About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 55 results economy clear search

MERCURY extension: population

Tom Brughmans | Published Thursday, May 23, 2019This model is an extended version of the original MERCURY model (https://www.comses.net/codebases/4347/releases/1.1.0/ ) . It allows for experiments to be performed in which empirically informed population sizes of sites are included, that allow for the scaling of the number of tableware traders with the population of settlements, and for hypothesised production centres of four tablewares to be used in experiments.

Experiments performed with this population extension and substantive interpretations derived from them are published in:

Hanson, J.W. & T. Brughmans. In press. Settlement scale and economic networks in the Roman Empire, in T. Brughmans & A.I. Wilson (ed.) Simulating Roman Economies. Theories, Methods and Computational Models. Oxford: Oxford University Press.

…

Metaphoria 2019

Timothy Gooding | Published Sunday, February 24, 2019This model test the efficiency of the market economy in comparison with a hunter/gatherer economy. It also compares the model outcomes between a market economy when using eternal agents with one using mortal agents.

An Agent-Based Simple Economy Model With Taxation And Almsgiving For Social Justice

Erşan Taşan | Published Monday, December 17, 2018An agent based simple economy model that examines the effect of taxation and almsgiving (particularly Islamic almsgiving - zakat) for ameliorating wealth inequality.

Peer reviewed Emergent Firms Model

J M Applegate | Published Friday, July 13, 2018The Emergent Firm (EF) model is based on the premise that firms arise out of individuals choosing to work together to advantage themselves of the benefits of returns-to-scale and coordination. The Emergent Firm (EF) model is a new implementation and extension of Rob Axtell’s Endogenous Dynamics of Multi-Agent Firms model. Like the Axtell model, the EF model describes how economies, composed of firms, form and evolve out of the utility maximizing activity on the part of individual agents. The EF model includes a cash-in-advance constraint on agents changing employment, as well as a universal credit-creating lender to explore how costs and access to capital affect the emergent economy and its macroeconomic characteristics such as firm size distributions, wealth, debt, wages and productivity.

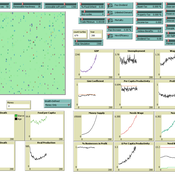

06 EiLab V1.40 – Entropic Index Laboratory

Garvin Boyle | Published Monday, March 19, 2018There is a new type of economic model called a capital exchange model, in which the biophysical economy is abstracted away, and the interaction of units of money is studied. Benatti, Drăgulescu and Yakovenko described at least eight capital exchange models – now referred to collectively as the BDY models – which are replicated as models A through H in EiLab. In recent writings, Yakovenko goes on to show that the entropy of these monetarily isolated systems rises to a maximal possible value as the model approaches steady state, and remains there, in analogy of the 2nd law of thermodynamics. EiLab demonstrates this behaviour. However, it must be noted that we are NOT talking about thermodynamic entropy. Heat is not being modeled – only simple exchanges of cash. But the same statistical formulae apply.

In three unpublished papers and a collection of diary notes and conference presentations (all available with this model), the concept of “entropic index” is defined for use in agent-based models (ABMs), with a particular interest in sustainable economics. Models I and J of EiLab are variations of the BDY model especially designed to study the Maximum Entropy Principle (MEP – model I) and the Maximum Entropy Production Principle (MEPP – model J) in ABMs. Both the MEPP and H.T. Odum’s Maximum Power Principle (MPP) have been proposed as organizing principles for complex adaptive systems. The MEPP and the MPP are two sides of the same coin, and an understanding of their implications is key, I believe, to understanding economic sustainability. Both of these proposed (and not widely accepted) principles describe the role of entropy in non-isolated systems in which complexity is generated and flourishes, such as ecosystems, and economies.

EiLab is one of several models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, and CmLab.

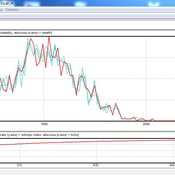

05 CmLab V1.17 – Conservation of Money Laboratory

Garvin Boyle | Published Saturday, April 15, 2017In CmLab we explore the implications of the phenomenon of Conservation of Money in a modern economy. This is one of a series of models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, CmLab.

01b ModEco NLG V1.39 – Model Economies – The PMM

Garvin Boyle | Published Friday, April 14, 2017It is very difficult to model a sustainable intergenerational biophysical/financial economy. ModEco NLG is one of a series of models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, CmLab.

Peer reviewed Simulating the Economic Impact of Boko Haram on a Cameroonian Floodplain

Mark Moritz Nathaniel Henry Sarah Laborde | Published Saturday, October 22, 2016 | Last modified Wednesday, June 07, 2017This model examines the potential impact of market collapse on the economy and demography of fishing households in the Logone Floodplain, Cameroon.

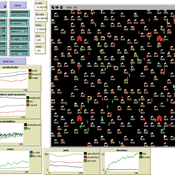

ABSAM model

Marcin Wozniak | Published Monday, August 29, 2016 | Last modified Tuesday, November 08, 2016ABSAM model is an agent-based search and matching model of the local labor market. There are four types of agents in the economy, which cooperate in the artificial world, where behavioral rules were extracted from the labor market search theory.

Peter Diamond's Coconut Model (Heterogeneity and Learning)

Sven Banisch Eckehard Olbrich | Published Monday, May 30, 2016Agent-based version of the simple search and barter economy conceived by Peter Diamond in 1982. The model is also known as Coconut Model.

Displaying 10 of 55 results economy clear search