About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 334 results for "Ali Termos" clear search

RiskNetABM

Birgit Müller Jürgen Groeneveld Karin Frank Meike Will Friederike Lenel | Published Monday, July 20, 2020 | Last modified Monday, May 03, 2021The fight against poverty is an urgent global challenge. Microinsurance is promoted as a valuable instrument for buffering income losses due to health or climate-related risks of low-income households in developing countries. However, apart from direct positive effects they can have unintended side effects when insured households lower their contribution to traditional arrangements where risk is shared through private monetary support.

RiskNetABM is an agent-based model that captures dynamics between income losses, insurance payments and informal risk-sharing. The model explicitly includes decisions about informal transfers. It can be used to assess the impact of insurance products and informal risk-sharing arrangements on the resilience of smallholders. Specifically, it allows to analyze whether and how economic needs (i.e. level of living costs) and characteristics of extreme events (i.e. frequency, intensity and type of shock) influence the ability of insurance and informal risk-sharing to buffer income shocks. Two types of behavior with regard to private monetary transfers are explicitly distinguished: (1) all households provide transfers whenever they can afford it and (2) insured households do not show solidarity with their uninsured peers.

The model is stylized and is not used to analyze a particular case study, but represents conditions from several regions with different risk contexts where informal risk-sharing networks between smallholder farmers are prevalent.

…

Feedback Loop Example: Forest Resource Transport

James Millington | Published Friday, December 21, 2012 | Last modified Saturday, April 27, 2013This model illustrates a positive ‘transport’ feedback loop in which lines with different resistance to flows of material result in variation in rates of change in linked entities.

Peer reviewed Umwelten Ants

Kit Martin | Published Thursday, January 15, 2015 | Last modified Thursday, August 27, 2015Simulates impacts of ants killing colony mates when in conflict with another nest. The murder rate is adjustable, and the environmental change is variable. The colonies employ social learning so knowledge diffusion proceeds if interactions occur.

Peer reviewed Least cost path mobility

Colin Wren Claudine Gravel-Miguel | Published Saturday, September 02, 2017 | Last modified Monday, October 04, 2021This model aims to mimic human movement on a realistic topographical surface. The agent does not have a perfect knowledge of the whole surface, but rather evaluates the best path locally, at each step, thus mimicking imperfect human behavior.

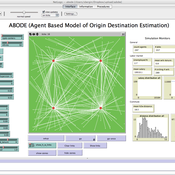

ABODE - Agent Based Model of Origin Destination Estimation

D Levinson | Published Monday, August 29, 2011 | Last modified Saturday, April 27, 2013The agent based model matches origins and destinations using employment search methods at the individual level.

WealthDistribRes

Romulus-Catalin Damaceanu | Published Friday, May 04, 2012 | Last modified Saturday, April 27, 2013This model WealthDistribRes can be used to study the distribution of wealth in function of using a combination of resources classified in two renewable and nonrenewable.

Bargaining with misvaluation

Marcin Czupryna | Published Wednesday, January 14, 2026Subjective biases and errors systematically affect market equilibria, whether at the population level or in bilateral trading. Here, we consider the possibility that an agent engaged in bilateral trading is mistaken about her own valuation of the good she expects to trade, that has not been explicitly incorporated into the existing bilateral trade literature. Although it may sound paradoxical that a subjective private valuation is something an agent can be mistaken about, as it is up to her to fix it, we consider the case in which that agent, seller or buyer, consciously or not, given the structure of a market, a type of good, and a temporary lack of information, may arrive at an erroneous valuation. The typical context through which this possibility may arise is in relation with so-called experience goods, which are sold while all their intrinsic qualities are still unknown (such as untasted bottled fine wines). We model this “private misvaluation” phenomenon in our study. The agents may also be mistaken about how their exchange counterparties are themselves mistaken. Formally, they attribute a certain margin of error to the other agent, which can differ from the actual way that another agent misvalues the good under consideration. This can constitute the source of a second-order misvaluation. We model different attitudes and situations in which agents face unexpected signals from their counterparties and the manner and extent to which they revise their initial beliefs. We analyse and simulate numerically the consequences of first-order and second-order misvaluation on market equilibria.

Market for Protection

Steven Doubleday | Published Monday, July 01, 2013 | Last modified Monday, August 19, 2013Simulation to replicate and extend an analytical model (Konrad & Skaperdas, 2010) of the provision of security as a collective good. We simulate bandits preying upon peasants in an anarchy condition.

PR-M: The Peer Review Model

Mario Paolucci Francisco Grimaldo | Published Sunday, November 10, 2013 | Last modified Wednesday, July 01, 2015This is an agent-based model of peer review built on the following three entities: papers, scientists and conferences. The model has been implemented on a BDI platform (Jason) that allows to perform both parameter and mechanism exploration.

A Model of Iterated Ultimatum game

Andrea Scalco | Published Tuesday, February 24, 2015 | Last modified Monday, March 09, 2015The simulation generates two kinds of agents, whose proposals are generated accordingly to their selfish or selfless behaviour. Then, agents compete in order to increase their portfolio playing the ultimatum game with a random-stranger matching.

Displaying 10 of 334 results for "Ali Termos" clear search