About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 62 results Agent-based modelling clear search

We provide a theory-grounded, socio-geographic agent-based model to present a possible explanation for human movement in the Adriatic region within the Cetina phenomenon.

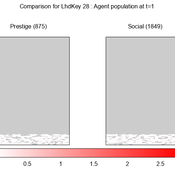

Focusing on ideas of social capital theory from Piere Bordieu (1986), we implement agent mobility in an abstract geography based on cultural capital (prestige) and social capital (social position). Agents hold myopic representations of social (Schaff, 2016) and geographical networks and decide in a heuristic way on moving (and where) or staying.

The model is implemented in a fork of the Laboratory for Simulation Development (LSD), appended with GIS capabilities (Pereira et. al. 2020).

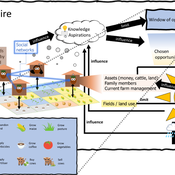

3spire: an agent-based model for exploring aspiration adaptation theory and its implications on smallholder farmers in Ethiopia

ateeuw Yue Dou Markus A Meyer Andrew Nelson | Published Sunday, February 16, 20253spire is an ABM where farming households make management decisions aimed at satisficing along the aspirational dimensions: food self-sufficiency, income, and leisure. Households decision outcomes depend on their social networks, knowledge, assets, household needs, past management, and climate/market trends

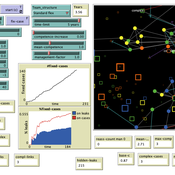

Using Agent-Based Modelling and Reinforcement Learning to Study Hybrid Threats

kpadur | Published Friday, September 20, 2024Hybrid attacks coordinate the exploitation of vulnerabilities across domains to undermine trust in authorities and cause social unrest. Whilst such attacks have primarily been seen in active conflict zones, there is growing concern about the potential harm that can be caused by hybrid attacks more generally and a desire to discover how better to identify and react to them. In addressing such threats, it is important to be able to identify and understand an adversary’s behaviour. Game theory is the approach predominantly used in security and defence literature for this purpose. However, the underlying rationality assumption, the equilibrium concept of game theory, as well as the need to make simplifying assumptions can limit its use in the study of emerging threats. To study hybrid threats, we present a novel agent-based model in which, for the first time, agents use reinforcement learning to inform their decisions. This model allows us to investigate the behavioural strategies of threat agents with hybrid attack capabilities as well as their broader impact on the behaviours and opinions of other agents.

epiworldR Type: Fast Agent-Based Epi Models

George G. Vega Yon Derek Meyer | Published Monday, August 26, 2024A flexible framework for Agent-Based Models (ABM), the ‘epiworldR’ package provides methods for prototyping disease outbreaks and transmission models using a ‘C++’ backend, making it very fast. It supports multiple epidemiological models, including the Susceptible-Infected-Susceptible (SIS), Susceptible-Infected-Removed (SIR), Susceptible-Exposed-Infected-Removed (SEIR), and others, involving arbitrary mitigation policies and multiple-disease models. Users can specify infectiousness/susceptibility rates as a function of agents’ features, providing great complexity for the model dynamics. Furthermore, ‘epiworldR’ is ideal for simulation studies featuring large populations.

Team Structure and Task Performance

Davide Secchi Martin Neumann | Published Monday, August 05, 2024This model was designed to study resilience in organizations. Inspired by ethnographic work, it follows the simple goal to understand whether team structure affects the way in which tasks are performed. In so doing, it compares the ‘hybrid’ data-inspired structure with three more traditional structures (i.e. hierarchy, flexible/relaxed hierarchy, and anarchy/disorganization).

Controlling the misinformation diffusion in social media by the effect of different classes of agents

Ali Khodabandeh Yalabadi | Published Thursday, October 05, 2023An agent-based framework to simulate the diffusion process of a piece of misinformation according to the SBFC model in which the fake news and its debunking compete in a social network. Considering new classes of agents, this model is closer to reality and proposed different strategies how to mitigate and control misinformation.

A replication and extension of the Taylor's Simulation Model of Insurance Market Dynamics in C#

Rei England | Published Sunday, September 24, 2023A simple model is constructed using C# in order to to capture key features of market dynamics, while also producing reasonable results for the individual insurers. A replication of Taylor’s model is also constructed in order to compare results with the new premium setting mechanism. To enable the comparison of the two premium mechanisms, the rest of the model set-up is maintained as in the Taylor model. As in the Taylor example, homogeneous customers represented as a total market exposure which is allocated amongst the insurers.

In each time period, the model undergoes the following steps:

1. Insurers set competitive premiums per exposure unit

2. Losses are generated based on each insurer’s share of the market exposure

3. Accounting results are calculated for each insurer

…

An Agent-Based Model of an Insurance Market driven by Supply and Demand with Imperfectly Estimated Strategies in C#

Rei England | Published Sunday, September 24, 2023This is a simulation of an insurance market where the premium moves according to the balance between supply and demand. In this model, insurers set their supply with the aim of maximising their expected utility gain while operating under imperfect information about both customer demand and underlying risk distributions.

There are seven types of insurer strategies. One type follows a rational strategy within the bounds of imperfect information. The other six types also seek to maximise their utility gain, but base their market expectations on a chartist strategy. Under this strategy, market premium is extrapolated from trends based on past insurance prices. This is subdivided according to whether the insurer is trend following or a contrarian (counter-trend), and further depending on whether the trend is estimated from short-term, medium-term, or long-term data.

Customers are modelled as a whole and allocated between insurers according to available supply. Customer demand is calculated according to a logit choice model based on the expected utility gain of purchasing insurance for an average customer versus the expected utility gain of non-purchase.

An Agent-Based Model of an Insurer's Estimated Capital Requirement in a Simple Insurance Market with Imperfect Information in C#

Rei England | Published Sunday, September 24, 2023This is an agent-based model of a simple insurance market with two types of agents: customers and insurers. Insurers set premium quotes for each customer according to an estimation of their underlying risk based on past claims data. Customers either renew existing contracts or else select the cheapest quote from a subset of insurers. Insurers then estimate their resulting capital requirement based on a 99.5% VaR of their aggregate loss distributions. These estimates demonstrate an under-estimation bias due to the winner’s curse effect.

Peer reviewed Modelling value change; An exploratory approach

Tristan de Wildt Ibo van de Poel | Published Tuesday, June 20, 2023 | Last modified Tuesday, December 12, 2023This model has been developed together with the publication ‘Modelling Value Change - An Exploratory Approach’

Value change and moral change have increasingly become topics of interest in the philosophical literature. Several theoretical accounts have been proposed. Such accounts are usually based on certain theoretical and conceptual assumptions and their strengths and weaknesses are often hard to determine and compare, also because they are based on limited empirical evidence.

We propose that a step forward can be made with the help of agent-based modelling (ABM). ABM can be used to investigate whether a simulation model based on a specific account of value change can reproduce relevant phenomena. To illustrate this approach, we built a model based on the pragmatist account of value change proposed in van de Poel and Kudina (2022). We show that this model can reproduce four relevant phenomena, namely 1) the inevitability and stability of values, 2) how different societies may react differently to external shocks, 3) moral revolutions, and 4) lock-in.

Displaying 10 of 62 results Agent-based modelling clear search