About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 124 results for "Julio César Acosta–Prado" clear search

Netlogo Earned Value Management Model

Manuel Castañón-Puga Ricardo Fernando Rosales–Cisneros Julio César Acosta–Prado Alfredo Tirado–Ramos Camilo Khatchikian Elías Aburto–Camacllanqui | Published Thursday, November 24, 2022The model aims to illustrate how Earned Value Management (EVM) provides an approach to measure a project’s performance by comparing its actual progress against the planned one, allowing it to evaluate trends to formulate forecasts. The instance performs a project execution and calculates the EVM performance indexes according to a Performance Measurement Baseline (PMB), which integrates the description of the work to do (scope), the deadlines for its execution (schedule), and the calculation of its costs and the resources required for its implementation (cost).

Specifically, we are addressing the following questions: How does the risk of execution delay or advance impact cost and schedule performance? How do the players’ number or individual work capacity impact cost and schedule estimations to finish? Regardless of why workers cause delays or produce overruns in their assignments, does EVM assess delivery performance and help make objective decisions?

To consider our model realistic enough for its purpose, we use the following patterns: The model addresses classic problems of Project Management (PM). It plays the typical task board where workers are assigned to complete a task backlog in project performance. Workers could delay or advance in the task execution, and we calculate the performance using the PMI-recommended Earned Value.

MiniDemographicABM.jl: A simplified agent-based demographic model of the UK

Atiyah Elsheikh | Published Friday, July 28, 2023 | Last modified Tuesday, December 12, 2023This package implements a simplified artificial agent-based demographic model of the UK. Individuals of an initial population are subject to ageing, deaths, births, divorces and marriages. A specific case-study simulation is progressed with a user-defined simulation fixed step size on a hourly, daily, weekly, monthly basis or even an arbitrary user-defined clock rate. While the model can serve as a base model to be adjusted to realistic large-scale socio-economics, pandemics or social interactions-based studies mainly within a demographic context, the main purpose of the model is to explore and exploit capabilities of the state-of-the-art Agents.jl Julia package as well as other ecosystem of Julia packages like GlobalSensitivity.jl. Code includes examples for evaluating global sensitivity analysis using Morris and Sobol methods and local sensitivity analysis using OFAT and OAT methods. Multi-threaded parallelization is enabled for improved runtime performance.

Life Cycle Cost of Military Manpower Model

Jonathan Ozik Todd Combs | Published Monday, January 05, 2015We demonstrate how Repast Simphony statecharts can efficiently encapsulate the deep classification hierarchy of the U.S. Air Force for manpower life cycle costing.

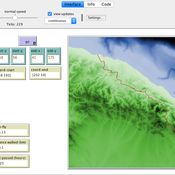

Peer reviewed Least cost path mobility

Colin Wren Claudine Gravel-Miguel | Published Saturday, September 02, 2017 | Last modified Monday, October 04, 2021This model aims to mimic human movement on a realistic topographical surface. The agent does not have a perfect knowledge of the whole surface, but rather evaluates the best path locally, at each step, thus mimicking imperfect human behavior.

MERCURY extension: transport-cost

Tom Brughmans | Published Monday, July 23, 2018This is extended version of the MERCRUY model (Brughmans 2015) incorporates a ‘transport-cost’ variable, and is otherwise unchanged. This extended model is described in this publication: Brughmans, T., 2019. Evaluating the potential of computational modelling for informing debates on Roman economic integration, in: Verboven, K., Poblome, J. (Eds.), Structural Determinants in the Roman World.

Brughmans, T., 2015. MERCURY: an ABM of tableware trade in the Roman East. CoMSES Comput. Model Libr. URL https://www.comses.net/codebases/4347/releases/1.1.0/

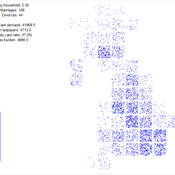

Simulating the cost of social care in an ageing population

Eric Silverman | Published Thursday, September 16, 2021This model is an agent-based simulation written in Python 2.7, which simulates the cost of social care in an ageing UK population. The simulation incorporates processes of population change which affect the demand for and supply of social care, including health status, partnership formation, fertility and mortality. Fertility and mortality rates are drawn from UK population data, then projected forward to 2050 using the methods developed by Lee and Carter 1992.

The model demonstrates that rising life expectancy combined with lower birthrates leads to growing social care costs across the population. More surprisingly, the model shows that the oft-proposed intervention of raising the retirement age has limited utility; some reductions in costs are attained initially, but these reductions taper off beyond age 70. Subsequent work has enhanced and extended this model by adding more detail to agent behaviours and familial relationships.

The version of the model provided here produces outputs in a format compatible with the GEM-SA uncertainty quantification software by Kennedy and O’Hagan. This allows sensitivity analyses to be performed using Gaussian Process Emulation.

Cultural Spread

Salvador Pardo Gordó Salvador Pardo-Gordó | Published Thursday, April 02, 2015 | Last modified Thursday, April 23, 2020The purpose of the model is to simulate the cultural hitchhiking hypothesis to explore how neutral cultural traits linked with advantageous traits spread together over time

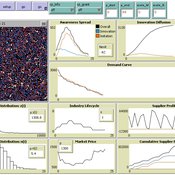

(Policy induced) Diffusion of Innovations - An integrated demand-supply Model based on Cournot Competition

Martin Rixin | Published Monday, August 29, 2011 | Last modified Saturday, April 27, 2013Objective is to simulate policy interventions in an integrated demand-supply model. The underlying demand function links both sides. Diffusion proceeds if interactions distribute awareness (Epidemic effect) and rivalry reduces the market price (Probit effect). Endogeneity is given due to the fact that consumer awareness as well as their willingness-to-pay drives supply-side rivalry. Firm´s entry and exit decisions as well as quantity and price settings are driven by Cournot competition.

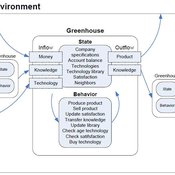

Universal Darwinism in Dutch Greenhouses

Julia Kasmire | Published Wednesday, May 09, 2012 | Last modified Saturday, April 27, 2013An ABM, derived from a case study and a series of surveys with greenhouse growers in the Westland, Netherlands. Experiments using this model showshow that the greenhouse horticulture industry displays diversity, adaptive complexity and an uneven distribution, which all suggest that the industry is an evolving system.

Evaluate government policies for farmers’ adoption and synergy in improving irrigation systems

Amir Hajimirzajan | Published Sunday, February 25, 2024The ABM model is designed to model the adaptability of farmers in DTIM. This model includes two groups of farmers and local government admins agents. Farmers with different levels, with low WP of DTIM, are looking for economic benefits and reduced irrigation and production costs. Meanwhile, the government is looking for strategic goals to maintain water resources’ sustainability. The local government admins employ incentives (subsidies in this study) to encourage farmers to DTIM. In addition, it is used as a tool for supervision and training farmers’ performance. Farmers are currently harvesting water resources with irrigation systems and different levels of technology, and they intend to provide short-term benefits. Farmers adjust the existing approach based on their knowledge of the importance of DTIM and propensity to increase WP and cost-benefit evaluation. DTIM has an initial implementation fee. Every farmer can increase WP by using government subsidies. If none of the farmers create optimal use of water resources, access to water resources will be threatened in the long term. This is considered a hypothetical cost for farmers who do not participate in DTIM. With DTIM, considering that local government admins’ facilities cover an essential part of implementation costs, farmers may think of profiting from local government admins’ facilities by selling that equipment, especially if the farmers in the following conditions may consider selling their developed irrigation equipment. In this case, the technology of their irrigation system will return to the state before development.

- When the threshold of farmers’ propensity to DTIM is low (for example, in the conditions of scarcity of access to sufficient training about the new irrigation system or its role in reducing the cost and sustainability of water resources)

- When the share of government subsidy is high, and as a result, the profit from the sale of equipment is attractive, especially in conditions of inflation.

- Finally, farmers’ honesty threshold should be reduced based on the positive experience of profit-seeking and deception among neighbors.

Increasing the share of government subsidies can encourage farmers to earn profits. Therefore, the government can help increase farmers’ profits by considering the assessment teams at different levels with DTIM training . local government admins evaluations monitor the behavior of farmers. If farmers sell their improved irrigation system for profit, they may be deprived of some local government admins’ services and the possibility of receiving subsidies again. Assessments The local government admins can increase farmers’ honesty. Next, the ABM model evaluates local government admins policies to achieve a suitable framework for water resources management in the Miandoab region.

Displaying 10 of 124 results for "Julio César Acosta–Prado" clear search