About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 50 results markets clear search

Generalized Trust in the Mirror - a model on the Dynamics of Trust

Dominik Klein Johannes Marx | Published Friday, January 12, 2018This model studies the emergence and dynamics of generalized trust. It does so by modeling agents that engage in trust games and, based on their experience, slowly determine whether others are, in general, trustworthy.

Viticulture development in emerging markets: Małopolska region

Marcin Czupryna Bogumił Kamiński Paweł Oleksy Piotr Przybek | Published Tuesday, November 28, 2017 | Last modified Saturday, June 16, 2018Model explains both the final state and the dynamics of the development process of the wine sector in the Małopolska region in Poland. Model admits heterogeneous agents (regular farms,large and small vineyards).

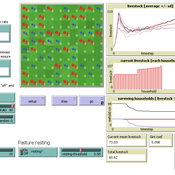

RAGE RAngeland Grazing Model

Carsten M Buchmann Jule Thober Birgit Müller Karin Frank Cheng Guo Jürgen Groeneveld Gunnar Dressler Niklas Hase | Published Monday, July 17, 2017 | Last modified Friday, October 26, 2018RAGE models a stylized common property grazing system. Agents follow a certain behavioral type. The model allows analyzing how household behavior with respect to a social norm on pasture resting affects long-term social-ecological system dynamics.

Coastal Coupled Housing and Land Markets (C-CHALMS)

Nicholas Magliocca | Published Thursday, May 18, 2017Next generation of the CHALMS model applied to a coastal setting to investigate the effects of subjective risk perception and salience decision-making on adaptive behavior by residents.

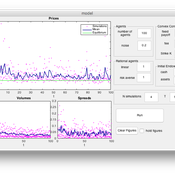

Multi Asset Variable Network Stock Market Model

Matthew Oldham | Published Monday, September 12, 2016 | Last modified Tuesday, October 10, 2017An artifcal stock market model that allows users to vary the number of risky assets as well as the network topology that investors forms in an attempt to understand the dynamics of the market.

An Agent Based Model for implementing a double auction financial market

Annalisa Fabretti | Published Thursday, April 14, 2016The model implements a double auction financial markets with two types of agents: rational and noise. The model aims to study the impact of different compensation structure on the market stability and market quantities as prices, volumes, spreads.

A simple agent-based spatial model of the economy

Bernardo Alves Furtado Isaque Daniel Rocha Eberhardt | Published Thursday, March 10, 2016 | Last modified Tuesday, November 22, 2016The modeling includes citizens, bounded into families; firms and governments; all of them interacting in markets for goods, labor and real estate. The model is spatial and dynamic.

Peer reviewed Hohokam Trade Networks Model

Joshua Watts | Published Sunday, October 26, 2014The Hohokam Trade Networks Model focuses on key features of the Hohokam economy to explore how differences in trade network topologies may show up in the archaeological record. The model is set in the Phoenix Basin of central Arizona, AD 200-1450.

SLUCEII LUXE (Land Use in an eXurban Environment)

Qingxu Huang Rick L Riolo Shipeng Sun Derek Robinson Dawn Parker Tatiana Filatova Meghan Hutchins Dan Brown | Published Tuesday, September 10, 2013 | Last modified Saturday, October 22, 2022LUXE is a land-use change model featuring different levels of land market implementation. It integrates utility measures, budget constraints, competitive bidding, and market interactions to model land-use change in exurban environment.

The various technologies used inside a Dutch greenhouse interact in combination with an external climate, resulting in an emergent internal climate, which contributes to the final productivity of the greenhouse. This model examines how differing technology development styles affects the overall ability of a community of growers to approach the theoretical maximum yield.

Displaying 10 of 50 results markets clear search