About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 105 results policy clear search

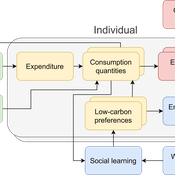

The cultural multiplier of climate policy

Daniel Torren-Peraire | Published Thursday, October 31, 2024For deep decarbonisation, the design of climate policy needs to account for consumption choices being influenced not only by pricing but also by social learning. This involves changes that pertain to the whole spectrum of consumption, possibly involving shifts in lifestyles. In this regard, it is crucial to consider not just short-term social learning processes but also slower, longer-term, cultural change. Against this background, we analyse the interaction between climate policy and cultural change, focusing on carbon taxation. We extend the notion of “social multiplier” of environmental policy derived in an earlier study to the context of multiple consumer needs while allowing for behavioural spillovers between these, giving rise to a “cultural multiplier”. We develop a model to assess how this cultural multiplier contributes to the effectiveness of carbon taxation. Our results show that the cultural multiplier stimulates greater low-carbon consumption compared to fixed preferences. The model results are of particular relevance for policy acceptance due to the cultural multiplier being most effective at low-carbon tax values, relative to a counter-case of short-term social interactions. Notably, at high carbon tax levels, the distinction between social and cultural multiplier effects diminishes, as the strong price signal drives even resistant individuals toward low-carbon consumption. By varying socio-economic conditions, such as substitutability between low- and high-carbon goods, social network structure, proximity of like-minded individuals and the richness of consumption lifestyles, the model provides insight into how cultural change can be leveraged to induce maximum effectiveness of climate policy.

Construction and Demolition model to track material flows and embodied carbon

Jonathan Edgardo Cohen | Published Monday, September 30, 2024Reusing existing material stocks in developed built environments can significantly reduce the environmental footprint of the construction and demolition sector. However, material reuse in urban areas presents technical, temporal, and geographical challenges. Although a better understanding of spatial and temporal changes in material stocks could improve city resource management, limited scientific contributions have addressed this challenge.

This study details the steps followed in developing a spatially explicit rule-based simulation of materials stock. The simulation provides a proof of concept by incorporating the spatial and temporal dimensions of construction and demolition activities to analyse how various urban parameters determine material flows and embodied carbon in urban areas. The model explores the effects of 1) re-using recycled materials, 2) demolitions, 3) renovations and 4) various building typologies.

To showcase the model’s capabilities, the residential building stock of Gothenburg City is used as a case study, and eight building materials are tracked. Environmental impacts (A1-A3) are calculated with embodied carbon factors. The main parameters are explored in a baseline scenario. Then, a second scenario focuses on a hypothetical policy that promotes improvements in building energy performance.

The simulation can be expanded to include more materials and built environment assets and allows for future explorations on, for example, the role of logistics, the implementation of recycling or reuse stations, and, in general, supporting sustainable and circular strategies from the construction sector.

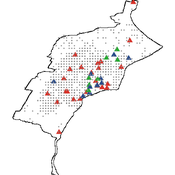

School Enrollment Model

Spiro Maroulis Catalina Canals Enrique Canessa Alejandra Mizala Sergio Chaigneau | Published Monday, July 08, 2024The School Enrollment Model is a spatially-explicit computational model that depicts a city, with schools and students located within the space. The model represents the Chilean school system, a market-based educational system, where people are free to choose among public, private voucher, or private fee-paying schools. In the model, students become aware of some schools, apply to schools, switch schools, pass or fail grade levels, and eventually either graduate or dropout. Schools select students, update their tuition, test scores, and other characteristics.

The purpose of the model is to represent the Chilean school system and analyze the different mechanisms that affected the enrollment distribution between public, private voucher, and private fee-paying school sectors during the period 2004-2016.

EU language skills

Marco Civico | Published Sunday, July 07, 2024The objective of this agent-based model is to test different language education orientations and their consequences for the EU population in terms of linguistic disenfranchisement, that is, the inability of citizens to understand EU documents and parliamentary discussions should their native language(s) no longer be official. I will focus on the impact of linguistic distance and language learning. Ideally, this model would be a tool to help EU policy makers make informed decisions about language practices and education policies, taking into account their consequences in terms of diversity and linguistic disenfranchisement. The model can be used to force agents to make certain choices in terms of language skills acquisition. The user can then go on to compare different scenarios in which language skills are acquired according to different rationales. The idea is that, by forcing agents to adopt certain language learning strategies, the model user can simulate policies promoting the acquisition of language skills and get an idea of their impact. In this way the model allows not only to sketch various scenarios of the evolution of language skills among EU citizens, but also to estimate the level of disenfranchisement in each of these scenarios.

Integrate land use policies into the agent-based model to simulate land use change

Jing Gao | Published Sunday, June 09, 2024Detailed information will be presented after the journal paper is published.

Simulating Social Interaction in Times of COVID Restrictions

Oscar de Vries | Published Friday, November 17, 2023Social distancing is a strategy to mitigate the spread of contagious disease, but it bears negative impacts on people’s social well-being, resulting in non-compliance. This paper uses an integrated behavioral simulation model, called HUMAT, to identify a sweet spot

that balances strictness of and obedience to social distancing rules.

A novel agent-based model was developed that aims to explore social interaction while it is constrained by visitor limitations (due to Dutch COVID measures). Specifically, the model aims to capture the interaction between the need for social contact and the support for the visitors measure. The model was developed using the HUMAT integrated framework, which offered a psychological and sociological foundation for the behavior of the agents.

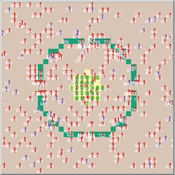

Design principles for a redistributive collective action institution in times of crisis

Aashis Joshi | Published Friday, September 15, 2023What policy measures are effective in redistributing essential resources during crisis situations such as climate change impacts? We model a collective action institution with different rules for designing and organizing it, and make our analysis specific to various societal contexts.

Our model captures a generic societal context of unequal vulnerability and climate change impact in a stylized form. We represent a community of people who harvest and consume an essential resource to maintain their well-being. However, their ability to harvest the resource is not equal; people are characterized by a ‘resource access’ attribute whose values are uniformly distributed from 0 to 1 in the population. A person’s resource access value determines the amount of resource units they are able to harvest, and therefore the welfare levels they are able to attain. People travel to the centralized resource region and derive well-being or welfare, represented as an energy gain, by harvesting and consuming resource units.

The community is subject to a climate change impact event that occurs with a certain periodicity and over a certain duration. The capacity of resource units to regenerate diminishes during the impact events. Unequal capacities to access the essential resource results in unequal vulnerability among people with regards to their ability to maintain a sufficient welfare level, especially during impact events.

…

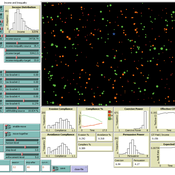

Peer reviewed Co-adoption of low-carbon household energy technologies

Mart van der Kam Maria Lagomarsino Elie Azar Ulf Hahnel David Parra | Published Tuesday, August 29, 2023 | Last modified Friday, February 23, 2024The model simulates the diffusion of four low-carbon energy technologies among households: photovoltaic (PV) solar panels, electric vehicles (EVs), heat pumps, and home batteries. We model household decision making as the decision marking of one person, the agent. The agent decides whether to adopt these technologies. Hereby, the model can be used to study co-adoption behaviour, thereby going beyond traditional diffusion models that focus on the adop-tion of single technologies. The combination of these technologies is of particular interest be-cause (1) using the energy generated by PV solar panels for EVs and heat pumps can reduce emissions associated with transport and heating, respectively, and (2) EVs, heat pumps, and home batteries can help to integrate PV solar panels in local electricity grids by offering flexible demand (EVs and heat pumps) and energy storage (home batteries and EVs), thereby reducing grid impacts and associated upgrading costs.

The purpose of the model is to represent realistic adoption and co-adoption behaviour. This is achieved by grounding the decision model on the risks-as-feelings model (Loewenstein et al., 2001), theory from environmental and social psychology, and empirically informing agent be-haviour by survey-data among 1469 people in the Swiss region Romandie.

The model can be used to construct scenarios for the diffusion of the four low-carbon energy technologies depending on different contexts, and as a virtual experimentation environment for ex ante evaluation of policy interventions to stimulate adoption and co-adoption.

U-TRANS Modelling Urban Transition with Coupled Housing and Labour Markets

Bernardo Furtado Jiaqi Ge | Published Monday, July 31, 2023We develop an agent-based model (U-TRANS) to simulate the transition of an abstract city under an industrial revolution. By coupling the labour and housing markets, we propose a holistic framework that incorporates the key interacting factors and micro processes during the transition. Using U-TRANS, we look at five urban transition scenarios: collapse, weak recovery, transition, enhanced training and global recruit, and find the model is able to generate patterns observed in the real world. For example, We find that poor neighbourhoods benefit the most from growth in the new industry, whereas the rich neighbourhoods do better than the rest when the growth is slow or the situation deteriorates. We also find a (subtle) trade-off between growth and equality. The strategy to recruit a large number of skilled workers globally will lead to higher growth in GDP, population and human capital, but it will also entail higher inequality and market volatility, and potentially create a divide between the local and international workers. The holistic framework developed in this paper will help us better understand urban transition and detect early signals in the process. It can also be used as a test-bed for policy and growth strategies to help a city during a major economic and technological revolution.

Agent-Based Simulation for International Tax Compliance

Peter Gerbrands | Published Tuesday, July 18, 2023Country-by-Country Reporting and Automatic Exchange of Information have recently been implemented in European Union (EU) countries. These international tax reforms increase tax compliance in the short term. In the long run, however, taxpayers will continue looking abroad to avoid taxation and, countries, looking for additional revenues, will provide opportunities. As a result, tax competition intensifies and the initial increase in compliance could reverse. To avoid international tax reforms being counteracted by tax competition, this paper suggests bilateral responsive regulation to maximize compliance. This implies that countries would use different tax policy instruments toward other countries, including tax and secrecy havens.

To assess the effectiveness of fully or partially enforce tax policies, this agent based model has been ran many times under different enforcement rules, which influence the perceived enforced- and voluntary compliance, as the slippery-slope model prescribes. Based on the dynamics of this perception and the extent to which agents influence each other, the annual amounts of tax evasion, tax avoidance and taxes paid are calculated over longer periods of time.

The agent-based simulation finds that a differentiated policy response could increase tax compliance by 6.54 percent, which translates into an annual increase of €105 billion in EU tax revenues on income, profits, and capital gains. Corporate income tax revenues in France, Spain, and the UK alone would already account for €35 billion.

Displaying 10 of 105 results policy clear search