About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 790 results for "Blanca Gonzalez-Mon" clear search

Social Construction of Reality Agent-Based Model

Manuel Castañón-Puga E. Dante Suarez Loren Demerath | Published Saturday, June 29, 2024This model illustrates the processes underlying the social construction of reality through an agent-based genetic algorithm. By simulating the interactions of agents within a structured environment, we have demonstrated how shared information and popularity contribute to the formation of emergent social structures with diverse cultures. The model illustrates how agents balance environmentally valid information with socially reliable information. It also highlights how social interaction leads to the formation of stable, yet diverse, social groups.

An Agent-Based Model of an Insurance Market driven by Supply and Demand with Imperfectly Estimated Strategies in C#

Rei England | Published Sunday, September 24, 2023This is a simulation of an insurance market where the premium moves according to the balance between supply and demand. In this model, insurers set their supply with the aim of maximising their expected utility gain while operating under imperfect information about both customer demand and underlying risk distributions.

There are seven types of insurer strategies. One type follows a rational strategy within the bounds of imperfect information. The other six types also seek to maximise their utility gain, but base their market expectations on a chartist strategy. Under this strategy, market premium is extrapolated from trends based on past insurance prices. This is subdivided according to whether the insurer is trend following or a contrarian (counter-trend), and further depending on whether the trend is estimated from short-term, medium-term, or long-term data.

Customers are modelled as a whole and allocated between insurers according to available supply. Customer demand is calculated according to a logit choice model based on the expected utility gain of purchasing insurance for an average customer versus the expected utility gain of non-purchase.

SpeciesWorld

Tony Lawson | Published Friday, March 16, 2012 | Last modified Saturday, April 27, 2013How can species evolve a cooperative network to keep the environment suitable for life?

LaMEStModel

Ruth Meyer | Published Friday, October 12, 2018The Labour Markets and Ethnic Segmentation (LaMESt) Model is a model of a simplified labour market, where only jobs of the lowest skill level are considered. Immigrants of two different ethnicities (“Latino”, “Asian”) compete with a majority (“White”) and minority (“Black”) native population for these jobs. The model’s purpose is to investigate the effect of ethnically homogeneous social networks on the emergence of ethnic segmentation in such a labour market. It is inspired by Waldinger & Lichter’s study of immigration and the social organisation of labour in 1990’s Los Angeles.

NK model for multilevel adaptation

Dario Blanco Fernandez | Published Wednesday, November 30, 2022Previous research on organizations often focuses on either the individual, team, or organizational level. There is a lack of multidimensional research on emergent phenomena and interactions between the mechanisms at different levels. This paper takes a multifaceted perspective on individual learning and autonomous group formation and turnover. To analyze interactions between the two levels, we introduce an agent-based model that captures an organization with a population of heterogeneous agents who learn and are limited in their rationality. To solve a task, agents form a group that can be adapted from time to time. We explore organizations that promote learning and group turnover either simultaneously or sequentially and analyze the interactions between the activities and the effects on performance. We observe underproportional interactions when tasks are interdependent and show that pushing learning and group turnover too far might backfire and decrease performance significantly.

Peak-seeking Adder

Julia Kasmire Janne M Korhonen | Published Tuesday, December 02, 2014 | Last modified Friday, February 20, 2015Continuing on from the Adder model, this adaptation explores how rationality, learning and uncertainty influence the exploration of complex landscapes representing technological evolution.

A model on feeding and social interaction behaviour of pigs

Iris J.M.M. Boumans | Published Thursday, May 04, 2017 | Last modified Tuesday, February 27, 2018The model simulates interaction between internal physiological factors (e.g. energy balance) and external social factors (e.g. competition level) underlying feeding and social interaction behaviour of commercially group-housed pigs.

Impact of Seasonal Forecast Use on Agricultural Income in a System with Varying Crop Costs and Returns

Thushara Gunda Josh T Bazuin John Nay Kam L Yeung | Published Tuesday, February 07, 2017The objective of the model is to evaluate the impact of seasonal forecasts on a farmer’s net agricultural income when their crop choices have different and variable costs and returns.

Interplay of actors about the construction of a dam

Christophe Sibertin-Blanc | Published Monday, December 05, 2016 | Last modified Wednesday, May 09, 2018Model of a very serious conflict about the relevance of a dam to impede its construction, between the client, the prime contractor, State, legalist opponents and activist opponents.

Peer reviewed TRANSOPE: a multi-agent model to simulate outsourcing networks in road freight transport.

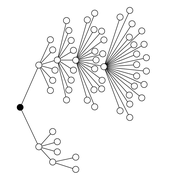

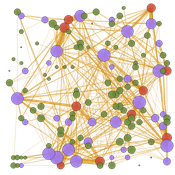

Aitor Salas-Peña Blanca Rosa Cases Gutiérrez | Published Friday, October 21, 2022A road freight transport (RFT) operation involves the participation of several types of companies in its execution. The TRANSOPE model simulates the subcontracting process between 3 types of companies: Freight Forwarders (FF), Transport Companies (TC) and self-employed carriers (CA). These companies (agents) form transport outsourcing chains (TOCs) by making decisions based on supplier selection criteria and transaction acceptance criteria. Through their participation in TOCs, companies are able to learn and exchange information, so that knowledge becomes another important factor in new collaborations. The model can replicate multiple subcontracting situations at a local and regional geographic level.

The succession of n operations over d days provides two types of results: 1) Social Complex Networks, and 2) Spatial knowledge accumulation environments. The combination of these results is used to identify the emergence of new logistics clusters. The types of actors involved as well as the variables and parameters used have their justification in a survey of transport experts and in the existing literature on the subject.

As a result of a preferential selection process, the distribution of activity among agents shows to be highly uneven. The cumulative network resulting from the self-organisation of the system suggests a structure similar to scale-free networks (Albert & Barabási, 2001). In this sense, new agents join the network according to the needs of the market. Similarly, the network of preferential relationships persists over time. Here, knowledge transfer plays a key role in the assignment of central connector roles, whose participation in the outsourcing network is even more decisive in situations of scarcity of transport contracts.

Displaying 10 of 790 results for "Blanca Gonzalez-Mon" clear search