About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 78 results risk clear search

IUCM - The Integrated Urban Complexity Model

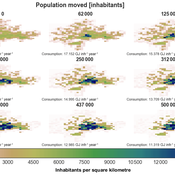

Roger Cremades Philipp S. Sommer | Published Thursday, December 14, 2023We present the Integrated Urban Complexity model (IUCm 1.0) that computes “climate-smart urban forms”, which are able to cut emissions related to energy consumption from urban mobility in half. Furthermore, we show the complex features that go beyond the normal debates about urban sprawl vs. compactness. Our results show how to reinforce fractal hierarchies and population density clusters within climate risk constraints to significantly decrease the energy consumption of urban mobility. The new model that we present aims to produce new advice about how cities can combat climate change. From a technical angle, this model is a geographical automaton, conceptually interfacing between cellular automata and spatial explicit optimisation to achieve normative sustainability goals related to low energy. See a complete user guide at https://iucm.readthedocs.io/en/latest/ .

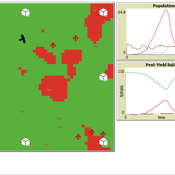

Peer reviewed Avian pest control: Yield outcome due to insectivorous birds, falconry, and integration of nest boxes.

David Jung | Published Monday, November 13, 2023 | Last modified Sunday, November 19, 2023The model aims to simulate predator-prey relationships in an agricultural setting. The focus lies on avian communities and their effect on different pest organisms (here: pest birds, rodents, and arthropod pests). Since most case studies focused on the impact on arthropod pests (AP) alone, this model attempts to include effects on yield outcome. By incorporating three treatments with different factor levels (insectivorous bird species, falconry, nest box density) an experimental setup is given that allows for further statistical analysis to identify an optimal combination of the treatments.

In light of a global decline of birds, insects, and many other groups of organisms, alternative practices of pest management are heavily needed to reduce the input of pesticides. Avian pest control therefore poses an opportunity to bridge the disconnect between humans and nature by realizing ecosystem services and emphasizing sustainable social ecological systems.

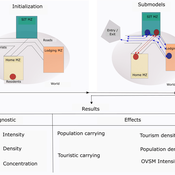

Peer reviewed ABM Overtourism Santa Marta

Janwar Moreno | Published Monday, October 23, 2023This model presents the simulation model of a city in the context of overtourism. The study area is the city of Santa Marta in Colombia. The purpose is to illustrate the spatial and temporal distribution of population and tourists in the city. The simulation analyzes emerging patterns that result from the interaction between critical components in the touristic urban system: residents, urban space, touristic sites, and tourists. The model is an Agent-Based Model (ABM) with the GAMA software. Also, it used public input data from statistical centers, geographical information systems, tourist websites, reports, and academic articles. The ABM includes assessing some measures used to address overtourism. This is a field of research with a low level of analysis for destinations with overtourism, but the ABM model allows it. The results indicate that the city has a high risk of overtourism, with spatial and temporal differences in the population distribution, and it illustrates the effects of two management measures of the phenomenon on different scales. Another interesting result is the proposed tourism intensity indicator (OVsm), taking into account that the tourism intensity indicators used by the literature on overtourism have an overestimation of tourism pressures.

An Agent-Based Model of an Insurance Market driven by Supply and Demand with Imperfectly Estimated Strategies in C#

Rei England | Published Sunday, September 24, 2023This is a simulation of an insurance market where the premium moves according to the balance between supply and demand. In this model, insurers set their supply with the aim of maximising their expected utility gain while operating under imperfect information about both customer demand and underlying risk distributions.

There are seven types of insurer strategies. One type follows a rational strategy within the bounds of imperfect information. The other six types also seek to maximise their utility gain, but base their market expectations on a chartist strategy. Under this strategy, market premium is extrapolated from trends based on past insurance prices. This is subdivided according to whether the insurer is trend following or a contrarian (counter-trend), and further depending on whether the trend is estimated from short-term, medium-term, or long-term data.

Customers are modelled as a whole and allocated between insurers according to available supply. Customer demand is calculated according to a logit choice model based on the expected utility gain of purchasing insurance for an average customer versus the expected utility gain of non-purchase.

An Agent-Based Model of an Insurer's Estimated Capital Requirement in a Simple Insurance Market with Imperfect Information in C#

Rei England | Published Sunday, September 24, 2023This is an agent-based model of a simple insurance market with two types of agents: customers and insurers. Insurers set premium quotes for each customer according to an estimation of their underlying risk based on past claims data. Customers either renew existing contracts or else select the cheapest quote from a subset of insurers. Insurers then estimate their resulting capital requirement based on a 99.5% VaR of their aggregate loss distributions. These estimates demonstrate an under-estimation bias due to the winner’s curse effect.

Learning Extension - RAGE RAngeland Grazing Model

Nikita Strelkovskii Cristina I. Apetrei Nikolay Khabarov Valeria Javalera Rincón | Published Saturday, July 22, 2023This is an extension of the original RAGE model (Dressler et al. 2018), where we add learning capabilities to agents, specifically learning-by-doing and social learning (two processes central to adaptive (co-)management).

The extension module is applied to smallholder farmers’ decision-making - here, a pasture (patch) is the private property of the household (agent) placed on it and there is no movement of the households. Households observe the state of the pasture and their neighrbours to make decisions on how many livestock to place on their pasture every year. Three new behavioural types are created (which cannot be combined with the original ones): E-RO (baseline behaviour), E-LBD (learning-by-doing) and E-RO-SL1 (social learning). Similarly to the original model, these three types can be compared regarding long-term social-ecological performance. In addition, a global strategy switching option (corresponding to double-loop learning) allows users to study how behavioural strategies diffuse in a heterogeneous population of learning and non-learning agents.

An important modification of the original model is that extension agents are heterogeneous in how they deal with uncertainty. This is represented by an agent property, called the r-parameter (household-risk-att in the code). The r-parameter is catch-all for various factors that form an agent’s disposition to act in a certain way, such as: uncertainty in the sensing (partial observability of the resource system), noise in the information received, or an inherent characteristic of the agent, for instance, their risk attitude.

Risk perception of individuals and the transmission dynamics of COVID-19

Sara Shahin Moghadam Franziska klügel | Published Tuesday, June 27, 2023The purpose of this model is to explore the influence of integrating individuals’ behavioral dynamics in an agent-based model of COVID-19, on the dynamics of disease transmission. The model is an agent-based extention of an established large-scale Individual-based model called STRIDE. Four risk factors determine the individual’s perception of the risk and how they behave accordingly. It is assumed that individuals with higher levels of risk perception adopt higher levels of contact reduction in their daily routines. Individuals can assign different weights to any of the four different risk factors, i.e., the modeler can model different populations and explore how the transmission dynamics vary among them.

Urban waterlogging disaster evaluation based on complex network a case study of Zhengzhou, China

Chao Ding Jia Xu | Published Monday, April 17, 2023The model constructs a complex network of traffic based on the main urban area of Zhengzhou, China, and simulates the urban rainfall process using the ABM model to analyse the real-time risk of flooding hazards in the nodes of the complex network.

Netlogo Earned Value Management Model

Manuel Castañón-Puga Ricardo Fernando Rosales–Cisneros Julio César Acosta–Prado Alfredo Tirado–Ramos Camilo Khatchikian Elías Aburto–Camacllanqui | Published Thursday, November 24, 2022The model aims to illustrate how Earned Value Management (EVM) provides an approach to measure a project’s performance by comparing its actual progress against the planned one, allowing it to evaluate trends to formulate forecasts. The instance performs a project execution and calculates the EVM performance indexes according to a Performance Measurement Baseline (PMB), which integrates the description of the work to do (scope), the deadlines for its execution (schedule), and the calculation of its costs and the resources required for its implementation (cost).

Specifically, we are addressing the following questions: How does the risk of execution delay or advance impact cost and schedule performance? How do the players’ number or individual work capacity impact cost and schedule estimations to finish? Regardless of why workers cause delays or produce overruns in their assignments, does EVM assess delivery performance and help make objective decisions?

To consider our model realistic enough for its purpose, we use the following patterns: The model addresses classic problems of Project Management (PM). It plays the typical task board where workers are assigned to complete a task backlog in project performance. Workers could delay or advance in the task execution, and we calculate the performance using the PMI-recommended Earned Value.

Agent-based simulation of discussion processes in risk workshops with quantitative skepticism

Matthias Meyer Clemens Harten Lucia Bellora-Bienengräber | Published Sunday, August 14, 2022The model measures drivers of effectiveness of risk assessments in risk workshops where a calculative culture of quantitative skepticism is present. We model the limits to information transfer, incomplete discussions, group characteristics, and interaction patterns and investigate their effect on risk assessment in risk workshops, in order to contrast results to a previous model focused on a calculative culture of quantitative enthusiasm.

The model simulates a discussion in the context of a risk workshop with 9 participants. The participants use constraint satisfaction networks to assess a given risk individually and as a group.

Displaying 10 of 78 results risk clear search