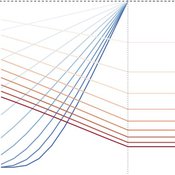

Peer reviewed Price Evolution with Expectations

J M Applegate Gesine Steudel Armin Haas Carlo Jaeger | Published Friday, September 10, 2021The Price Evolution with Expectations model provides the opportunity to explore the question of non-equilibrium market dynamics, and how and under which conditions an economic system converges to the classically defined economic equilibrium. To accomplish this, we bring together two points of view of the economy; the classical perspective of general equilibrium theory and an evolutionary perspective, in which the current development of the economic system determines the possibilities for further evolution.

The Price Evolution with Expectations model consists of a representative firm producing no profit but producing a single good, which we call sugar, and a representative household which provides labour to the firm and purchases sugar.The model explores the evolutionary dynamics whereby the firm does not initially know the household demand but eventually this demand and thus the correct price for sugar given the household’s optimal labour.

The model can be run in one of two ways; the first does not include money and the second uses money such that the firm and/or the household have an endowment that can be spent or saved. In either case, the household has preferences for leisure and consumption and a demand function relating sugar and price, and the firm has a production function and learns the household demand over a set number of time steps using either an endogenous or exogenous learning algorithm. The resulting equilibria, or fixed points of the system, may or may not match the classical economic equilibrium.

Wolf-sheep predation Netlogo model, extended, with foresight

Guido Fioretti andreapolicarpi | Published Wednesday, September 16, 2020 | Last modified Tuesday, April 13, 2021This model is an extension of the Netlogo Wolf-sheep predation model by U.Wilensky (1997). This extended model studies several different behavioural mechanisms that wolves and sheep could adopt in order to enhance their survivability, and their overall impact on global equilibrium of the system.

A Pastoral Stoking Strategy Model with Fodder Import and Loan Scenarios

Yanbo Li | Published Tuesday, December 24, 2019This model was built to estimate the impacts of exogenous fodder input and credit loans services on livelihood, rangeland health and profits of pastoral production in a small holder pastoral household in the arid steppe rangeland of Inner Mongolia, China. The model simulated the long-term dynamic of herd size and structure, the forage demand and supply, the cash flow, and the situation of loan debt under three different stocking strategies: (1) No external fodder input, (2) fodders were only imported when natural disaster occurred, and (3) frequent import of external fodder, with different amount of available credit loans. Monte-Carlo method was used to address the influence of climate variability.

Displaying 10 of 19 results equilibrium clear search