About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 103 results market clear

A Consumer in the Jungle of Product Differentiation

Alessio Emanuele Biondo Alfio Giarlotta Alessandro Pluchino Andrea Rapisarda | Published Tuesday, December 22, 2015Building upon the distance-based Hotelling’s differentiation idea, we describe the behavioral experience of several prototypes of consumers, who walk a hypothetical cognitive path in an attempt to maximize their satisfaction.

Policy Formulation for Public Administration - Innovation

Bashar Ourabi | Published Tuesday, August 29, 2017 | Last modified Tuesday, August 29, 2017Innovation a byproduct of the intellectual capital, requires a new paradigm for the production constituents. Human Capital HC,Structural capital SC and relational capital RC become key for intellectual capital and consequently for innovation.

Coastal Coupled Housing and Land Markets (C-CHALMS)

Nicholas Magliocca | Published Thursday, May 18, 2017Next generation of the CHALMS model applied to a coastal setting to investigate the effects of subjective risk perception and salience decision-making on adaptive behavior by residents.

Firm explore-exploit of knowledge

Rosanna Garcia | Published Monday, March 28, 2011 | Last modified Saturday, April 27, 2013The basic premise of the model is to simulate several ‘agents’ going through build-buy cycles: Build: Factories follow simple rules of strategy in the allocation of resources between making exploration and exploitation type products. Buy: Each of two types of Consumers, early-adopters and late adopters, follow simple purchase decision rules in deciding to purchase a product from one of two randomly chosen factories. Thus, the two working ‘agents’ of the model are ‘factories’ and […]

The Agent-Based Model of the Closed Market( similar to Stock Market) with One Commodity and with careful and risky mechanisms

Mark Voronovitsky | Published Sunday, March 15, 2015 | Last modified Sunday, March 22, 2015The model of market of one commodity , in which there are in each moment of time the same quantity and the same quantity of money was formulated and researched in this text. We also study this system as a game of automata.

Urban Sprawl and Income segregation with effect from income level and inequality

Cheng Guo Nina Schwarz Carsten M Buchmann | Published Tuesday, November 01, 2016 | Last modified Friday, May 26, 2017This is a stylized model based on Alonso’s model investigating the relationship between urban sprawl and income segregation.

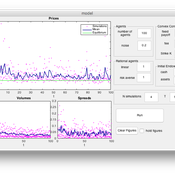

Multi Asset Variable Network Stock Market Model

Matthew Oldham | Published Monday, September 12, 2016 | Last modified Tuesday, October 10, 2017An artifcal stock market model that allows users to vary the number of risky assets as well as the network topology that investors forms in an attempt to understand the dynamics of the market.

An Agent Based Model for implementing a double auction financial market

Annalisa Fabretti | Published Thursday, April 14, 2016The model implements a double auction financial markets with two types of agents: rational and noise. The model aims to study the impact of different compensation structure on the market stability and market quantities as prices, volumes, spreads.

Endogenous Dynamics of Housing Market Cycles

Birnur Özbaş Onur Özgün Yaman Barlas | Published Monday, September 09, 2013 | Last modified Wednesday, January 08, 2014The purpose of this model is to analyze the dynamics of endogenously created oscillations in housing prices using a system dynamics simulation model, built from the perspective of construction companies.

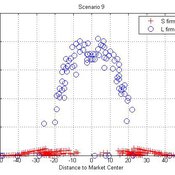

Micro-level Adaptation, Macro-level Selection, and the Dynamics of Market Partitioning

Cesar Garcia-Diaz | Published Monday, October 19, 2015 | Last modified Monday, October 19, 2015This model simulates the emergence of a dual market structure from firm-level interaction. Firms are profit-seeking, and demand is represented by a unimodal distribution of consumers along a set of taste positions.

Displaying 10 of 103 results market clear