About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 20 results Housing clear

The PARSO_demo Model

Davide Secchi | Published Tuesday, November 05, 2019This model explores different aspects of the formation of urban neighbourhoods where residents believe in values distant from those dominant in society. Or, at least, this is what the Danish government beliefs when they discuss their politics about parallel societies. This simulation is set to understand (a) whether these alternative values areas form and what determines their formation, (b) if they are linked to low or no income residents, and (c) what happens if they disappear from the map. All these three points are part of the Danish government policy. This agent-based model is set to understand the boundaries and effects of this policy.

Coupled Housing and Land Markets (CHALMS)

Nicholas Magliocca | Published Thursday, August 29, 2019An economic agent-based model of Coupled Housing and Land Markets (CHALMS) simulates the location choices, insurance purchasing decisions, and risk perceptions of coastal residents, and how coastal risks are capitalized (or not) into coastal housing and land markets.

Risks and Hedonics in Empirical Agent-based land market (RHEA) model

Koen de Koning Tatiana Filatova | Published Monday, April 01, 2019RHEA aims to provide a methodological platform to simulate the aggregated impact of households’ residential location choice and dynamic risk perceptions in response to flooding on urban land markets. It integrates adaptive behaviour into the spatial landscape using behavioural theories and empirical data sources. The platform can be used to assess: how changes in households’ preferences or risk perceptions capitalize in property values, how price dynamics in the housing market affect spatial demographics in hazard-prone urban areas, how structural non-marginal shifts in land markets emerge from the bottom up, and how economic land use systems react to climate change. RHEA allows direct modelling of interactions of many heterogeneous agents in a land market over a heterogeneous spatial landscape. As other ABMs of markets it helps to understand how aggregated patterns and economic indices result from many individual interactions of economic agents.

The model could be used by scientists to explore the impact of climate change and increased flood risk on urban resilience, and the effect of various behavioural assumptions on the choices that people make in response to flood risk. It can be used by policy-makers to explore the aggregated impact of climate adaptation policies aimed at minimizing flood damages and the social costs of flood risk.

Recycling behavior of Chinese households

B Dijkhuizen M Van Den Hoven M Minderhoud N Wäckerlin Igor Nikolic | Published Monday, June 19, 2017 | Last modified Thursday, March 29, 2018The model represents empirically observed recycling behaviour of Chinese citizens, based on the theory of reasoned action (TRA), the theory of planned behaviour (TPB) and the theory of planned behaviour extended with situational factors (TPB+).

Coastal Coupled Housing and Land Markets (C-CHALMS)

Nicholas Magliocca | Published Thursday, May 18, 2017Next generation of the CHALMS model applied to a coastal setting to investigate the effects of subjective risk perception and salience decision-making on adaptive behavior by residents.

Endogenous Dynamics of Housing Market Cycles

Birnur Özbaş Onur Özgün Yaman Barlas | Published Monday, September 09, 2013 | Last modified Wednesday, January 08, 2014The purpose of this model is to analyze the dynamics of endogenously created oscillations in housing prices using a system dynamics simulation model, built from the perspective of construction companies.

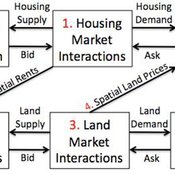

Coupled Housing and Land Markets (CHALMS)

Nicholas Magliocca Virginia Mcconnell Margaret Walls | Published Friday, November 02, 2012 | Last modified Monday, October 27, 2014CHALMS simulates housing and land market interactions between housing consumers, developers, and farmers in a growing ex-urban area.

Income and Expenditure

Tony Lawson | Published Thursday, October 06, 2011 | Last modified Saturday, April 27, 2013How do households alter their spending patterns when they experience changes in income? This model answers this question using a random assignment scheme where spending patterns are copied from a household in the new income bracket.

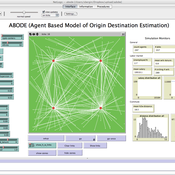

ABODE - Agent Based Model of Origin Destination Estimation

D Levinson | Published Monday, August 29, 2011 | Last modified Saturday, April 27, 2013The agent based model matches origins and destinations using employment search methods at the individual level.

An Agent-Based Model of Flood Risk and Insurance

J Dubbelboer I Nikolic K Jenkins J Hall | Published Monday, July 27, 2015 | Last modified Monday, October 03, 2016A model to show the effects of flood risk on a housing market; the role of flood protection for risk reduction; the working of the existing public-private flood insurance partnership in the UK, and the proposed scheme ‘Flood Re’.

Displaying 10 of 20 results Housing clear