About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 78 results risk clear search

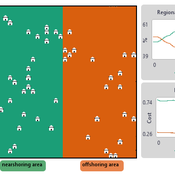

NOMAD: Near–Off Mobility under Aspiration Dynamics

Alejandro Platas López | Published Wednesday, December 17, 2025NOMAD is an agent-based model of firm location choice between two aggregate regions (“near” and “off”) under logistics uncertainty. Firms occupy sites characterised by attractiveness and logistics risk, earn a risk-adjusted payoff that depends on regional costs (wages plus congestion) and an individual risk-tolerance trait, and update location choices using aspiration-based satisficing rules with switching frictions. Logistics risk evolves endogenously on occupied sites through a region-specific absorption mechanism (good/bad events that reduce/increase risk), while congestion feeds back into regional costs via regional shares and local crowding. Runs stop endogenously once the near-region share becomes quasi-stable after burn-in, and the model records time series and quasi-stable outcomes such as near/off composition, switching intensity, costs, average risk, and average risk tolerance.

FRAMe (Flood Resilience Agent-Based Model)

Wenhan Feng | Published Wednesday, October 22, 2025The FRAMe (Flood Resilience Agent-Based Model) serves as a framework designed to simulate flood resilience dynamics at the community level, focusing on a rural settlement in the Mekong River Basin. Integrating empirical data from extensive surveys, Bayesian networks, and hydrological simulations, the framework quantifies resilience as a trade-off between robustness (resistance to damage) and adaptability (capacity for dynamic response). Agents include households, governments, and other actors, linked by social and governance networks that facilitate knowledge transfer, resource distribution, and risk communication. FRAMe incorporates mechanisms for flood forecasting, policy interventions (education, aid, insurance), and individual and collective decision-making, grounded in Protection Motivation Theory and MoHuB frameworks. The framework’s spatially explicit design leverages GIS data, which supports scenario testing of governance structures and stakeholder interactions. By examining policy scenarios and agent behavior, FRAMe aims to inform adaptive flood management strategies and enhance community resilience.

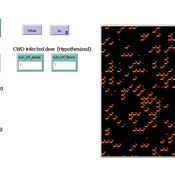

Peer reviewed CapOvCWD

Aniruddha Belsare | Published Tuesday, September 09, 2025 | Last modified Tuesday, November 11, 2025CapOvCWD is an agent-based model that simulates a captive cervid herd composed of adults and fawns. The model deer population is initialized using data on herd size and composition from captive facility records. Individual deer domiciliary history and annual CWD testing records inform the herd size and sample size (for CWD testing), respectively. The model can be used to iteratively estimate the facility level annual CWD detection probability. Detection probability estimates can be further refined by incorporating multiyear CWD testing data. This approach can be particularly useful for interpreting negative test results from a subset of the captive herd. Facility level detection probability estimates provide a comprehensive and standardized risk metric that reflects the likelihood of undetected CWD in the facility.

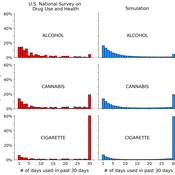

A simple computational algorithm for simulating population substance use

Jacob Borodovsky | Published Thursday, March 27, 2025This code simulates individual-level, longitudinal substance use patterns that can be used to understand how cross-sectional U-shaped distributions of population substance use emerge. Each independent computational object transitions between two states: using a substance (State 1), or not using a substance (State 2). The simulation has two core components. Component 1: each object is assigned a unique risk factor transition probability and unique protective factor transition probability. Component 2: each object’s current decision to use or not use the substance is influenced by the object’s history of decisions (i.e., “path dependence”).

Soy2Grow-ABM-V1

Siavash Farahbakhsh | Published Monday, January 20, 2025The Soy2Grow ABM aims to simulate the adoption of soybean production in Flanders, Belgium. The model primarily considers two types of agents as farmers: 1) arable and 2) dairy farmers. Each farmer, based on its type, assesses the feasibility of adopting soybean cultivation. The feasibility assessment depends on many interrelated factors, including price, production costs, yield, disease, drought (i.e., environmental stress), social pressure, group formations, learning and skills, risk-taking, subsidies, target profit margins, tolerance to bad experiences, etc. Moreover, after adopting soybean production, agents will reassess their performance. If their performance is unsatisfactory, an agent may opt out of soy production. Therefore, one of the main outcomes to look for in the model is the number of adopters over time.

The main agents are farmers. Generally, factors influencing farmers’ decision-making are divided into seven main areas: 1) external environmental factors, 2) cooperation and learning (with slight differences depending on whether they are arable or dairy farmers), 3) crop-specific factors, 4) economics, 5) support frameworks, 6) behavioral factors, and 7) the role of mobile toasters (applicable only to dairy farmers).

Moreover, factors not only influence decision-making but also interact with each other. Specifically, external environmental factors (i.e., stress) will result in lower yield and quality (protein content). The reducing effect, identified during participatory workshops, can reach 50 %. Skills can grow and improve yield; however, their growth has a limit and follows different learning curves depending on how individualistic a farmer is. During participatory workshops, it was identified that, contrary to cooperative farmers, individualistic farmers may learn faster and reach their limits more quickly. Furthermore, subsidies directly affect revenues and profit margins; however, their impact may disappear when they are removed. In the case of dairy farmers, mobile toasters play an important role, adding toasting and processing costs to those producing soy for their animal feed consumption.

Last but not least, behavioral factors directly influence the final adoption decision. For example, high risk-taking farmers may adopt faster, whereas more conservative farmers may wait for their neighbors to adopt first. Farmers may evaluate their success based on their own targets and may also consider other crops rather than soy.

A formalized implementation of Halstead and O’Shea’s Bad Year Economics. The agent population uses one of four resilience strategies in an attempt to cope with a dynamic environment of stresses and shocks.

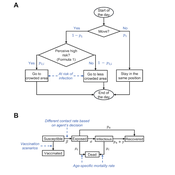

Peer reviewed Behavioral Dynamics of Epidemic Trajectories and Vaccination Strategies: An Agent-Based Model

Ziyuan Zhang | Published Tuesday, December 10, 2024This agent-based model explores the dynamics between human behavior and vaccination strategies during COVID-19 pandemics. It examines how individual risk perceptions influence behaviors and subsequently affect epidemic outcomes in a simulated metropolitan area resembling New York City from December 2020 to May 2021.

Agents modify their daily activities—deciding whether to travel to densely populated urban centers or stay in less crowded neighborhoods—based on their risk perception. This perception is influenced by factors such as risk perception threshold, risk tolerance personality, mortality rate, disease prevalence, and the average number of contacts per agent in crowded settings. Agent characteristics are carefully calibrated to reflect New York City demographics, including age distribution and variations in infection probability and mortality rates across these groups. The agents can experience six distinct health statuses: susceptible, exposed, infectious, recovered from infection, dead, and vaccinated (SEIRDV). The simulation focuses on the Iota and Alpha variants, the dominant strains in New York City during the period.

We simulate six scenarios divided into three main categories:

1. A baseline model without vaccinations where agents exhibit no risk perception and are indifferent to virus transmission and disease prevalence.

…

This paper presents an agent-based model to study the dynamics of city-state systems in a constrained environment with limited space and resources. The model comprises three types of agents: city-states, villages, and battalions, where city-states, the primary decision-makers, can build villages for food production and recruit battalions for defense and aggression. In this setting, simulation results, generated through a multi-parameter grid sampling, suggest that risk-seeking strategies are more effective in high-cost scenarios, provided that the production rate is sufficiently high. Also, the model highlights the role of output productivity in defining which strategic preferences are successful in a long-term scenario, with higher outputs supporting more aggressive expansion and military actions, while resource limitations compel more conservative strategies focused on survival and resource conservation. Finally, the results suggest the existence of a non-linear effect of diminishing returns in strategic investments on successful strategies, emphasizing the need for careful resource allocation in a competitive environment.

Agent-based tax evasion model for investigating impacts of public disclosure

Hiroyuki Sano | Published Thursday, March 14, 2024The model explores the impact of public disclosure on tax compliance among diverse agents, including individual taxpayers and a tax authority. It incorporates heterogeneous preferences and income endowments among taxpayers, captured through a utility function that considers psychic costs subtracted from expected pecuniary utility. These costs include moral, reciprocity, and stigma costs associated with norm violations, leading to variations in taxpayers’ risk attitudes and related parameters. The tax authority’s attributes, such as the frequency of random audits, penalty rate, and the choice between partial or full disclosure, remain fixed throughout the simulation. Income endowments and preference parameters are randomly assigned to taxpayers at the outset.

Taxpayers maximize their expected utility by reporting income, taking into account tax, penalty, and audit rates. They make annual decisions based on their own and their peers’ behaviors from the previous year. Taxpayers indirectly interact at the societal level through public disclosure conducted by the tax authority, exchanging tax information among peers. Each period in the simulation collects data on total reported income, average compliance rates per income group, distribution of compliance rates, counts of compliers, full evaders, partial evaders, and the numbers of taxpayers experiencing guilt and anger. The model evaluates whether public disclosure positively or negatively impacts compliance rates and quantifies this impact based on aggregated individual reporting behaviors.

Seascapes of the Unreal: Using Agent Based Modeling to Examine Traditional Coast Salish Maritime Mobility

Adam Rorabaugh | Published Friday, December 22, 2023Non-traditional tools and mediums can provide unique methodological and interpretive opportunities for archaeologists. In this case, the Unreal Engine (UE), which is typically used for games and media, has provided a powerful tool for non-programmers to engage with 3D visualization and programming as never before. UE has a low cost of entry for researchers as it is free to download and has user-friendly “blueprint” tools that are visual and easily extendable. Traditional maritime mobility in the Salish Sea is examined using an agent-based model developed in blueprints. Focusing on the sea canoe travel of the Straits Salish northwestern Washington State and southwest British Columbia. This simulation integrates GIS data to assess travel time between Coast Salish archaeological village locations and archaeologically represented resource gathering areas. Transportation speeds informed by ethnographic data were used to examine travel times for short forays and longer inter-village journeys. The results found that short forays tended to half day to full day trips when accounting for resource gathering activities. Similarly, many locations in the Salish Sea were accessible in long journeys within two to three days, assuming fair travel conditions. While overall transportation costs to reach sites may be low, models such as these highlight the variability in transport risk and cost. The integration of these types of tools, traditionally used for entertainment, can increase the accessibility of modeling approaches to researchers, be expanded to digital storytelling, including aiding in the teaching of traditional ecological knowledge and placenames, and can have wide applications beyond maritime archaeology.

This is v0.01 of a UE5.2.1 agent based model.

Displaying 10 of 78 results risk clear search