About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 235 results for "Marcel Volosin" clear search

Perspectives on the Information-Based Economy

Vladimir Gazda Jana Zausinova Marcel Volosin | Published Monday, October 24, 2022This is the agent-based model of information market evolution. It simulates the influences of the transition from material to electronic carriers of information, which is modelled by the falling price of variable production factor. It demonstrates that due to zero marginal production costs, the competition increases, the market becomes unstable, and experience various phases of evolution leading to market monopolization.

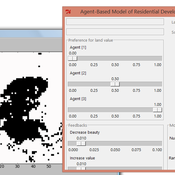

IDEAL

Arika Ligmann-Zielinska | Published Thursday, August 07, 2014IDEAL: Agent-Based Model of Residential Land Use Change where the choice of new residential development in based on the Ideal-point decision rule.

Market for Protection

Steven Doubleday | Published Monday, July 01, 2013 | Last modified Monday, August 19, 2013Simulation to replicate and extend an analytical model (Konrad & Skaperdas, 2010) of the provision of security as a collective good. We simulate bandits preying upon peasants in an anarchy condition.

Transfer of Development Rights (TDR) Simulation for Compact Urban Growth in Dublin: An Agent-Based Model in NetLogo

ajithvyas | Published Wednesday, May 14, 2025This agent-based model simulates the implementation of a Transfer of Development Rights (TDR) mechanism in a stylized urban environment inspired by Dublin. It explores how developer agents interact with land parcels under spatial zoning, conservation protections, and incentive-based policy rules. The model captures emergent outcomes such as compact growth, green and heritage zone preservation, and public cost-efficiency. Built in NetLogo, the model enables experimentation with variable FSI bonuses, developer behavior, and spatial alignment of sending/receiving zones. It is intended as a policy sandbox to test market-aligned planning tools under behavioral and spatial uncertainty.

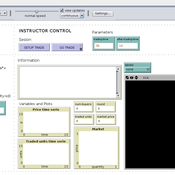

Quality uncertainty and market failure

David Poza José Manuel Galán María Pereda José Santos | Published Wednesday, May 14, 2014 | Last modified Wednesday, April 25, 2018Quality uncertainty and market failure: an interactive model to conduct classroom experiments

Adoption as a social marker

Paul Smaldino | Published Monday, October 17, 2016A model of innovation diffusion in a structured population with two groups who are averse to adopting a produce popular with the outgroup.

Investor-based electricity market model

Oscar Kraan | Published Monday, January 02, 2017 | Last modified Friday, October 12, 2018The model is a representation of a liberalised electricity market designed as an energy-only market and consists of large scale investors and their power generation assets in the electricity market.

Endogenous Dynamics of Housing Market Cycles

Onur Özgün Birnur Özbaş Yaman Barlas | Published Monday, September 09, 2013 | Last modified Wednesday, January 08, 2014The purpose of this model is to analyze the dynamics of endogenously created oscillations in housing prices using a system dynamics simulation model, built from the perspective of construction companies.

Multi Asset Variable Network Stock Market Model

Matthew Oldham | Published Monday, September 12, 2016 | Last modified Tuesday, October 10, 2017An artifcal stock market model that allows users to vary the number of risky assets as well as the network topology that investors forms in an attempt to understand the dynamics of the market.

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

Displaying 10 of 235 results for "Marcel Volosin" clear search