About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 12 results bottom-up clear search

Peer reviewed COMMONSIM: Simulating the utopia of COMMONISM

Lena Gerdes Manuel Scholz-Wäckerle Ernest Aigner Stefan Meretz Jens Schröter Hanno Pahl Annette Schlemm Simon Sutterlütti | Published Sunday, November 05, 2023This research article presents an agent-based simulation hereinafter called COMMONSIM. It builds on COMMONISM, i.e. a large-scale commons-based vision for a utopian society. In this society, production and distribution of means are not coordinated via markets, exchange, and money, or a central polity, but via bottom-up signalling and polycentric networks, i.e. ex-ante coordination via needs. Heterogeneous agents care for each other in life groups and produce in different groups care, environmental as well as intermediate and final means to satisfy sensual-vital needs. Productive needs decide on the magnitude of activity in groups for a common interest, e.g. the production of means in a multi-sectoral artificial economy. Agents share cultural traits identified by different behaviour: a propensity for egoism, leisure, environmentalism, and productivity. The narrative of this utopian society follows principles of critical psychology and sociology, complexity and evolution, the theory of commons, and critical political economy. The article presents the utopia and an agent-based study of it, with emphasis on culture-dependent allocation mechanisms and their social and economic implications for agents and groups.

Peer reviewed Share: bottom-up disaster information management

Vittorio Nespeca Tina Comes Frances Brazier | Published Monday, December 05, 2022This model is intended to study the way information is collectively managed (i.e. shared, collected, processed, and stored) in a system and how it performs during a crisis or disaster. Performance is assessed in terms of the system’s ability to provide the information needed to the actors who need it when they need it. There are two main types of actors in the simulation, namely communities and professional responders. Their ability to exchange information is crucial to improve the system’s performance as each of them has direct access to only part of the information they need.

In a nutshell, the following occurs during a simulation. Due to a disaster, a series of randomly occurring disruptive events takes place. The actors in the simulation need to keep track of such events. Specifically, each event generates information needs for the different actors, which increases the information gaps (i.e. the “piles” of unaddressed information needs). In order to reduce the information gaps, the actors need to “discover” the pieces of information they need. The desired behavior or performance of the system is to keep the information gaps as low as possible, which is to address as many information needs as possible as they occur.

Cellular automata model of social networks

Rubens de Almeida Zimbres | Published Tuesday, August 02, 2022This project was developed during the Santa Fe course Introduction to Agent-Based Modeling 2022. The origin is a Cellular Automata (CA) model to simulate human interactions that happen in the real world, from Rubens and Oliveira (2009). These authors used a market research with real people in two different times: one at time zero and the second at time zero plus 4 months (longitudinal market research). They developed an agent-based model whose initial condition was inherited from the results of the first market research response values and evolve it to simulate human interactions with Agent-Based Modeling that led to the values of the second market research, without explicitly imposing rules. Then, compared results of the model with the second market research. The model reached 73.80% accuracy.

In the same way, this project is an Exploratory ABM project that models individuals in a closed society whose behavior depends upon the result of interaction with two neighbors within a radius of interaction, one on the relative “right” and other one on the relative “left”. According to the states (colors) of neighbors, a given cellular automata rule is applied, according to the value set in Chooser. Five states were used here and are defined as levels of quality perception, where red (states 0 and 1) means unhappy, state 3 is neutral and green (states 3 and 4) means happy.

There is also a message passing algorithm in the social network, to analyze the flow and spread of information among nodes. Both the cellular automaton and the message passing algorithms were developed using the Python extension. The model also uses extensions csv and arduino.

Risk-Sharing under Heterogeneity: NetLogo simulation

Eva Vriens | Published Monday, February 28, 2022Motivated by the emergence of new Peer-to-Peer insurance organizations that rethink how insurance is organized, we propose a theoretical model of decision-making in risk-sharing arrangements with risk heterogeneity and incomplete information about the risk distribution as core features. For these new, informal organisations, the available institutional solutions to heterogeneity (e.g., mandatory participation or price differentiation) are either impossible or undesirable. Hence, we need to understand the scope conditions under which individuals are motivated to participate in a bottom-up risk-sharing setting. The model puts forward participation as a utility maximizing alternative for agents with higher risk levels, who are more risk averse, are driven more by solidarity motives, and less susceptible to cost fluctuations. This basic micro-level model is used to simulate decision-making for agent populations in a dynamic, interdependent setting. Simulation results show that successful risk-sharing arrangements may work if participants are driven by motivations of solidarity or risk aversion, but this is less likely in populations more heterogeneous in risk, as the individual motivations can less often make up for the larger cost deficiencies. At the same time, more heterogeneous groups deal better with uncertainty and temporary cost fluctuations than more homogeneous populations do. In the latter, cascades following temporary peaks in support requests more often result in complete failure, while under full information about the risk distribution this would not have happened.

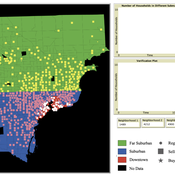

While the world’s total urban population continues to grow, not all cities are witnessing such growth, some are actually shrinking. This shrinkage causes several problems to emerge including population loss, economic depression, vacant properties and the contraction of housing markets. Such problems challenge efforts to make cities sustainable. While there is a growing body of work on study shrinking cities, few explore such a phenomenon from the bottom up using dynamic computational models. To overcome this issue this paper presents an spatially explicit agent-based model stylized on the Detroit Tri-county area, an area witnessing shrinkage. Specifically, the model demonstrates how through the buying and selling of houses can lead to urban shrinkage from the bottom up. The model results indicate that along with the lower level housing transactions being captured, the aggregated level market conditions relating to urban shrinkage are also captured (i.e., the contraction of housing markets). As such, the paper demonstrates the potential of simulation to explore urban shrinkage and potentially offers a means to test polices to achieve urban sustainability.

Peer reviewed BAMERS: Macroeconomic effect of extortion

Alejandro Platas López Alejandro Guerra-Hernández | Published Monday, March 23, 2020 | Last modified Sunday, July 26, 2020Inspired by the European project called GLODERS that thoroughly analyzed the dynamics of extortive systems, Bottom-up Adaptive Macroeconomics with Extortion (BAMERS) is a model to study the effect of extortion on macroeconomic aggregates through simulation. This methodology is adequate to cope with the scarce data associated to the hidden nature of extortion, which difficults analytical approaches. As a first approximation, a generic economy with healthy macroeconomics signals is modeled and validated, i.e., moderate inflation, as well as a reasonable unemployment rate are warranteed. Such economy is used to study the effect of extortion in such signals. It is worth mentioning that, as far as is known, there is no work that analyzes the effects of extortion on macroeconomic indicators from an agent-based perspective. Our results show that there is significant effects on some macroeconomics indicators, in particular, propensity to consume has a direct linear relationship with extortion, indicating that people become poorer, which impacts both the Gini Index and inflation. The GDP shows a marked contraction with the slightest presence of extortion in the economic system.

Peer reviewed BAM: The Bottom-up Adaptive Macroeconomics Model

Alejandro Platas López Alejandro Guerra-Hernández | Published Tuesday, January 14, 2020 | Last modified Sunday, July 26, 2020Overview

Purpose

Modeling an economy with stable macro signals, that works as a benchmark for studying the effects of the agent activities, e.g. extortion, at the service of the elaboration of public policies..

…

A Bottom-Up Simulation on Competition and Displacement of Online Interpersonal Communication Platforms

great-sage-futao | Published Tuesday, December 31, 2019 | Last modified Tuesday, December 31, 2019This model aims to simulate Competition and Displacement of Online Interpersonal Communication Platforms process from a bottom-up angle. Individual interpersonal communication platform adoption and abandonment serve as the micro-foundation of the simulation model. The evolution mode of platform user online communication network determines how present platform users adjust their communication relationships as well as how new users join that network. This evolution mode together with innovations proposed by individual interpersonal communication platforms would also have impacts on the platform competition and displacement process and result by influencing individual platform adoption and abandonment behaviors. Three scenes were designed to simulate some common competition situations occurred in the past and current time, that two homogeneous interpersonal communication platforms competed with each other when this kind of platforms first came into the public eye, that a late entrant platform with a major innovation competed with the leading incumbent platform during the following days, as well as that both the leading incumbent and the late entrant continued to propose many small innovations to compete in recent days, respectively.

Initial parameters are as follows: n(Nmax in the paper), denotes the final node number of the online communication network node. mi (m in the paper), denotes the initial degree of those initial network nodes and new added nodes. pc(Pc in the paper), denotes the proportion of links to be removed and added in each epoch. pst(Pv in the paper), denotes the proportion of nodes with a viscosity to some platforms. comeintime(Ti in the paper), denotes the epoch when Platform 2 joins the market. pit(Pi in the paper), denotes the proportion of nodes adopting Platform 2 immediately at epoch comeintime(Ti). ct(Ct in the paper), denotes the Innovation Effective Period length. In Scene 2, There is only one major platform proposed by Platform 2, and ct describes that length. However, in Scene 3, Platform 2 and 1 will propose innovations alternately. And so, we set ct=10000 in simulation program, and every jtt epochs, we alter the innovation proposer from one platform to the other. Hence in this scene, jtt actually denotes the Innovation Effective Period length instead of ct.

Risks and Hedonics in Empirical Agent-based land market (RHEA) model

Tatiana Filatova Koen de Koning | Published Monday, April 01, 2019RHEA aims to provide a methodological platform to simulate the aggregated impact of households’ residential location choice and dynamic risk perceptions in response to flooding on urban land markets. It integrates adaptive behaviour into the spatial landscape using behavioural theories and empirical data sources. The platform can be used to assess: how changes in households’ preferences or risk perceptions capitalize in property values, how price dynamics in the housing market affect spatial demographics in hazard-prone urban areas, how structural non-marginal shifts in land markets emerge from the bottom up, and how economic land use systems react to climate change. RHEA allows direct modelling of interactions of many heterogeneous agents in a land market over a heterogeneous spatial landscape. As other ABMs of markets it helps to understand how aggregated patterns and economic indices result from many individual interactions of economic agents.

The model could be used by scientists to explore the impact of climate change and increased flood risk on urban resilience, and the effect of various behavioural assumptions on the choices that people make in response to flood risk. It can be used by policy-makers to explore the aggregated impact of climate adaptation policies aimed at minimizing flood damages and the social costs of flood risk.

SMILI-T: Small-scale fisheries institutions and local interactions for transformations

Emilie Lindkvist Maja Schlüter Xavier Basurto | Published Tuesday, January 09, 2018 | Last modified Friday, March 26, 2021This model examines how financial and social top-down interventions interplay with the internal self-organizing dynamics of a fishing community. The aim is to transform from hierarchical fishbuyer-fisher relationship into fishing cooperatives.

Displaying 10 of 12 results bottom-up clear search