About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1118 results for "Elena A. Pearce" clear search

Agent-based Model of Industrial Evolution

Martin Zoričak Denis Horvath Vladimir Gazda Oto Hudec | Published Wednesday, July 10, 2019This is a conceptual model of underlying forces creating industrial clusters. There are two contradictory forces - attraction and repulsion. Firms within the same Industry are attracted to each other and on the other hand, firms with the same Activity are repulsed from each other. In each round firm with the lowest fitness is selected to change its profile of Industries and Activities. Based on these simple rules interesting patterns emerge.

Fertility Tradeoffs

Kristin Crouse | Published Tuesday, November 05, 2019 | Last modified Thursday, April 06, 2023Fertility Tradeoffs is a NetLogo model that illustrates the emergencent tradeoffs between the quality and quantity of offspring. Often, we associate high fitness with maximizing the number of offspring. However, under certain circumstances, it pays instead to optimize the number of offspring, having fewer offspring than is possible. When the number of offspring is reduced, more energy can be invested in each offspring, which can have fitness benefits.

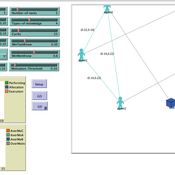

Eco-Evolutionary Pathways Toward Industrial Cities

Handi Chandra Putra | Published Thursday, May 21, 2020Industrial location theory has not emphasized environmental concerns, and research on industrial symbiosis has not emphasized workforce housing concerns. This article brings jobs, housing, and environmental considerations together in an agent-based model of industrial

and household location. It shows that four classic outcomes emerge from the interplay of a relatively small number of explanatory factors: the isolated enterprise with commuters; the company town; the economic agglomeration; and the balanced city.

Autonomy or control? An agent-based study of self-organising versus centralised task allocation

Shaoni Wang | Published Wednesday, January 29, 2025The aim of our model is to investigate the team dynamics through two types of task allocation strategies, with a focus on the dynamic interplay between individual needs and group performance. To achieve this goal, we have formulated an agent-based model (ABM) to formalize Deci & Ryan’s self-determination theory (SDT) and explore the social dynamics that govern the relationship between individual and group levels of team performance.

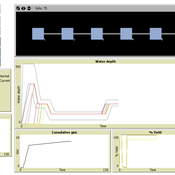

An agent-based model to simulate field-specific nitrogen fertilizer applications in grasslands

Maria Haensel Thomas Schmitt Andrea Kaim Sylvia Helena Annuth Thomas Koellner | Published Sunday, February 09, 2025Grasslands have a large share of the world’s land cover and their sustainable management is important for the protection and provisioning of grassland ecosystem services. The question of how to manage grassland sustainably is becoming increasingly important, especially in view of climate change, which on the one hand extends the vegetation period (and thus potentially allows use intensification) and on the other hand causes yield losses due to droughts. Fertilization plays an important role in grassland management and decisions are usually made at farm level. Data on fertilizer application rates are crucial for an accurate assessment of the effects of grassland management on ecosystem services. However, these are generally not available on farm/field scale. To close this gap, we present an agent-based model for Fertilization In Grasslands (FertIG). Based on animal, land-use, and cutting data, the model estimates grassland yields and calculates field-specific amounts of applied organic and mineral nitrogen on grassland (and partly cropland). Furthermore, the model considers different legal requirements (including fertilization ordinances) and nutrient trade among farms. FertIG was applied to a grassland-dominated region in Bavaria, Germany comparing the effects of changes in the fertilization ordinance as well as nutrient trade. The results show that the consideration of nutrient trade improves organic fertilizer distribution and leads to slightly lower Nmin applications. On a regional scale, recent legal changes (fertilization ordinance) had limited impacts. Limiting the maximum applicable amount of Norg to 170 kg N/ha fertilized area instead of farm area as of 2020 hardly changed fertilizer application rates. No longer considering application losses in the calculation of fertilizer requirements had the strongest effects, leading to lower supplementary Nmin applications. The model can be applied to other regions in Germany and, with respective adjustments, in Europe. Generally, it allows comparing the effects of policy changes on fertilization management at regional, farm and field scale.

An agent-based model to study the effects of urban sprawl on bird distribution

Yun Ouyang | Published Tuesday, December 16, 2008 | Last modified Saturday, April 27, 2013This model was programmed for a class project, which studied the effects of urban sprawl on bird distribution. For the urban sprawl part of the model, we started from the model in (udhira, H. S., 200

The purpose of the AdaptPumpa model is to analyze the robustness of the Pumpa irrigation system in Nepal to climate change.

Adoption of conservation practices

Irem Daloglu | Published Monday, October 21, 2013This model is designed to investigate the impact of alternative policy approaches and changing land tenure dynamics on farmer adoption of conservation practices intended to increase the water quality.

TELL ME: protective behaviour in an epidemic

Jennifer Badham | Published Tuesday, February 10, 2015Models the connection between health agency communication, personal protective behaviour (eg vaccination, hand hygiene) and influenza transmission.

Armature distribution within the PaleoscapeABM

Claudine Gravel-Miguel | Published Tuesday, March 23, 2021This is a variant of the PaleoscapeABM model available here written by Wren and Janssen. In this variant, we give projectile weapons to hunter and document where they discard them over time. Discard rate and location are influenced by probabilities of hitting/missing the prey, probabilities of damaging the weapon, and probabilities of carrying back embedded projectile armatures to the habitation camp with the body carcass.

Displaying 10 of 1118 results for "Elena A. Pearce" clear search