About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 85 results Python clear

VIDA: A simulation model of domestic VIolence in times of social DistAncing

B Furtado | Published Monday, January 11, 2021Violence against women occurs predominantly in the family and domestic context. The COVID-19 pandemic led Brazil to recommend and, at times, impose social distancing, with the partial closure of economic activities, schools, and restrictions on events and public services. Preliminary evidence shows that intense co- existence increases domestic violence, while social distancing measures may have prevented access to public services and networks, information, and help. We propose an agent-based model (ABM), called VIDA, to illustrate and examine multi-causal factors that influence events that generate violence. A central part of the model is the multi-causal stress indicator, created as a probability trigger of domestic violence occurring within the family environment. Two experimental design tests were performed: (a) absence or presence of the deterrence system of domestic violence against women and measures to increase social distancing. VIDA presents comparative results for metropolitan regions and neighbourhoods considered in the experiments. Results suggest that social distancing measures, particularly those encouraging staying at home, may have increased domestic violence against women by about 10%. VIDA suggests further that more populated areas have comparatively fewer cases per hundred thousand women than less populous capitals or rural areas of urban concentrations. This paper contributes to the literature by formalising, to the best of our knowledge, the first model of domestic violence through agent-based modelling, using empirical detailed socioeconomic, demographic, educational, gender, and race data at the intraurban level (census sectors).

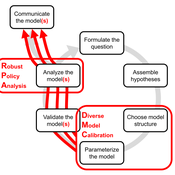

DMC-RPA: Diverse Model Calibration for Robust Policy Analysis (applied to an ABM of smallholder farmer resilience)

Tim Williams | Published Sunday, August 30, 2020This repository contains: (1) a model calibration procedure that identifies a set of diverse, plausible models; and (2) an ABM of smallholder agriculture, which is used as a case study application for the calibration method. By identifying a set of diverse models, the calibration method attends to the issue of “equifinality” prevalent in complex systems, which is a situation where multiple plausible process descriptions exist for a single outcome.

Urban/Rural Adaptive Culture Model

Nick LaBerge | Published Sunday, July 19, 2020Contains python3 code used to replicate the culture model from the JASSS submission: “Modeling Cultural Dissemination and Divergence between Rural and Urban Regions.”

A discrete-time stochastic model with state-dependent transmission probabilities and multi-agent simulations focusing on possible risks that could materialize in the final phase of the epidemic.

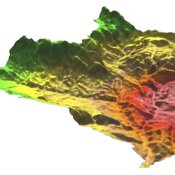

MedLanD Modeling Laboratory

C Michael Barton Isaac Ullah Gary Mayer Sean Bergin Hessam Sarjoughian Helena Mitasova | Published Friday, May 08, 2015 | Last modified Thursday, December 14, 2017The MML is a hybrid modeling environment that couples an agent-based model of small-holder agropastoral households and a cellular landscape evolution model that simulates changes in erosion/deposition, soils, and vegetation.

Reflexivity in a diffusion of innovations model

Carlos Cordoba Cesar Garcia-Diaz | Published Thursday, May 07, 2020In this agent-based model, agents decide to adopt a new product according to a utility function that depends on two kinds of social influences. First, there is a local influence exerted on an agent by her closest neighbors that have already adopted, and also by herself if she feels the product suits her personal needs. Second, there is a global influence which leads agents to adopt when they become aware of emerging trends happening in the system. For this, we endow agents with a reflexive capacity that allows them to recognize a trend, even if they can not perceive a significant change in their neighborhood.

Results reveal the appearance of slowdown periods along the adoption rate curve, in contrast with the classic stylized bell-shaped behavior. Results also show that network structure plays an important role in the effect of reflexivity: while some structures (e.g., scale-free networks) may amplify it, others (e.g., small-world structure) weaken such an effect.

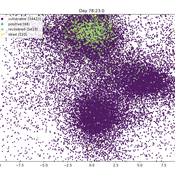

Ornstein-Uhlenbeck Pandemic package

Peter Cotton | Published Friday, April 24, 2020 | Last modified Friday, May 08, 2020Pandemic (pip install pandemic)

An agent model in which commuting, compliance, testing and contagion parameters drive infection in a population of thousands of millions. Agents follow Ornstein-Uhlenbeck processes in the plane and collisions drive transmission. Results are stored at SwarmPrediction.com for further analysis, and can be retrieved by anyone.

This is a very simple simulation that in a special case can be shown to be approximated by a compartmental model with time varying infection rate.

Impacts of consensus protocols and trade network topologies on blockchain system performance

Zhou HE | Published Friday, March 20, 2020This model is programmed in Python 3.6. We model how different consensus protocols and trade network topologies affect the performance of a blockchain system. The model consists of multiple trader and miner agents (Trader.py and Tx.py), and one system agent (System.py). We investigated three consensus protocols, namely proof-of-work (PoW), proof-of-stake (PoS), and delegated proof-of-stake (DPoS). We also examined three common trade network topologies: random, small-world, and scale-free. To reproduce our results, you may need to create some databases using, e.g., MySQL; or read and write some CSV files as model configurations.

Exploring the Effects of Link Recommendations on Social Networks

Ciara Sibley Andrew Crooks | Published Thursday, March 19, 2020The purpose of this model is explore how “friend-of-friend” link recommendations, which are commonly used on social networking sites, impact online social network structure. Specifically, this model generates online social networks, by connecting individuals based upon varying proportions of a) connections from the real world and b) link recommendations. Links formed by recommendation mimic mutual connection, or friend-of-friend algorithms. Generated networks can then be analyzed, by the included scripts, to assess the influence that different proportions of link recommendations have on network properties, specifically: clustering, modularity, path length, eccentricity, diameter, and degree distribution.

A Balance Model of Opinion Hyperpolarization

Simon Schweighofer Simon Schweighofer Frank Schweitzer David Garcia | Published Tuesday, December 17, 2019 | Last modified Tuesday, December 17, 2019Contains python3 code to replicate the opinion dynamics model from our (so far unpublished) JASSS sumbission “A Balance Model of Opinion Hyperpolarization”. The main function is run_model(), which returns a dictionary object containing various outcome metrics.

Displaying 10 of 85 results Python clear