About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 58 results complexity clear search

Logônia: Plant Growth Response Model in NetLogo

Leandro Garcia Daniel Vartanian Aline | Published Saturday, September 13, 2025 | Last modified Tuesday, September 16, 2025Logônia is a NetLogo model that simulates the growth response of a fictional plant, logônia, under different climatic conditions. The model uses climate data from WorldClim 2.1 and demonstrates how to integrate the LogoClim model through the LevelSpace extension.

Logônia follows the FAIR Principles for Research Software (Barker et al., 2022) and is openly available on the CoMSES Network and GitHub.

Peer reviewed The Indus Village's Weather model: procedural generation of daily weather

Andreas Angourakis | Published Tuesday, May 13, 2025Overview

The Weather model is a procedural generation model designed to create realistic daily weather data for socioecological simulations. It generates synthetic weather time series for solar radiation, temperature, and precipitation using algorithms based on sinusoidal and double logistic functions. The model incorporates stochastic variation to mimic unpredictable weather patterns and aims to provide realistic yet flexible weather inputs for exploring diverse climate scenarios.

The Weather model can be used independently or integrated into larger models, providing realistic weather patterns without extensive coding or data collection. It can be customized to meet specific requirements, enabling users to gain a better understanding of the underlying mechanisms and have greater confidence in their applications.

…

Agent-Based Model for Multiple Team Membership (ABMMTM)

Andrew Collins | Published Thursday, April 03, 2025The Agent-Based Model for Multiple Team Membership (ABMMTM) simulates design teams searching for viable design solutions, for a large design project that requires multiple design teams that are working simultaneously, under different organizational structures; specifically, the impact of multiple team membership (MTM). The key mechanism under study is how individual agent-level decision-making impacts macro-level project performance, specifically, wage cost. Each agent follows a stochastic learning approach, akin to simulated annealing or reinforcement learning, where they iteratively explore potential design solutions. The agent evaluates new solutions based on a random-walk exploration, accepting improvements while rejecting inferior designs. This iterative process simulates real-world problem-solving dynamics where designers refine solutions based on feedback.

As a proof-of-concept demonstration of assessing the macro-level effects of MTM in organizational design, we developed this agent-based simulation model which was used in a simulation experiment. The scenario is a system design project involving multiple interdependent teams of engineering designers. In this scenario, the required system design is split into three separate but interdependent systems, e.g., the design of a satellite could (trivially) be split into three components: power source, control system, and communication systems; each of three design team is in charge of a design of one of these components. A design team is responsible for ensuring its proposed component’s design meets the design requirement; they are not responsible for the design requirements of the other components. If the design of a given component does not affect the design requirements of the other components, we call this the uncoupled scenario; otherwise, it is a coupled scenario.

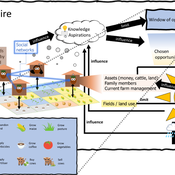

3spire: an agent-based model for exploring aspiration adaptation theory and its implications on smallholder farmers in Ethiopia

ateeuw Yue Dou Markus A Meyer Andrew Nelson | Published Sunday, February 16, 20253spire is an ABM where farming households make management decisions aimed at satisficing along the aspirational dimensions: food self-sufficiency, income, and leisure. Households decision outcomes depend on their social networks, knowledge, assets, household needs, past management, and climate/market trends

Simple models with different types of complexity

Michael Roos | Published Tuesday, September 17, 2024 | Last modified Saturday, March 01, 2025Hierarchical problem-solving model

The model simulates a hierarchical problem-solving process in which a manager delegates parts of a problem to specialists, who attempt to solve specific aspects based on their unique skills. The goal is to examine how effectively the hierarchical structure works in solving the problem, the total cost of the process, and the resulting solution quality.

Problem-solving random network model

The model simulates a network of agents (generalists) who collaboratively solve a fixed problem by iterating over it and using their individual skills to reduce the problem’s complexity. The goal is to study the dynamics of the problem-solving process, including agent interactions, work cycles, total cost, and solution quality.

epiworldR Type: Fast Agent-Based Epi Models

George G. Vega Yon Derek Meyer | Published Monday, August 26, 2024A flexible framework for Agent-Based Models (ABM), the ‘epiworldR’ package provides methods for prototyping disease outbreaks and transmission models using a ‘C++’ backend, making it very fast. It supports multiple epidemiological models, including the Susceptible-Infected-Susceptible (SIS), Susceptible-Infected-Removed (SIR), Susceptible-Exposed-Infected-Removed (SEIR), and others, involving arbitrary mitigation policies and multiple-disease models. Users can specify infectiousness/susceptibility rates as a function of agents’ features, providing great complexity for the model dynamics. Furthermore, ‘epiworldR’ is ideal for simulation studies featuring large populations.

Team Structure and Task Performance

Davide Secchi Martin Neumann | Published Monday, August 05, 2024This model was designed to study resilience in organizations. Inspired by ethnographic work, it follows the simple goal to understand whether team structure affects the way in which tasks are performed. In so doing, it compares the ‘hybrid’ data-inspired structure with three more traditional structures (i.e. hierarchy, flexible/relaxed hierarchy, and anarchy/disorganization).

Peer reviewed FISHCODE - FIsheries Simulation with Human COmplex DEcision-making

Birgit Müller Gunnar Dressler Jonas Letschert Christian Möllmann Vanessa Stelzenmüller | Published Monday, August 05, 2024FIsheries Simulation with Human COmplex DEcision-making (FISHCODE) is an agent-based model to depict and analyze current and future spatio-temporal dynamics of three German fishing fleets in the southern North Sea. Every agent (fishing vessel) makes daily decisions about if, what, and how long to fish. Weather, fuel and fish prices, as well as the actions of their colleagues influence agents’ decisions. To combine behavioral theories and enable agents to make dynamic decision, we implemented the Consumat approach, a framework in which agents’ decisions vary in complexity and social engagement depending on their satisfaction and uncertainty. Every agent has three satisfactions and two uncertainties representing different behavioral aspects, i.e. habitual behavior, profit maximization, competition, conformism, and planning insecurity. Availability of extensive information on fishing trips allowed us to parameterize many model parameters directly from data, while others were calibrated using pattern oriented modelling. Model validation showed that spatial and temporal aggregated ABM outputs were in realistic ranges when compared to observed data. Our ABM hence represents a tool to assess the impact of the ever growing challenges to North Sea fisheries and provides insight into fisher behavior beyond profit maximization.

Exploring the Potential of Conversational AI Support for Agent-Based Social Simulation Model Design

Peer-Olaf Siebers | Published Sunday, May 12, 2024Our aim is to demonstrate how conversational AI systems, exemplified by ChatGPT, can support the conceptualisation of Agent-Based Social Simulation (ABSS) models, leading to a full ABSS model design document. Through advanced prompt engineering and adherence to the Engineering ABSS framework (Siebers and Klügl 2017), we have constructed a comprehensive script that is easy to use and that supports the design of ABSS models with or even by AI. The performance of the script is demonstrated through an illustrative case study related to the use of adaptive architecture in museums. The repository contains (1) the comprehensive script in a format that allows copying and pasting prompts for use with ChatGPT, (2) the results of the illustrative case study in the form of two conceptual ABSS models, the ground truth and the autogenerated version.

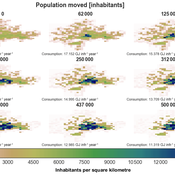

IUCM - The Integrated Urban Complexity Model

Roger Cremades Philipp S. Sommer | Published Thursday, December 14, 2023We present the Integrated Urban Complexity model (IUCm 1.0) that computes “climate-smart urban forms”, which are able to cut emissions related to energy consumption from urban mobility in half. Furthermore, we show the complex features that go beyond the normal debates about urban sprawl vs. compactness. Our results show how to reinforce fractal hierarchies and population density clusters within climate risk constraints to significantly decrease the energy consumption of urban mobility. The new model that we present aims to produce new advice about how cities can combat climate change. From a technical angle, this model is a geographical automaton, conceptually interfacing between cellular automata and spatial explicit optimisation to achieve normative sustainability goals related to low energy. See a complete user guide at https://iucm.readthedocs.io/en/latest/ .

Displaying 10 of 58 results complexity clear search