About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 41 results trade clear search

Peer reviewed B3GET

Kristin Crouse | Published Thursday, November 14, 2019 | Last modified Tuesday, September 20, 2022B3GET simulates populations of virtual organisms evolving over generations, whose evolutionary outcomes reflect the selection pressures of their environment. The model simulates several factors considered important in biology, including life history trade-offs, investment in fighting ability and aggression, sperm competition, infanticide, and competition over access to food and mates. Downloaded materials include starting genotype and population files. Edit the these files and see what changes occur in the behavior of virtual populations!

View the B3GET user manual here.

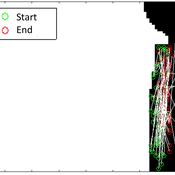

Exploration and Exploitation: Persistence with local exploration under varying resource distribution, resource availability over time and cost of relocation

Arpan Jani | Published Monday, September 30, 2019Organisms, Individuals and Organizations face the dilemma of exploration vs. exploitation

Identifying the optimal trade-off between the two is a challenge

Too much exploration (e.g. gaining new knowledge) can be detrimental to day-to-day survival and too much exploitation (applying existing knowledge) could be detrimental to long term survival esp. if conditions change over time

The purpose of the model is to investigate how the amount of resources acquired (wealth/success) is related to persistence with the strategy of local exploration under different resource distributions, availability of resources over time and cost of relocation

MERCURY extension: population

Tom Brughmans | Published Thursday, May 23, 2019This model is an extended version of the original MERCURY model (https://www.comses.net/codebases/4347/releases/1.1.0/ ) . It allows for experiments to be performed in which empirically informed population sizes of sites are included, that allow for the scaling of the number of tableware traders with the population of settlements, and for hypothesised production centres of four tablewares to be used in experiments.

Experiments performed with this population extension and substantive interpretations derived from them are published in:

Hanson, J.W. & T. Brughmans. In press. Settlement scale and economic networks in the Roman Empire, in T. Brughmans & A.I. Wilson (ed.) Simulating Roman Economies. Theories, Methods and Computational Models. Oxford: Oxford University Press.

…

The code shared here accompanies the paper at https://doi.org/10.1371/journal.pone.0208451. It simulates the effects of various economic trade scenarios on the phenomenon of the ‘disappearing middle’ in the Scottish beef and dairy farming industries. The ‘disappearing middle’ is a situation in which there is a simultaneous observed decline in medium-sized enterprises and rise in the number of small and large-scale enterprises.

Toy Trader 2019

Timothy Gooding | Published Sunday, February 24, 2019A model that strips trade down to its core to explore foundational emergent behaviour and evolution in trade systems.

MERCURY extension: transport-cost

Tom Brughmans | Published Monday, July 23, 2018This is extended version of the MERCRUY model (Brughmans 2015) incorporates a ‘transport-cost’ variable, and is otherwise unchanged. This extended model is described in this publication: Brughmans, T., 2019. Evaluating the potential of computational modelling for informing debates on Roman economic integration, in: Verboven, K., Poblome, J. (Eds.), Structural Determinants in the Roman World.

Brughmans, T., 2015. MERCURY: an ABM of tableware trade in the Roman East. CoMSES Comput. Model Libr. URL https://www.comses.net/codebases/4347/releases/1.1.0/

Zero, Some, or Zero-Sum: Exploring Trade-Offs in Identifying Human Trafficking Among Migration Flows

Kyle Ballard | Published Saturday, September 23, 2017The model attempts to explore the trade-offs between immigration policies and successfully identifying human trafficking victims.

Policy Formulation for Public Administration - Innovation

Bashar Ourabi | Published Tuesday, August 29, 2017 | Last modified Tuesday, August 29, 2017Innovation a byproduct of the intellectual capital, requires a new paradigm for the production constituents. Human Capital HC,Structural capital SC and relational capital RC become key for intellectual capital and consequently for innovation.

Coastal Coupled Housing and Land Markets (C-CHALMS)

Nicholas Magliocca | Published Thursday, May 18, 2017Next generation of the CHALMS model applied to a coastal setting to investigate the effects of subjective risk perception and salience decision-making on adaptive behavior by residents.

05 CmLab V1.17 – Conservation of Money Laboratory

Garvin Boyle | Published Saturday, April 15, 2017In CmLab we explore the implications of the phenomenon of Conservation of Money in a modern economy. This is one of a series of models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, CmLab.

Displaying 10 of 41 results trade clear search