About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 9 of 9 results ecological economics clear search

RiskNetABM

Birgit Müller Jürgen Groeneveld Karin Frank Meike Will Friederike Lenel | Published Monday, July 20, 2020 | Last modified Monday, May 03, 2021The fight against poverty is an urgent global challenge. Microinsurance is promoted as a valuable instrument for buffering income losses due to health or climate-related risks of low-income households in developing countries. However, apart from direct positive effects they can have unintended side effects when insured households lower their contribution to traditional arrangements where risk is shared through private monetary support.

RiskNetABM is an agent-based model that captures dynamics between income losses, insurance payments and informal risk-sharing. The model explicitly includes decisions about informal transfers. It can be used to assess the impact of insurance products and informal risk-sharing arrangements on the resilience of smallholders. Specifically, it allows to analyze whether and how economic needs (i.e. level of living costs) and characteristics of extreme events (i.e. frequency, intensity and type of shock) influence the ability of insurance and informal risk-sharing to buffer income shocks. Two types of behavior with regard to private monetary transfers are explicitly distinguished: (1) all households provide transfers whenever they can afford it and (2) insured households do not show solidarity with their uninsured peers.

The model is stylized and is not used to analyze a particular case study, but represents conditions from several regions with different risk contexts where informal risk-sharing networks between smallholder farmers are prevalent.

…

07 EffLab_V5.07 NL

Garvin Boyle | Published Monday, October 07, 2019EffLab was built to support the study of the efficiency of agents in an evolving complex adaptive system. In particular:

- There is a definition of efficiency used in ecology, and an analogous definition widely used in business. In ecological studies it is called EROEI (energy returned on energy invested), or, more briefly, EROI (pronounced E-Roy). In business it is called ROI (dollars returned on dollars invested).

- In addition, there is the more well-known definition of efficiency first described by Sadi Carnot, and widely used by engineers. It is usually represented by the Greek letter ‘h’ (pronounced as ETA). These two measures of efficiency bear a peculiar relationship to each other: EROI = 1 / ( 1 - ETA )

In EffLab, blind seekers wander through a forest looking for energy-rich food. In this multi-generational world, they live and reproduce, or die, depending on whether they can find food more effectively than their contemporaries. Data is collected to measure their efficiency as they evolve more effective search patterns.

…

05 CmLab V1.17 – Conservation of Money Laboratory

Garvin Boyle | Published Saturday, April 15, 2017In CmLab we explore the implications of the phenomenon of Conservation of Money in a modern economy. This is one of a series of models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, CmLab.

04 TpLab V2.08 – Teleological Pruning Laboratory

Garvin Boyle | Published Saturday, April 15, 2017Our societal belief systems are pruned by evolution, informing our unsustainable economies. This is one of a series of models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, CmLab.

03 MppLab V1.09 – Maximum Power Principle Laboratory

Garvin Boyle | Published Saturday, April 15, 2017Using webs of replicas of Atwood’s Machine, we explore implications of the Maximum Power Principle. This is one of a series of models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, CmLab.

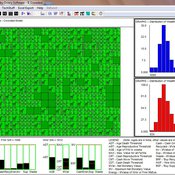

01b ModEco NLG V1.39 – Model Economies – The PMM

Garvin Boyle | Published Friday, April 14, 2017It is very difficult to model a sustainable intergenerational biophysical/financial economy. ModEco NLG is one of a series of models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, CmLab.

00 PSoup V1.22 – Primordial Soup

Garvin Boyle | Published Thursday, April 13, 2017PSoup is an educational program in which evolution is demonstrated, on the desk-top, as you watch. Blind bugs evolve sophisticated heuristic search algorithms to be the best at finding food fast.

02 OamLab V1.10 - Open Atwood Machine Laboratory

Garvin Boyle | Published Saturday, January 31, 2015 | Last modified Thursday, April 13, 2017Using chains of replicas of Atwood’s Machine, this model explores implications of the Maximum Power Principle. It is one of a series of models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, EiLab.

01a ModEco V2.05 – Model Economies – In C++

Garvin Boyle | Published Monday, February 04, 2013 | Last modified Friday, April 14, 2017Perpetual Motion Machine - A simple economy that operates at both a biophysical and economic level, and is sustainable. The goal: to determine the necessary and sufficient conditions of sustainability, and the attendant necessary trade-offs.