About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 41 results supply clear search

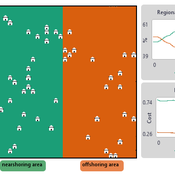

NOMAD: Near–Off Mobility under Aspiration Dynamics

Alejandro Platas López | Published Wednesday, December 17, 2025NOMAD is an agent-based model of firm location choice between two aggregate regions (“near” and “off”) under logistics uncertainty. Firms occupy sites characterised by attractiveness and logistics risk, earn a risk-adjusted payoff that depends on regional costs (wages plus congestion) and an individual risk-tolerance trait, and update location choices using aspiration-based satisficing rules with switching frictions. Logistics risk evolves endogenously on occupied sites through a region-specific absorption mechanism (good/bad events that reduce/increase risk), while congestion feeds back into regional costs via regional shares and local crowding. Runs stop endogenously once the near-region share becomes quasi-stable after burn-in, and the model records time series and quasi-stable outcomes such as near/off composition, switching intensity, costs, average risk, and average risk tolerance.

Peer reviewed E³-MAN. An Institutionally-guided multi-agent. Model for fair and efficient negotiation.

José luis bustelo | Published Monday, September 01, 2025Negotiation plays a fundamental role in shaping human societies, underpinning conflict resolution, institutional design, and economic coordination. This article introduces E³-MAN, a novel multi-agent model for negotiation that integrates individual utility maximization with fairness and institutional legitimacy. Unlike classical approaches grounded solely in game theory, our model incorporates Bayesian opponent modeling, transfer learning from past negotiation domains, and fallback institutional rules to resolve deadlocks. Agents interact in dynamic environments characterized by strategic heterogeneity and asymmetric information, negotiating over multidimensional issues under time constraints. Through extensive simulation experiments, we compare E³-MAN against the Nash bargaining solution and equal-split baselines using key performance metrics: utilitarian efficiency, Nash social welfare, Jain fairness index, Gini coefficient, and institutional compliance. Results show that E³-MAN achieves near-optimal efficiency while significantly improving distributive equity and agreement stability. A legal application simulating multilateral labor arbitration demonstrates that institutional default rules foster more balanced outcomes and increase negotiation success rates from 58% to 98%. By combining computational intelligence with normative constraints, this work contributes to the growing field of socially aware autonomous agents. It offers a virtual laboratory for exploring how simple institutional interventions can enhance justice, cooperation, and robustness in complex socio-legal systems.

Protein 2.0: An Agent-Based Model for Simulating Norway’s Protein Sector Under Carbon Pricing and the Emergence of Cultivated Proteins

Gary Polhill Nick Roxburgh Rob J.F. Burton Klaus Mittenzwei | Published Thursday, May 08, 2025Protein 2.0 is a systems model of the Norwegian protein sector designed to explore the potential impacts of carbon taxation and the emergence of cultivated meat and dairy technologies. The model simulates production, pricing, and consumption dynamics across conventional and cultivated protein sources, accounting for emissions intensity, technological learning, economies of scale, and agent behaviour. It assesses how carbon pricing could alter the competitiveness of conventional beef, lamb, pork, chicken, milk, and egg production relative to emerging cultivated alternatives, and evaluates the implications for domestic production, emissions, and food system resilience. The model provides a flexible platform for exploring policy scenarios and transition pathways in protein supply. Further details can be found in the associated publication.

BarterNet is a platform for modeling early barter networks with the aim of learning how supply and demand for a good determine if traders will learn to use that good as a form of money. Traders use a good as money when they offer to trade for it even if they can’t consume it, but believe that they can subsequently trade it for a good they can consume in the near future.

Agent-Based Model of a Circular Food Packaging Ecosystem to assess Packaging Waste Dynamics

Annoek Reitsema | Published Friday, October 11, 2024Reducing packaging waste is a critical challenge that requires organizations to collaborate within circular ecosystems, considering social, economic, and technical variables like decision-making behavior, material prices, and available technologies. Agent-Based Modeling (ABM) offers a valuable methodology for understanding these complex dynamics. In our research, we have developed an ABM to explore circular ecosystems’ potential in reducing packaging waste, using a case study of the Dutch food packaging ecosystem. The model incorporates three types of agents—beverage producers, packaging producers, and waste treaters—who can form closed-loop recycling systems.

Beverage Producer Agents: These agents represent the beverage company divided into five types based on packaging formats: cans, PET bottles, glass bottles, cartons, and bag-in-boxes. Each producer has specific packaging demands based on product volume, type, weight, and reuse potential. They select packaging suppliers annually, guided by deterministic decision styles: bargaining (seeking the lowest price) or problem-solving (prioritizing high recycled content).

Packaging Producer Agents: These agents are responsible for creating packaging using either recycled or virgin materials. The model assumes a mix of monopolistic and competitive market situations, with agents calculating annual material needs. Decision styles influence their choices: bargaining agents compare recycled and virgin material costs, while problem-solving agents prioritize maximum recycled content. They calculate recycled content in packaging and set prices accordingly, ensuring all produced packaging is sold within or outside the model.

…

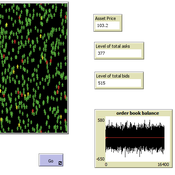

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

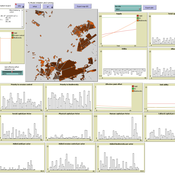

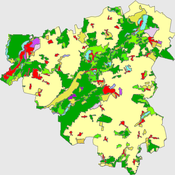

Peer reviewed The Viability of the Social-Ecological Agroecosystem (ViSA) Spatial Agent-based Model

Mostafa Shaaban | Published Monday, March 25, 2024ViSA 2.0.0 is an updated version of ViSA 1.0.0 aiming at integrating empirical data of a new use case that is much smaller than in the first version to include field scale analysis. Further, the code of the model is simplified to make the model easier and faster. Some features from the previous version have been removed.

It simulates decision behaviors of different stakeholders showing demands for ecosystem services (ESS) in agricultural landscape. It investigates conditions and scenarios that can increase the supply of ecosystem services while keeping the viability of the social system by suggesting different mixes of initial unit utilities and decision rules.

An Agent-Based Model of an Insurance Market driven by Supply and Demand with Imperfectly Estimated Strategies in C#

Rei England | Published Sunday, September 24, 2023This is a simulation of an insurance market where the premium moves according to the balance between supply and demand. In this model, insurers set their supply with the aim of maximising their expected utility gain while operating under imperfect information about both customer demand and underlying risk distributions.

There are seven types of insurer strategies. One type follows a rational strategy within the bounds of imperfect information. The other six types also seek to maximise their utility gain, but base their market expectations on a chartist strategy. Under this strategy, market premium is extrapolated from trends based on past insurance prices. This is subdivided according to whether the insurer is trend following or a contrarian (counter-trend), and further depending on whether the trend is estimated from short-term, medium-term, or long-term data.

Customers are modelled as a whole and allocated between insurers according to available supply. Customer demand is calculated according to a logit choice model based on the expected utility gain of purchasing insurance for an average customer versus the expected utility gain of non-purchase.

WATER REUSE ADOPTION BY FARMERS (WRAF)

Farshid Shoushtarian | Published Tuesday, September 27, 2022Agriculture is the largest water-consuming sector worldwide, responsible for almost 70% of the world’s total freshwater consumption. Agricultural water reuse is one of the most sustainable and reliable methods to alleviate water shortages worldwide. However, the dynamics of agricultural water reuse adoption by farmers and its impacts on local water resources are still unknown to the scientific community, according to the literature. Therefore, the primary purpose of the WRAF model is to investigate the micro-level dynamics of agricultural water reuse adoption by farmers and its impacts on local water resources. The WRAF was developed using agent-based modeling as an exploratory tool for scenario analysis. The model was specifically designed for researchers and water resources decision-makers, especially those interested in natural resources management and water reuse.

WRAF simulates a virtual agricultural area in which several autonomous farms operate. It also simulates these farms’ water consumption dynamics. The developed model includes two types of agents: farmers and wastewater treatment plants. In general, farmer agents are the main water-consuming agents, and wastewater treatment plant agents are recycled water providers in the WRAF model. Dynamic simulation of agricultural water supply and demand in the area allows the user to observe the results of various irrigation water management scenarios, including recycled water. The models also enable the user to apply multiple climate change scenarios, including normal, moderate drought, severe drought, and wet weather conditions.

Peer reviewed The Viability of the Social-Ecological Agroecosystem (ViSA) Spatial Agent-based Model

Mostafa Shaaban | Published Friday, June 03, 2022ViSA simulates the decision behaviors of different stakeholders showing demands for ecosystem services (ESS) in agricultural landscape. The lack of sufficient supply of ESSs triggers stakeholders to apply different management options to increase their supply. However, while attempting to reduce the supply-demand gap, conflicts arise among stakeholders due to the tradeoff nature of some ESS. ViSA investigates conditions and scenarios that can minimize such supply-demand gap while reducing the risk of conflicts by suggesting different mixes of management options and decision rules.

Displaying 10 of 41 results supply clear search