About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 301 results for "Martin Lange" clear search

SimPioN - Simulating Path dependence in inter-organisational Networks

Nanda Wijermans Frithjof Stöppler | Published Monday, January 11, 2021The SimPioN model aims to abstractly reproduce and experiment with the conditions under which a path-dependent process may lead to a (structural) network lock-in in interorganisational networks.

Path dependence theory is constructed around a process argumentation regarding three main elements: a situation of (at least) initially non-ergodic (unpredictable with regard to outcome) starting conditions in a social setting; these become reinforced by the workings of (at least) one positive feedback mechanism that increasingly reduces the scope of conceivable alternative choices; and that process finally results in a situation of lock-in, where any alternatives outside the already adopted options become essentially impossible or too costly to pursue despite (ostensibly) better options theoretically being available.

The purpose of SimPioN is to advance our understanding of lock-ins arising in interorganisational networks based on the network dynamics involving the mechanism of social capital. This mechanism and the lock-ins it may drive have been shown above to produce problematic consequences for firms in terms of a loss of organisational autonomy and strategic flexibility, especially in high-tech knowledge-intensive industries that rely heavily on network organising.

…

WATER REUSE ADOPTION BY FARMERS (WRAF)

Farshid Shoushtarian | Published Tuesday, September 27, 2022Agriculture is the largest water-consuming sector worldwide, responsible for almost 70% of the world’s total freshwater consumption. Agricultural water reuse is one of the most sustainable and reliable methods to alleviate water shortages worldwide. However, the dynamics of agricultural water reuse adoption by farmers and its impacts on local water resources are still unknown to the scientific community, according to the literature. Therefore, the primary purpose of the WRAF model is to investigate the micro-level dynamics of agricultural water reuse adoption by farmers and its impacts on local water resources. The WRAF was developed using agent-based modeling as an exploratory tool for scenario analysis. The model was specifically designed for researchers and water resources decision-makers, especially those interested in natural resources management and water reuse.

WRAF simulates a virtual agricultural area in which several autonomous farms operate. It also simulates these farms’ water consumption dynamics. The developed model includes two types of agents: farmers and wastewater treatment plants. In general, farmer agents are the main water-consuming agents, and wastewater treatment plant agents are recycled water providers in the WRAF model. Dynamic simulation of agricultural water supply and demand in the area allows the user to observe the results of various irrigation water management scenarios, including recycled water. The models also enable the user to apply multiple climate change scenarios, including normal, moderate drought, severe drought, and wet weather conditions.

Peer reviewed Agent-based model to simulate equilibria and regime shifts emerged in lake ecosystems

no contributors listed | Published Tuesday, January 25, 2022(An empty output folder named “NETLOGOexperiment” in the same location with the LAKEOBS_MIX.nlogo file is required before the model can be run properly)

The model is motivated by regime shifts (i.e. abrupt and persistent transition) revealed in the previous paleoecological study of Taibai Lake. The aim of this model is to improve a general understanding of the mechanism of emergent nonlinear shifts in complex systems. Prelimnary calibration and validation is done against survey data in MLYB lakes. Dynamic population changes of function groups can be simulated and observed on the Netlogo interface.

Main functional groups in lake ecosystems were modelled as super-individuals in a space where they interact with each other. They are phytoplankton, zooplankton, submerged macrophyte, planktivorous fish, herbivorous fish and piscivorous fish. The relationships between these functional groups include predation (e.g. zooplankton-phytoplankton), competition (phytoplankton-macrophyte) and protection (macrophyte-zooplankton). Each individual has properties in size, mass, energy, and age as physiological variables and reproduce or die according to predefined criteria. A system dynamic model was integrated to simulate external drivers.

Set biological and environmental parameters using the green sliders first. If the data of simulation are to be logged, set “Logdata” as true and input the name of the file you want the spreadsheet(.csv) to be called. You will need create an empty folder called “NETLOGOexperiment” in the same level and location with the LAKEOBS_MIX.nlogo file. Press “setup” to initialise the system and “go” to start life cycles.

Rebel Group Protection Rackets

Gerd Wagner Luis Gustavo Nardin Kamil C. Klosek Frances Duffy | Published Wednesday, December 04, 2019System Narrative

How do rebel groups control territory and engage with the local economy during civil war? Charles Tilly’s seminal War and State Making as Organized Crime (1985) posits that the process of waging war and providing governance resembles that of a protection racket, in which aspiring governing groups will extort local populations in order to gain power, and civilians or businesses will pay in order to ensure their own protection. As civil war research increasingly probes the mechanisms that fuel local disputes and the origination of violence, we develop an agent-based simulation model to explore the economic relationship of rebel groups with local populations, using extortion racket interactions to explain the dynamics of rebel fighting, their impact on the economy, and the importance of their economic base of support. This analysis provides insights for understanding the causes and byproducts of rebel competition in present-day conflicts, such as the cases of South Sudan, Afghanistan, and Somalia.

Model Description

The model defines two object types: RebelGroup and Enterprise. A RebelGroup is a group that competes for power in a system of anarchy, in which there is effectively no government control. An Enterprise is a local civilian-level actor that conducts business in this environment, whose objective is to make a profit. In this system, a RebelGroup may choose to extort money from Enterprises in order to support its fighting efforts. It can extract payments from an Enterprise, which fears for its safety if it does not pay. This adds some amount of money to the RebelGroup’s resources, and they can return to extort the same Enterprise again. The RebelGroup can also choose to loot the Enterprise instead. This results in gaining all of the Enterprise wealth, but prompts the individual Enterprise to flee, or leave the model. This reduces the available pool of Enterprises available to the RebelGroup for extortion. Following these interactions the RebelGroup can choose to AllocateWealth, or pay its rebel fighters. Depending on the value of its available resources, it can add more rebels or expel some of those which it already has, changing its size. It can also choose to expand over new territory, or effectively increase its number of potential extorting Enterprises. As a response to these dynamics, an Enterprise can choose to Report expansion to another RebelGroup, which results in fighting between the two groups. This system shows how, faced with economic choices, RebelGroups and Enterprises make decisions in war that impact conflict and violence outcomes.

Peer reviewed CHIME ABM of Hurricane Evacuation

C Michael Barton Sean Bergin Joshua Watts Joshua Alland Rebecca Morss | Published Monday, October 18, 2021 | Last modified Tuesday, January 04, 2022The Communicating Hazard Information in the Modern Environment (CHIME) agent-based model (ABM) is a Netlogo program that facilitates the analysis of information flow and protective decisions across space and time during hazardous weather events. CHIME ABM provides a platform for testing hypotheses about collective human responses to weather forecasts and information flow, using empirical data from historical hurricanes. The model uses real world geographical and hurricane data to set the boundaries of the simulation, and it uses historical hurricane forecast information from the National Hurricane Center to initiate forecast information flow to citizen agents in the model.

Peer reviewed HUMLAND: HUMan impact on LANDscapes agent-based model

Fulco Scherjon Anastasia Nikulina Anhelina Zapolska Maria Antonia Serge Marco Davoli Dave van Wees Katharine MacDonald | Published Monday, October 16, 2023The HUMan impact on LANDscapes (HUMLAND) model has been developed to track and quantify the intensity of different impacts on landscapes at the continental level. This agent-based model focuses on determining the most influential factors in the transformation of interglacial vegetation with a specific emphasis on burning organized by hunter-gatherers. HUMLAND integrates various spatial datasets as input and target for the agent-based model results. Additionally, the simulation incorporates recently obtained continental-scale estimations of fire return intervals and the speed of vegetation regrowth. The obtained results include maps of possible scenarios of modified landscapes in the past and quantification of the impact of each agent, including climate, humans, megafauna, and natural fires.

Model of communication between two groups of managers in the course of project implementation

Smarzhevskiy Ivan | Published Monday, December 07, 2020This is a simulation model of communication between two groups of managers in the course of project implementation. The “world” of the model is a space of interaction between project participants, each of which belongs either to a group of work performers or to a group of customers. Information about the progress of the project is publicly available and represents the deviation Earned value (EV) from the planned project value (cost baseline).

The key elements of the model are 1) persons belonging to a group of customers or performers, 2) agents that are communication acts. The life cycle of persons is equal to the time of the simulation experiment, the life cycle of the communication act is 3 periods of model time (for the convenience of visualizing behavior during the experiment). The communication act occurs at a specific point in the model space, the coordinates of which are realized as random variables. During the experiment, persons randomly move in the model space. The communication act involves persons belonging to a group of customers and a group of performers, remote from the place of the communication act at a distance not exceeding the value of the communication radius (MaxCommRadius), while at least one representative from each of the groups must participate in the communication act. If none are found, the communication act is not carried out. The number of potential communication acts per unit of model time is a parameter of the model (CommPerTick).

The managerial sense of the feedback is the stimulating effect of the positive value of the accumulated communication complexity (positive background of the project implementation) on the productivity of the performers. Provided there is favorable communication (“trust”, “mutual understanding”) between the customer and the contractor, it is more likely that project operations will be performed with less lag behind the plan or ahead of it.

The behavior of agents in the world of the model (change of coordinates, visualization of agents’ belonging to a specific communicative act at a given time, etc.) is not informative. Content data are obtained in the form of time series of accumulated communicative complexity, the deviation of the earned value from the planned value, average indicators characterizing communication - the total number of communicative acts and the average number of their participants, etc. These data are displayed on graphs during the simulation experiment.

The control elements of the model allow seven independent values to be varied, which, even with a minimum number of varied values (three: minimum, maximum, optimum), gives 3^7 = 2187 different variants of initial conditions. In this case, the statistical processing of the results requires repeated calculation of the model indicators for each grid node. Thus, the set of varied parameters and the range of their variation is determined by the logic of a particular study and represents a significant narrowing of the full set of initial conditions for which the model allows simulation experiments.

…

PopComp

Andre Costopoulos | Published Thursday, December 10, 2020PopComp by Andre Costopoulos 2020

[email protected]

Licence: DWYWWI (Do whatever you want with it)

I use Netlogo to build a simple environmental change and population expansion and diffusion model. Patches have a carrying capacity and can host two kinds of populations (APop and BPop). Each time step, the carrying capacity of each patch has a given probability of increasing or decreasing up to a maximum proportion.

…

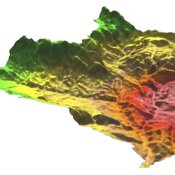

MedLanD Modeling Laboratory

C Michael Barton Sean Bergin Isaac Ullah Gary Mayer Hessam Sarjoughian Helena Mitasova | Published Friday, May 08, 2015 | Last modified Thursday, December 14, 2017The MML is a hybrid modeling environment that couples an agent-based model of small-holder agropastoral households and a cellular landscape evolution model that simulates changes in erosion/deposition, soils, and vegetation.

Political Participation

Didier Ruedin | Published Saturday, April 12, 2014 | Last modified Sunday, September 28, 2025Implementation of Milbrath’s (1965) model of political participation. Individual participation is determined by stimuli from the political environment, interpersonal interaction, as well as individual characteristics.

Displaying 10 of 301 results for "Martin Lange" clear search