About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 69 results for "Carlo Jaeger" clear search

Peer reviewed Price Evolution with Expectations

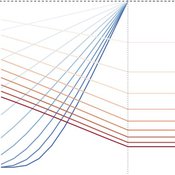

J M Applegate Gesine Steudel Armin Haas Carlo Jaeger | Published Friday, September 10, 2021The Price Evolution with Expectations model provides the opportunity to explore the question of non-equilibrium market dynamics, and how and under which conditions an economic system converges to the classically defined economic equilibrium. To accomplish this, we bring together two points of view of the economy; the classical perspective of general equilibrium theory and an evolutionary perspective, in which the current development of the economic system determines the possibilities for further evolution.

The Price Evolution with Expectations model consists of a representative firm producing no profit but producing a single good, which we call sugar, and a representative household which provides labour to the firm and purchases sugar.The model explores the evolutionary dynamics whereby the firm does not initially know the household demand but eventually this demand and thus the correct price for sugar given the household’s optimal labour.

The model can be run in one of two ways; the first does not include money and the second uses money such that the firm and/or the household have an endowment that can be spent or saved. In either case, the household has preferences for leisure and consumption and a demand function relating sugar and price, and the firm has a production function and learns the household demand over a set number of time steps using either an endogenous or exogenous learning algorithm. The resulting equilibria, or fixed points of the system, may or may not match the classical economic equilibrium.

A Pastoral Stoking Strategy Model with Fodder Import and Loan Scenarios

Yanbo Li | Published Tuesday, December 24, 2019This model was built to estimate the impacts of exogenous fodder input and credit loans services on livelihood, rangeland health and profits of pastoral production in a small holder pastoral household in the arid steppe rangeland of Inner Mongolia, China. The model simulated the long-term dynamic of herd size and structure, the forage demand and supply, the cash flow, and the situation of loan debt under three different stocking strategies: (1) No external fodder input, (2) fodders were only imported when natural disaster occurred, and (3) frequent import of external fodder, with different amount of available credit loans. Monte-Carlo method was used to address the influence of climate variability.

Emergency Warning Dissemination in a Multiplex Social Network

Charles Koll | Published Tuesday, January 31, 2023This is an interdisciplinary agent-based model with Monte Carlo simulations to assess the relative effects of broadcast and contagion processes in a multiplex social network. This multiplex approach models multiple channels of informal communication - phone, word-of-mouth, and social media - that vary in their attribute values. Each agent is an individual in a threatened community who, once warned, has a probability of warning others in their social network using one of these channels. The probability of an individual warning others is based on their warning source and the time remaining until disaster impact, among other variables. Default parameter values were chosen from empirical studies of disaster warnings along with the spatial aspects of Coos Bay, OR, USA and Seaside, OR, USA communities.

Peer reviewed Agent-Based Ramsey growth model with Brown and Green capital (ABRam-BG)

Sarah Wolf Aida Sarai Figueroa Alvarez | Published Monday, December 09, 2024The purpose of the ABRam-BG model is to study belief dynamics as a potential driver of green (growth) transitions and illustrate their dynamics in a closed, decentralized economy populated by utility maximizing agents with an environmental attitude. The model is built using the ABRam-T model (for model visit: https://doi.org/10.25937/ep45-k084) and introduces two types of capital – green (low carbon intensity) and brown (high carbon intensity) – with their respective technological progress levels. ABRam-BG simulates a green transition as an emergent phenomenon resulting from well-known opinion dynamics along the economic process.

Peer reviewed Agent-Based Ramsey growth model with endogenous technical progress (ABRam-T)

Sarah Wolf Aida Sarai Figueroa Alvarez Malika Tokpanova | Published Wednesday, February 14, 2024 | Last modified Monday, February 19, 2024The Agent-Based Ramsey growth model is designed to analyze and test a decentralized economy composed of utility maximizing agents, with a particular focus on understanding the growth dynamics of the system. We consider farms that adopt different investment strategies based on the information available to them. The model is built upon the well-known Ramsey growth model, with the introduction of endogenous technical progress through mechanisms of learning by doing and knowledge spillovers.

Peer reviewed An Agent-Based Model of Status Construction in Task Focused Groups

Andreas Flache Rafael Wittek André Grow | Published Sunday, May 18, 2014 | Last modified Tuesday, June 16, 2015The model simulates interactions in small, task focused groups that might lead to the emergence of status beliefs among group members.

A Simple Agent Based Modeling Tool for Plastic and Debris Tracking in Oceans

Subu Kandaswamy Koushik Sura Bhaskar Sai Amulya Murukutla Sai Pranay Raju Chinthala Abhishek Bobbillapati | Published Monday, October 04, 2021Plastics and the pollution caused by their waste have always been a menace to both nature and humans. With the continual increase in plastic waste, the contamination due to plastic has stretched to the oceans. Many plastics are being drained into the oceans and rose to accumulate in the oceans. These plastics have seemed to form large patches of debris that keep floating in the oceans over the years. Identification of the plastic debris in the ocean is challenging and it is essential to clean plastic debris from the ocean. We propose a simple tool built using the agent-based modeling framework NetLogo. The tool uses ocean currents data and plastic data both being loaded using GIS (Geographic Information System) to simulate and visualize the movement of floatable plastic and debris in the oceans. The tool can be used to identify the plastic debris that has been piled up in the oceans. The tool can also be used as a teaching aid in classrooms to bring awareness about the impact of plastic pollution. This tool could additionally assist people to realize how a small plastic chunk discarded can end up as large debris drifting in the oceans. The same tool might help us narrow down the search area while looking out for missing cargo and wreckage parts of ships or flights. Though the tool does not pinpoint the location, it might help in reducing the search area and might be a rudimentary alternative for more computationally expensive models.

An Agent-Based Model of Collective Action

Hai-Hua Hu | Published Tuesday, August 20, 2013We provide an agent-based model of collective action, informed by Granovetter (1978) and its replication model by Siegel (2009). We use the model to examine the role of ICTs in collective action under different cultural and political contexts.

Evolution of cooperation, punishment and retaliation

Marco Janssen | Published Friday, September 06, 2013Cultural group selection model of agents playing public good games and who are able to punish and punish back.

Alternative scenarios of green consumption in Italy: an empirically grounded model.

Giangiacomo Bravo Elena Vallino Alessandro K Cerutti Maria Beatrice Pairotti | Published Thursday, March 28, 2013 | Last modified Saturday, April 27, 2013We provide a full description of the model following the ODD protocol (Grimm et al. 2010) in the attached document. The model is developed in NetLogo 5.0 (Wilenski 1999).

Displaying 10 of 69 results for "Carlo Jaeger" clear search