About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 80 results for "Mark Stoove" clear search

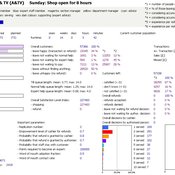

ManPraSim: A Management Practice Simulation

peer-olaf_siebers | Published Wednesday, February 23, 2011 | Last modified Saturday, April 27, 2013This simulation model is associated with the journal paper “A First Approach on Modelling Staff Proactiveness in Retail Simulation Models” to appear in the Journal of Artificial Societies and Social Simulation 14 (2) 2. The authors are Peer-Olaf Siebers ([email protected]) and Uwe Aickelin ([email protected]).

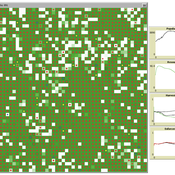

Mobility, Resource Harvesting and Robustness of Social-Ecological Systems

Irene Perez Ibarra | Published Monday, September 24, 2012 | Last modified Saturday, April 27, 2013The model is a stylized representation of a social-ecological system of agents moving and harvesting a renewable resource. The purpose is to analyze how mobility affects sustainability. Experiments changing agents’ mobility, landscape and information governments have can be run.

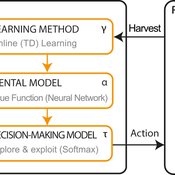

LBD Model: Learning-by-doing for sustainable management of renewable resources

Emilie Lindkvist Örjan Ekeberg Jon Norberg | Published Thursday, March 09, 2017This is a simulation model of an intelligent agent that has the objective to learn sustainable management of a renewable resource, such as a fish stock.

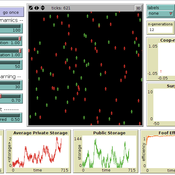

“Food for all” (FFD)

Andreas Angourakis José Manuel Galán Andrea L Balbo José Santos | Published Friday, April 25, 2014 | Last modified Monday, April 08, 2019“Food for all” (FFD) is an agent-based model designed to study the evolution of cooperation for food storage. Households face the social dilemma of whether to store food in a corporate stock or to keep it in a private stock.

An agent-based approach to weighted decision making in the spatially and temporally variable South African Paleoscape

Colin Wren | Published Thursday, December 29, 2016This model simulates a foraging system based on Middle Stone Age plant and shellfish foraging in South Africa.

Peer reviewed Evolution of Ecological Communities: Testing Constraint Closure

Steve Peck | Published Sunday, December 06, 2020 | Last modified Friday, April 16, 2021Ecosystems are among the most complex structures studied. They comprise elements that seem both stable and contingent. The stability of these systems depends on interactions among their evolutionary history, including the accidents of organisms moving through the landscape and microhabitats of the earth, and the biotic and abiotic conditions in which they occur. When ecosystems are stable, how is that achieved? Here we look at ecosystem stability through a computer simulation model that suggests that it may depend on what constrains the system and how those constraints are structured. Specifically, if the constraints found in an ecological community form a closed loop, that allows particular kinds of feedback may give structure to the ecosystem processes for a period of time. In this simulation model, we look at how evolutionary forces act in such a way these closed constraint loops may form. This may explain some kinds of ecosystem stability. This work will also be valuable to ecological theorists in understanding general ideas of stability in such systems.

HyperMu’NmGA - Effect of Hypermutation Cycles in a NetLogo Minimal Genetic Algorithm

Cosimo Leuci | Published Tuesday, October 27, 2020 | Last modified Sunday, July 31, 2022A minimal genetic algorithm was previously developed in order to solve an elementary arithmetic problem. It has been modified to explore the effect of a mutator gene and the consequent entrance into a hypermutation state. The phenomenon seems relevant in some types of tumorigenesis and in a more general way, in cells and tissues submitted to chronic sublethal environmental or genomic stress.

For a long time, some scholars suppose that organisms speed up their own evolution by varying mutation rate, but evolutionary biologists are not convinced that evolution can select a mechanism promoting more (often harmful) mutations looking forward to an environmental challenge.

The model aims to shed light on these controversial points of view and it provides also the features required to check the role of sex and genetic recombination in the mutator genes diffusion.

NK model for multilevel adaptation

Dario Blanco Fernandez | Published Wednesday, November 30, 2022Previous research on organizations often focuses on either the individual, team, or organizational level. There is a lack of multidimensional research on emergent phenomena and interactions between the mechanisms at different levels. This paper takes a multifaceted perspective on individual learning and autonomous group formation and turnover. To analyze interactions between the two levels, we introduce an agent-based model that captures an organization with a population of heterogeneous agents who learn and are limited in their rationality. To solve a task, agents form a group that can be adapted from time to time. We explore organizations that promote learning and group turnover either simultaneously or sequentially and analyze the interactions between the activities and the effects on performance. We observe underproportional interactions when tasks are interdependent and show that pushing learning and group turnover too far might backfire and decrease performance significantly.

Replication of ECEC model: Environmental Feedback and the Evolution of Cooperation

Pierre Bommel | Published Tuesday, April 05, 2011 | Last modified Saturday, April 27, 2013The model, presented here, is a re-implementation of the Pepper and Smuts’ model : - Pepper, J.W. and B.B. Smuts. 2000. “The evolution of cooperation in an ecological context: an agent-based model”. Pp. 45-76 in T.A. Kohler and G.J. Gumerman, eds. Dynamics of human and primate societies: agent-based modeling of social and spatial processes. Oxford University Press, Oxford. - Pepper, J.W. and B.B. Smuts. 2002. “Assortment through Environmental Feedback”. American Naturalist, 160: 205-213 […]

Simulation of the Effects of Disorganization on Goals and Problem Solving

Dinuka Herath | Published Sunday, August 13, 2017 | Last modified Sunday, August 13, 2017This is a model of the occurrence of disorganization and its impact on individual goal setting and problem-solving. This model therefore, explores the effects of disorganization on goal achievement.

Displaying 10 of 80 results for "Mark Stoove" clear search