About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 33 results firms clear search

Peer reviewed BAM: The Bottom-up Adaptive Macroeconomics Model

Alejandro Platas López Alejandro Guerra-Hernández | Published Tuesday, January 14, 2020 | Last modified Sunday, July 26, 2020Overview

Purpose

Modeling an economy with stable macro signals, that works as a benchmark for studying the effects of the agent activities, e.g. extortion, at the service of the elaboration of public policies..

…

Agent-based Model of Industrial Evolution

Martin Zoričak Denis Horvath Vladimir Gazda Oto Hudec | Published Wednesday, July 10, 2019This is a conceptual model of underlying forces creating industrial clusters. There are two contradictory forces - attraction and repulsion. Firms within the same Industry are attracted to each other and on the other hand, firms with the same Activity are repulsed from each other. In each round firm with the lowest fitness is selected to change its profile of Industries and Activities. Based on these simple rules interesting patterns emerge.

Peer reviewed Emergent Firms Model

J M Applegate | Published Friday, July 13, 2018The Emergent Firm (EF) model is based on the premise that firms arise out of individuals choosing to work together to advantage themselves of the benefits of returns-to-scale and coordination. The Emergent Firm (EF) model is a new implementation and extension of Rob Axtell’s Endogenous Dynamics of Multi-Agent Firms model. Like the Axtell model, the EF model describes how economies, composed of firms, form and evolve out of the utility maximizing activity on the part of individual agents. The EF model includes a cash-in-advance constraint on agents changing employment, as well as a universal credit-creating lender to explore how costs and access to capital affect the emergent economy and its macroeconomic characteristics such as firm size distributions, wealth, debt, wages and productivity.

Peer reviewed Strategy with Externalities

J M Applegate Glenn Hoetker | Published Thursday, December 21, 2017The SWE models firms search behaviour as the performance landscape shifts. The shift represents society’s pricing of negative externalities, and the performance landscape is an NK structure. The model is written in NetLogo.

MCR Model

Davide Secchi Nuno R Barros De Oliveira | Published Friday, July 22, 2016 | Last modified Saturday, January 23, 2021The aim of the model is to define when researcher’s assumptions of dependence or independence of cases in multiple case study research affect the results — hence, the understanding of these cases.

A Simulation of Entrepreneurial Spawning

Mark Bagley | Published Wednesday, June 08, 2016 | Last modified Friday, June 30, 2017Industrial clustering patterns are the result of an entrepreneurial process where spinoffs inherit the ideas and attributes of their parent firms. This computational model maps these patterns using abstract methodologies.

Endogenous dynamics of firms made up by networked agents: an exploratory analysis

Bernardo Alves Furtado Isaque Daniel Rocha Eberhardt | Published Wednesday, March 23, 2016 | Last modified Wednesday, October 05, 2016This is an adaptation and extension of Robert Axtell’s model (2013) of endogenous firms, in Python 3.4

A simple agent-based spatial model of the economy

Bernardo Alves Furtado Isaque Daniel Rocha Eberhardt | Published Thursday, March 10, 2016 | Last modified Tuesday, November 22, 2016The modeling includes citizens, bounded into families; firms and governments; all of them interacting in markets for goods, labor and real estate. The model is spatial and dynamic.

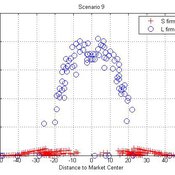

Micro-level Adaptation, Macro-level Selection, and the Dynamics of Market Partitioning

César García-Díaz | Published Monday, October 19, 2015 | Last modified Monday, October 19, 2015This model simulates the emergence of a dual market structure from firm-level interaction. Firms are profit-seeking, and demand is represented by a unimodal distribution of consumers along a set of taste positions.

Long Term Impacts of Bank Behavior on Financial Stability An Agent Based Modeling Approach

Ilker Arslan | Published Tuesday, October 13, 2015 | Last modified Monday, April 08, 2019This model simulates a bank - firm credit network.

Displaying 10 of 33 results firms clear search