About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 238 results for "Marcel Volosin" clear search

Metaphoria 2019

Timothy Gooding | Published Sunday, February 24, 2019This model test the efficiency of the market economy in comparison with a hunter/gatherer economy. It also compares the model outcomes between a market economy when using eternal agents with one using mortal agents.

Micro-level Adaptation, Macro-level Selection, and the Dynamics of Market Partitioning

César García-Díaz | Published Monday, October 19, 2015 | Last modified Monday, October 19, 2015This model simulates the emergence of a dual market structure from firm-level interaction. Firms are profit-seeking, and demand is represented by a unimodal distribution of consumers along a set of taste positions.

A Consumer in the Jungle of Product Differentiation

Alessandro Pluchino Andrea Rapisarda Alessio Emanuele Biondo Alfio Giarlotta | Published Tuesday, December 22, 2015Building upon the distance-based Hotelling’s differentiation idea, we describe the behavioral experience of several prototypes of consumers, who walk a hypothetical cognitive path in an attempt to maximize their satisfaction.

A replication and extension of the Taylor's Simulation Model of Insurance Market Dynamics in C#

Rei England | Published Sunday, September 24, 2023A simple model is constructed using C# in order to to capture key features of market dynamics, while also producing reasonable results for the individual insurers. A replication of Taylor’s model is also constructed in order to compare results with the new premium setting mechanism. To enable the comparison of the two premium mechanisms, the rest of the model set-up is maintained as in the Taylor model. As in the Taylor example, homogeneous customers represented as a total market exposure which is allocated amongst the insurers.

In each time period, the model undergoes the following steps:

1. Insurers set competitive premiums per exposure unit

2. Losses are generated based on each insurer’s share of the market exposure

3. Accounting results are calculated for each insurer

…

Simulating the Cinema Market: How Cross-Cultural Differences in Social Influence Explain Box Office Distributions

Sebastiano Delre | Published Thursday, February 11, 2010 | Last modified Saturday, April 27, 2013This model simulates the motion picture industry and tests how social influences affect market shares. It is empirically validated at the micro level by a cross-cultural survey.

A Multi-Agent Simulation Approach to Farmland Auction Markets

James Nolan | Published Wednesday, June 22, 2011 | Last modified Saturday, April 27, 2013This model explores the effects of agent interaction, information feedback, and adaptive learning in repeated auctions for farmland. It gathers information for three types of sealed-bid auctions, and one English auction and compares the auctions on the basis of several measures, including efficiency, price information revelation, and ability to handle repeated bidding and agent learning.

Modeling information Asymmetries in Tourism

Jacopo A. Baggio Rodolfo Baggio | Published Monday, January 09, 2012 | Last modified Saturday, April 27, 2013A very simple model elaborated to explore what may happens when buyers (travelers) have more information than sellers (tourist destinations)

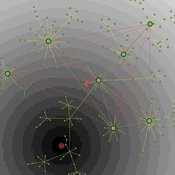

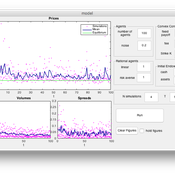

An Agent Based Model for implementing a double auction financial market

Annalisa Fabretti | Published Thursday, April 14, 2016The model implements a double auction financial markets with two types of agents: rational and noise. The model aims to study the impact of different compensation structure on the market stability and market quantities as prices, volumes, spreads.

Risks and Hedonics in Empirical Agent-based land market (RHEA) model

Tatiana Filatova Koen de Koning | Published Monday, April 01, 2019RHEA aims to provide a methodological platform to simulate the aggregated impact of households’ residential location choice and dynamic risk perceptions in response to flooding on urban land markets. It integrates adaptive behaviour into the spatial landscape using behavioural theories and empirical data sources. The platform can be used to assess: how changes in households’ preferences or risk perceptions capitalize in property values, how price dynamics in the housing market affect spatial demographics in hazard-prone urban areas, how structural non-marginal shifts in land markets emerge from the bottom up, and how economic land use systems react to climate change. RHEA allows direct modelling of interactions of many heterogeneous agents in a land market over a heterogeneous spatial landscape. As other ABMs of markets it helps to understand how aggregated patterns and economic indices result from many individual interactions of economic agents.

The model could be used by scientists to explore the impact of climate change and increased flood risk on urban resilience, and the effect of various behavioural assumptions on the choices that people make in response to flood risk. It can be used by policy-makers to explore the aggregated impact of climate adaptation policies aimed at minimizing flood damages and the social costs of flood risk.

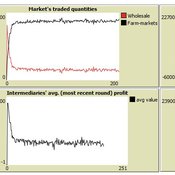

Market-level effects of firm-level adaptation and intermediation in networked markets of fresh foods: a case study in Colombia.

César García-Díaz | Published Sunday, April 12, 2020 | Last modified Sunday, April 12, 2020This a model developed as a part of the paper Mejía, G. & García-Díaz, C. (2018). Market-level effects of firm-level adaptation and intermediation in networked markets of fresh foods: a case study in Colombia. Agricultural Systems 160: 132-142.

It simulates the competition dynamics of the potato market in Bogotá, Colombia. The model explores the economic impact of intermediary actors on the potato supply chain.

Displaying 10 of 238 results for "Marcel Volosin" clear search