About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 972 results for "M Van Den Hoven" clear search

Peer reviewed Price Evolution with Expectations

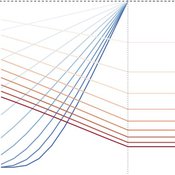

J M Applegate Gesine Steudel Armin Haas Carlo Jaeger | Published Friday, September 10, 2021The Price Evolution with Expectations model provides the opportunity to explore the question of non-equilibrium market dynamics, and how and under which conditions an economic system converges to the classically defined economic equilibrium. To accomplish this, we bring together two points of view of the economy; the classical perspective of general equilibrium theory and an evolutionary perspective, in which the current development of the economic system determines the possibilities for further evolution.

The Price Evolution with Expectations model consists of a representative firm producing no profit but producing a single good, which we call sugar, and a representative household which provides labour to the firm and purchases sugar.The model explores the evolutionary dynamics whereby the firm does not initially know the household demand but eventually this demand and thus the correct price for sugar given the household’s optimal labour.

The model can be run in one of two ways; the first does not include money and the second uses money such that the firm and/or the household have an endowment that can be spent or saved. In either case, the household has preferences for leisure and consumption and a demand function relating sugar and price, and the firm has a production function and learns the household demand over a set number of time steps using either an endogenous or exogenous learning algorithm. The resulting equilibria, or fixed points of the system, may or may not match the classical economic equilibrium.

A model on feeding and social interaction behaviour of pigs

Iris J.M.M. Boumans | Published Thursday, May 04, 2017 | Last modified Tuesday, February 27, 2018The model simulates interaction between internal physiological factors (e.g. energy balance) and external social factors (e.g. competition level) underlying feeding and social interaction behaviour of commercially group-housed pigs.

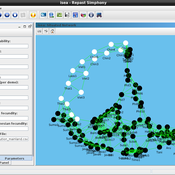

Modeling Asian-Papuan Admixture during the Neolithic Expansion across Island Southeast Asia

Murray Cox François Vallée | Published Friday, December 09, 2016This Repast Simphony model simulates genomic admixture during the farming expansion of human groups from mainland Asia into the Papuan dominated islands of Southeast Asia during the Neolithic period.

WealthDistribRes

Romulus-Catalin Damaceanu | Published Friday, May 04, 2012 | Last modified Saturday, April 27, 2013This model WealthDistribRes can be used to study the distribution of wealth in function of using a combination of resources classified in two renewable and nonrenewable.

Peer reviewed NoD-Neg: A Non-Deterministic model of affordable housing Negotiations

Aya Badawy Nuno Pinto Richard Kingston | Published Sunday, September 08, 2024The Non-Deterministic model of affordable housing Negotiations (NoD-Neg) is designed for generating hypotheses about the possible outcomes of negotiating affordable housing obligations in new developments in England. By outcomes we mean, the probabilities of failing the negotiation and/or the different possibilities of agreement.

The model focuses on two negotiations which are key in the provision of affordable housing. The first is between a developer (DEV) who is submitting a planning application for approval and the relevant Local Planning Authority (LPA) who is responsible for reviewing the application and enforcing the affordable housing obligations. The second negotiation is between the developer and a Registered Social Landlord (RSL) who buys the affordable units from the developer and rents them out. They can negotiate the price of selling the affordable units to the RSL.

The model runs the two negotiations on the same development project several times to enable agents representing stakeholders to apply different negotiation tactics (different agendas and concession-making tactics), hence, explore the different possibilities of outcomes.

The model produces three types of outputs: (i) histograms showing the distribution of the negotiation outcomes in all the simulation runs and the probability of each outcome; (ii) a data file with the exact values shown in the histograms; and (iii) a conversation log detailing the exchange of messages between agents in each simulation run.

Peer reviewed SIM-VOLATILE: Adoption of emerging circular technologies in the waste-treatment sector

Siavash Farahbakhsh | Published Wednesday, December 14, 2022The SIM-VOLATILE model is a technology adoption model at the population level. The technology, in this model, is called Volatile Fatty Acid Platform (VFAP) and it is in the frame of the circular economy. The technology is considered an emerging technology and it is in the optimization phase. Through the adoption of VFAP, waste-treatment plants will be able to convert organic waste into high-end products rather than focusing on the production of biogas. Moreover, there are three adoption/investment scenarios as the technology enables the production of polyhydroxyalkanoates (PHA), single-cell oils (SCO), and polyunsaturated fatty acids (PUFA). However, due to differences in the processing related to the products, waste-treatment plants need to choose one adoption scenario.

In this simulation, there are several parameters and variables. Agents are heterogeneous waste-treatment plants that face the problem of circular economy technology adoption. Since the technology is emerging, the adoption decision is associated with high risks. In this regard, first, agents evaluate the economic feasibility of the emerging technology for each product (investment scenarios). Second, they will check on the trend of adoption in their social environment (i.e. local pressure for each scenario). Third, they combine these two economic and social assessments with an environmental assessment which is their environmental decision-value (i.e. their status on green technology). This combination gives the agent an overall adaptability fitness value (detailed for each scenario). If this value is above a certain threshold, agents may decide to adopt the emerging technology, which is ultimately depending on their predominant adoption probabilities and market gaps.

Industrial Cooperation and the Hydrogen Transition

Amineh Ghorbani Renske van 't Veer Emre Ates Zofia Lukszo | Published Tuesday, September 23, 2025An Agent Based Model that explores the deployment of hydrogen among a regional industrial cluster in the Netherlands, consisting of 15 companies. The companies seek to decarbonize by replacing their natural gas by hydrogen.

The model integrates technical characteristics as well as company motivations to transition to hydrogen. The baseline model only considers individual investments where company can locally produce hydrogen. If they reach the backbone threshold, companies can also consider buying hydrogen through a connection to the national hydrogen network. The second scenario considers that companies can participate in a joint investment to get an electrolyzer to locally produce the hydrogen.

Two experiments look at the impact of the sectoral configuration and at the impact of subsidy conditions on the region’s hydrogen transition

Interplay between stakeholders of the management of a river

Christophe Sibertin-Blanc Pascal Roggero Bertrand Baldet | Published Wednesday, November 12, 2014This model describes and analyses the outcomes of the confrontation of interests, some conflicting, some common, about the management of a small river in SW France

IUCM - The Integrated Urban Complexity Model

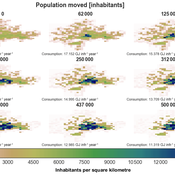

Roger Cremades Philipp S. Sommer | Published Thursday, December 14, 2023We present the Integrated Urban Complexity model (IUCm 1.0) that computes “climate-smart urban forms”, which are able to cut emissions related to energy consumption from urban mobility in half. Furthermore, we show the complex features that go beyond the normal debates about urban sprawl vs. compactness. Our results show how to reinforce fractal hierarchies and population density clusters within climate risk constraints to significantly decrease the energy consumption of urban mobility. The new model that we present aims to produce new advice about how cities can combat climate change. From a technical angle, this model is a geographical automaton, conceptually interfacing between cellular automata and spatial explicit optimisation to achieve normative sustainability goals related to low energy. See a complete user guide at https://iucm.readthedocs.io/en/latest/ .

Gender Disparity in COVID-19’s Impact on Academic Careers: An Agent-Based Model

S.R. Aurora (a.k.a. Mai P. Trinh) Chantal van Esch | Published Tuesday, September 26, 2023Prior to COVID-19, female academics accounted for 45% of assistant professors, 37% of associate professors, and 21% of full professors in business schools (Morgan et al., 2021). The pandemic arguably widened this gender gap, but little systemic data exists to quantify it. Our study set out to answer two questions: (1) How much will the COVID-19 pandemic have impacted the gender gap in U.S. business school tenured and tenure-track faculty? and (2) How much will institutional policies designed to help faculty members during the pandemic have affected this gender gap? We used agent-based modeling coupled with archival data to develop a simulation of the tenure process in business schools in the U.S. and tested how institutional interventions would affect this gender gap. Our simulations demonstrated that the gender gap in U.S. business schools was on track to close but would need further interventions to reach equality (50% females). In the long-term picture, COVID-19 had a small impact on the gender gap, as did dependent care assistance and tenure extensions (unless only women received tenure extensions). Changing performance evaluation methods to better value teaching and service activities and increasing the proportion of female new hires would help close the gender gap faster.

Displaying 10 of 972 results for "M Van Den Hoven" clear search