About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 113 results market clear search

World of Cows - Exploring land-use policies for a dairy-farm world (teaching modeling complex human-environment systems)

Maria Haensel Thomas Michael Schmitt Jakob Bogenreuther | Published Wednesday, January 11, 2023In the “World of Cows”, dairy farmers run their farms and interact with each other, the surrounding agricultural landscape, and the economic and political framework. The model serves as an exemplary case of an interdependent human-environment system.

With the model, users can analyze the influence of policies and markets on land use decisions of dairy farms. The land use decisions taken by farms determine the delivered ecosystem services on the landscape level. Users can choose a combination of five policy options and how strongly market prices fluctuate. Ideally, the choice of policy options fulfills the following three “political goals” 1) dairy farming stays economically viable, 2) the provision of ecosystem services is secured, and 3) government spending on subsidies is as low as possible.

The model has been designed for students to practice agent-based modeling and analyze the impacts of land use policies.

Peer reviewed SIM-VOLATILE: Adoption of emerging circular technologies in the waste-treatment sector

Siavash Farahbakhsh | Published Wednesday, December 14, 2022The SIM-VOLATILE model is a technology adoption model at the population level. The technology, in this model, is called Volatile Fatty Acid Platform (VFAP) and it is in the frame of the circular economy. The technology is considered an emerging technology and it is in the optimization phase. Through the adoption of VFAP, waste-treatment plants will be able to convert organic waste into high-end products rather than focusing on the production of biogas. Moreover, there are three adoption/investment scenarios as the technology enables the production of polyhydroxyalkanoates (PHA), single-cell oils (SCO), and polyunsaturated fatty acids (PUFA). However, due to differences in the processing related to the products, waste-treatment plants need to choose one adoption scenario.

In this simulation, there are several parameters and variables. Agents are heterogeneous waste-treatment plants that face the problem of circular economy technology adoption. Since the technology is emerging, the adoption decision is associated with high risks. In this regard, first, agents evaluate the economic feasibility of the emerging technology for each product (investment scenarios). Second, they will check on the trend of adoption in their social environment (i.e. local pressure for each scenario). Third, they combine these two economic and social assessments with an environmental assessment which is their environmental decision-value (i.e. their status on green technology). This combination gives the agent an overall adaptability fitness value (detailed for each scenario). If this value is above a certain threshold, agents may decide to adopt the emerging technology, which is ultimately depending on their predominant adoption probabilities and market gaps.

Perspectives on the Information-Based Economy

Vladimir Gazda Jana Zausinova Marcel Volosin | Published Monday, October 24, 2022This is the agent-based model of information market evolution. It simulates the influences of the transition from material to electronic carriers of information, which is modelled by the falling price of variable production factor. It demonstrates that due to zero marginal production costs, the competition increases, the market becomes unstable, and experience various phases of evolution leading to market monopolization.

Peer reviewed TRANSOPE: a multi-agent model to simulate outsourcing networks in road freight transport.

Aitor Salas-Peña Blanca Rosa Cases Gutiérrez | Published Friday, October 21, 2022A road freight transport (RFT) operation involves the participation of several types of companies in its execution. The TRANSOPE model simulates the subcontracting process between 3 types of companies: Freight Forwarders (FF), Transport Companies (TC) and self-employed carriers (CA). These companies (agents) form transport outsourcing chains (TOCs) by making decisions based on supplier selection criteria and transaction acceptance criteria. Through their participation in TOCs, companies are able to learn and exchange information, so that knowledge becomes another important factor in new collaborations. The model can replicate multiple subcontracting situations at a local and regional geographic level.

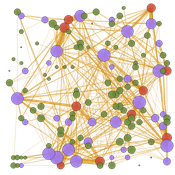

The succession of n operations over d days provides two types of results: 1) Social Complex Networks, and 2) Spatial knowledge accumulation environments. The combination of these results is used to identify the emergence of new logistics clusters. The types of actors involved as well as the variables and parameters used have their justification in a survey of transport experts and in the existing literature on the subject.

As a result of a preferential selection process, the distribution of activity among agents shows to be highly uneven. The cumulative network resulting from the self-organisation of the system suggests a structure similar to scale-free networks (Albert & Barabási, 2001). In this sense, new agents join the network according to the needs of the market. Similarly, the network of preferential relationships persists over time. Here, knowledge transfer plays a key role in the assignment of central connector roles, whose participation in the outsourcing network is even more decisive in situations of scarcity of transport contracts.

Cellular automata model of social networks

Rubens de Almeida Zimbres | Published Tuesday, August 02, 2022This project was developed during the Santa Fe course Introduction to Agent-Based Modeling 2022. The origin is a Cellular Automata (CA) model to simulate human interactions that happen in the real world, from Rubens and Oliveira (2009). These authors used a market research with real people in two different times: one at time zero and the second at time zero plus 4 months (longitudinal market research). They developed an agent-based model whose initial condition was inherited from the results of the first market research response values and evolve it to simulate human interactions with Agent-Based Modeling that led to the values of the second market research, without explicitly imposing rules. Then, compared results of the model with the second market research. The model reached 73.80% accuracy.

In the same way, this project is an Exploratory ABM project that models individuals in a closed society whose behavior depends upon the result of interaction with two neighbors within a radius of interaction, one on the relative “right” and other one on the relative “left”. According to the states (colors) of neighbors, a given cellular automata rule is applied, according to the value set in Chooser. Five states were used here and are defined as levels of quality perception, where red (states 0 and 1) means unhappy, state 3 is neutral and green (states 3 and 4) means happy.

There is also a message passing algorithm in the social network, to analyze the flow and spread of information among nodes. Both the cellular automaton and the message passing algorithms were developed using the Python extension. The model also uses extensions csv and arduino.

Peer reviewed A Simple Agent-Based Spatial Model of the Economy: Tools for Policy

Bernardo Furtado Isaque Daniel Rocha Eberhardt | Published Tuesday, July 05, 2022This study simulates the evolution of artificial economies in order to understand the tax relevance of administrative boundaries in the quality of life of its citizens. The modeling involves the construction of a computational algorithm, which includes citizens, bounded into families; firms and governments; all of them interacting in markets for goods, labor and real estate. The real estate market allows families to move to dwellings with higher quality or lower price when the families capitalize property values. The goods market allows consumers to search on a flexible number of firms choosing by price and proximity. The labor market entails a matching process between firms (given its location) and candidates, according to their qualification. The government may be configured into one, four or seven distinct sub-national governments, which are all economically conurbated. The role of government is to collect taxes on the value added of firms in its territory and invest the taxes into higher levels of quality of life for residents. The results suggest that the configuration of administrative boundaries is relevant to the levels of quality of life arising from the reversal of taxes. The model with seven regions is more dynamic, but more unequal and heterogeneous across regions. The simulation with only one region is more homogeneously poor. The study seeks to contribute to a theoretical and methodological framework as well as to describe, operationalize and test computer models of public finance analysis, with explicitly spatial and dynamic emphasis. Several alternatives of expansion of the model for future research are described. Moreover, this study adds to the existing literature in the realm of simple microeconomic computational models, specifying structural relationships between local governments and firms, consumers and dwellings mediated by distance.

Peer reviewed Modern Wage Dynamics

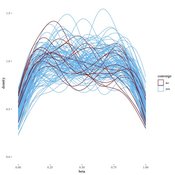

J M Applegate | Published Sunday, June 05, 2022The Modern Wage Dynamics Model is a generative model of coupled economic production and allocation systems. Each simulation describes a series of interactions between a single aggregate firm and a set of households through both labour and goods markets. The firm produces a representative consumption good using labour provided by the households, who in turn purchase these goods as desired using wages earned, thus the coupling.

Each model iteration the firm decides wage, price and labour hours requested. Given price and wage, households decide hours worked based on their utility function for leisure and consumption. A labour market construct chooses the minimum of hours required and aggregate hours supplied. The firm then uses these inputs to produce goods. Given the hours actually worked, the households decide actual consumption and a market chooses the minimum of goods supplied and aggregate demand. The firm uses information gained through observing market transactions about consumption demand to refine their conceptions of the population’s demand.

The purpose of this model is to explore the general behaviour of an economy with coupled production and allocation systems, as well as to explore the effects of various policies on wage and production, such as minimum wage, tax credits, unemployment benefits, and universal income.

…

Competitive Arousal Agent Based Model

Zoé Chollet | Published Friday, May 13, 2022What is it?

This model demonstrates a very simple bidding market where buyers try to acquire a desired item at the best price in a competitive environment

…

An Agent-Based Model of Insurance Customer Behaviour with Word of Mouth Network in C#

Rei England Iqbal Owadally Douglas Wright | Published Friday, March 04, 2022This is an agent-based model with two types of agents: customers and insurers. Insurers are price-takers who choose how much to spend on their service quality, and customers evaluate insurers based on premium, brand preference, and their perceived service quality. Customers are also connected in a small-world network and may share their opinions with their network.

The ABM contains two types of agents: insurers and customers. These act within the environment of a motor insurance market. At each simulation, the model undergoes the following steps:

- Network generation: At the start of the simulation, the model generates a small world network of social links between the customers, and randomly assigns each customer to an initial insurer ...

AMIRIS

Ulrich Frey Felix Nitsch Christoph Schimeczek Johannes Kochems Kristina Nienhaus Evelyn Sperber Aboubakr Achraf El Ghazi Seyedfarzad Sarfarazi | Published Thursday, February 03, 2022AMIRIS is the Agent-based Market model for the Investigation of Renewable and Integrated energy Systems.

It is an agent-based simulation of electricity markets and their actors.

AMIRIS enables researches to analyse and evaluate energy policy instruments and their impact on the actors involved in the simulation context.

Different prototypical agents on the electricity market interact with each other, each employing complex decision strategies.

AMIRIS allows to calculate the impact of policy instruments on economic performance of power plant operators and marketers.

…

Displaying 10 of 113 results market clear search