About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 114 results for "Annemijn Peters" clear search

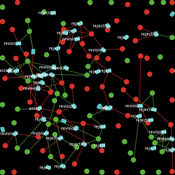

PR-M: The Peer Review Model

Mario Paolucci Francisco Grimaldo | Published Sunday, November 10, 2013 | Last modified Wednesday, July 01, 2015This is an agent-based model of peer review built on the following three entities: papers, scientists and conferences. The model has been implemented on a BDI platform (Jason) that allows to perform both parameter and mechanism exploration.

Peer reviewed Charging behaviour of electric vehicle drivers

Wilfried van Sark Annemijn Peters Floor Alkemade Mart van der Kam | Published Wednesday, May 08, 2019 | Last modified Tuesday, April 14, 2020This model was developed to study the combination of electric vehicles (EVs) and intermitten renewable energy sources. The model presents an EV fleet in a fictional area, divided into a residential area, an office area and commercial area. The area has renewable energy sources: wind and PV solar panels. The agents can be encouraged to charge their electric vehicles at times of renewable energy surplus by introducing different policy interventions. Other interesting variables in the model are the installed renewable energy sources, EV fleet composition and available charging infrastructure. Where possible, use emperical data as input for our model. We expand upon previous models by incorporating environmental self-identity and range anxiety as agent variables.

Sharing economy in the short-time accommodations market

Bruna Bruno Marisa Faggini | Published Wednesday, October 16, 2019We present an agent-based model for the sharing economy, in the short-time accommodations market, where peers participating as suppliers and demanders follow simple decision rules about sharing market participation, according to their heterogeneous characteristics. We consider the sharing economy mainly as a peer-to-peer market where the access is preferred to ownership, excluding professional agents using sharing platforms as Airbnb to promote their business.

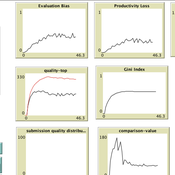

Peer Review Game

Giangiacomo Bravo Flaminio Squazzoni Francisco Grimaldo Federico Bianchi | Published Monday, April 30, 2018NetLogo software for the Peer Review Game model. It represents a population of scientists endowed with a proportion of a fixed pool of resources. At each step scientists decide how to allocate their resources between submitting manuscripts and reviewing others’ submissions. Quality of submissions and reviews depend on the amount of allocated resources and biased perception of submissions’ quality. Scientists can behave according to different allocation strategies by simply reacting to the outcome of their previous submission process or comparing their outcome with published papers’ quality. Overall bias of selected submissions and quality of published papers are computed at each step.

Peer reviewed Historical Letters

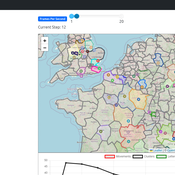

Bernardo Buarque Malte Vogl Jascha Merijn Schmitz Aleksandra Kaye | Published Thursday, May 16, 2024 | Last modified Friday, May 24, 2024A letter sending model with historically informed initial positions to reconstruct communication and archiving processes in the Republic of Letters, the 15th to 17th century form of scholarship.

The model is aimed at historians, willing to formalize historical assumptions about the letter sending process itself and allows in principle to set heterogeneous social roles, e.g. to evaluate the role of gender or social status in the formation of letter exchange networks. The model furthermore includes a pruning process to simulate the loss of letters to critically asses the role of biases e.g. in relation to gender, geographical regions, or power structures, in the creation of empirical letter archives.

Each agent has an initial random topic vector, expressed as a RGB value. The initial positions of the agents are based on a weighted random draw based on data from [2]. In each step, agents generate two neighbourhoods for sending letters and potential targets to move towards. The probability to send letters is a self-reinforcing process. After each sending the internal topic of the receiver is updated as a movement in abstract space by a random amount towards the letters topic.

…

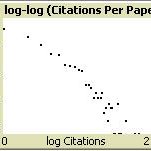

Citation Agents: A model of collective learning through scientific publication

Christopher Watts | Published Friday, July 31, 2015Simulates the construction of scientific journal publications, including authors, references, contents and peer review. Also simulates collective learning on a fitness landscape. Described in: Watts, Christopher & Nigel Gilbert (forthcoming) “Does cumulative advantage affect collective learning in science? An agent-based simulation”, Scientometrics.

The PRIF Model

Davide Secchi | Published Friday, November 08, 2019This model takes into consideration Peer Reviewing under the influence of Impact Factor (PRIF) and it has the purpose to explore whether the infamous metric affects assessment of papers under review. The idea is to consider to types of reviewers, those who are agnostic towards IF (IU1) and those that believe that it is a measure of journal (and article) quality (IU2). This perception is somehow reflected in the evaluation, because the perceived scientific value of a paper becomes a function of the journal in which an article has been submitted. Various mechanisms to update reviewer preferences are also implemented.

Peter Diamond's Coconut Model (Heterogeneity and Learning)

Sven Banisch Eckehard Olbrich | Published Monday, May 30, 2016Agent-based version of the simple search and barter economy conceived by Peter Diamond in 1982. The model is also known as Coconut Model.

Symmetric two-sided matching

Naoki Shiba | Published Wednesday, January 09, 2013 | Last modified Wednesday, May 29, 2013This is a replication model of the matching problem including the mate search problem, which is the generalization of a traditional optimization problem.

Perceived Scientific Value and Impact Factor

Davide Secchi Stephen J Cowley | Published Wednesday, April 12, 2017 | Last modified Monday, January 29, 2018The model explores the impact of journal metrics (e.g., the notorious impact factor) on the perception that academics have of an article’s scientific value.

Displaying 10 of 114 results for "Annemijn Peters" clear search