About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 29 results for 'Nicholas Mark Gotts'

Peer reviewed Coupled demographic dynamics of herd and household in pastoral systems

Chelsea E Hunter Daniel C Peart Abigail Buffington Andrew Yoak Ian M Hamilton Mark Moritz | Published Saturday, April 08, 2023This purpose of this model is to understand how the coupled demographic dynamics of herds and households constrain the growth of livestock populations in pastoral systems.

Knowledge Sharing in a Hospital

bpint Emily Molfino Joshua Goldstein Kathryn Schaefer Ziemer Mark Orr Bryan Lewis Jose Jimenez | Published Friday, January 27, 2023Organizations are complex systems comprised of many dynamic and evolving interaction patterns among individuals and groups. Understanding these interactions and how patterns, such as informal structures and knowledge sharing behavior, emerge are crucial to creating effective and efficient organizations. To explore such organizational dynamics, the agent-based model integrates a cognitive model, dynamic social networks, and a physical environment.

The simulation on the study of the optimal business strategy with the interaction between technologies and consumers.

sej-yoo | Published Monday, June 27, 2022 | Last modified Monday, July 04, 2022HOW IT WORKS

This model consists of three agents, and each agent type operates per business theories as below.

a. New technologies(Tech): It evolves per sustaining or disruptive technology trajectory with the constraint of project management triangle (Scope, Time, Quality, and Cost).

b. Entrepreneurs(Entre): It builds up the solution by combining Tech components per its own strategy (Exploration, Exploitation, or Ambidex).

c. Consumer(Consumer): It selects the solution per its own preference due to Diffusion of innovation theory (Innovators, Early Adopters, Early Majority, Late Majority, Laggards)

…

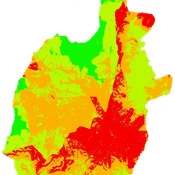

Peer reviewed Gregarious Behavior, Human Colonization and Social Differentiation Agent-Based Model

Sebastian Fajardo Andrés Bernal Gert Jan Hofstede Mark R Kramer Martijn de Vries | Published Thursday, August 20, 2020 | Last modified Thursday, October 29, 2020Studies of colonization processes in past human societies often use a standard population model in which population is represented as a single quantity. Real populations in these processes, however, are structured with internal classes or stages, and classes are sometimes created based on social differentiation. In this present work, information about the colonization of old Providence Island was used to create an agent-based model of the colonization process in a heterogeneous environment for a population with social differentiation. Agents were socially divided into two classes and modeled with dissimilar spatial clustering preferences. The model and simulations assessed the importance of gregarious behavior for colonization processes conducted in heterogeneous environments by socially-differentiated populations. Results suggest that in these conditions, the colonization process starts with an agent cluster in the largest and most suitable area. The spatial distribution of agents maintained a tendency toward randomness as simulation time increased, even when gregariousness values increased. The most conspicuous effects in agent clustering were produced by the initial conditions and behavioral adaptations that increased the agent capacity to access more resources and the likelihood of gregariousness. The approach presented here could be used to analyze past human colonization events or support long-term conceptual design of future human colonization processes with small social formations into unfamiliar and uninhabited environments.

Peer reviewed Infectious diseases model for mixed-methods research chapter

Daniel C Peart Chelsea E Hunter Ian M Hamilton Mark Moritz | Published Sunday, January 30, 2022The purpose of this curricular model is to teach students the basics of modeling complex systems using agent-based modeling. It is a simple SIR model that simulates how a disease spreads through a population as its members change from susceptible to infected to recovered and then back to susceptible. The dynamics of the model are such that there are multiple emergent outcomes depending on the parameter settings, initial conditions, and chance.

The curricular model can be used with the chapter Agent-Based Modeling in Mixed Methods Research (Moritz et al. 2022) in the Handbook of Teaching Qualitative & Mixed Methods (Ruth et al. 2022).

The instructional videos can be accessed on YouTube: Video 1 (https://youtu.be/32_JIfBodWs); Video 2 (https://youtu.be/0PK_zVKNcp8); and Video 3 (https://youtu.be/0bT0_mYSAJ8).

CINCH1 (Covid-19 INfection Control in Hospitals)

N Gotts | Published Sunday, August 29, 2021CINCH1 (Covid-19 INfection Control in Hospitals), is a prototype model of physical distancing for infection control among staff in University College London Hospital during the Covid-19 pandemic, developed at the University of Leeds, School of Geography. It models the movement of collections of agents in simple spaces under conflicting motivations of reaching their destination, maintaining physical distance from each other, and walking together with a companion. The model incorporates aspects of the Capability, Opportunity and Motivation of Behaviour (COM-B) Behaviour Change Framework developed at University College London Centre for Behaviour Change, and is aimed at informing decisions about behavioural interventions in hospital and other workplace settings during this and possible future outbreaks of highly contagious diseases. CINCH1 was developed as part of the SAFER (SARS-CoV-2 Acquisition in Frontline Health Care Workers – Evaluation to Inform Response) project

(https://www.ucl.ac.uk/behaviour-change/research/safer-sars-cov-2-acquisition-frontline-health-care-workers-evaluation-inform-response), funded by the UK Medical Research Council. It is written in Python 3.8, and built upon Mesa version 0.8.7 (copyright 2020 Project Mesa Team).

Wildlife-Human Interactions in Shared Landscapes (WHISL)

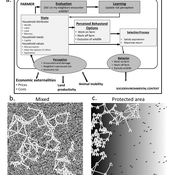

Andres Baeza-Castro Neil Carter Nicholas Magliocca | Published Friday, May 22, 2020This model simulates a group of farmers that have encounters with individuals of a wildlife population. Each farmer owns a set of cells that represent their farm. Each farmer must decide what cells inside their farm will be used to produce an agricultural good that is self in an external market at a given price. The farmer must decide to protect the farm from potential encounters with individuals of the wildlife population. This decision in the model is called “fencing”. Each time that a cell is fenced, the chances of a wildlife individual to move to that cell is reduced. Each encounter reduces the productive outcome obtained of the affected cell. Farmers, therefore, can reduce the risk of encounters by exclusion. The decision of excluding wildlife is made considering the perception of risk of encounters. In the model, the perception of risk is subjective, as it depends on past encounters and on the perception of risk from other farmers in the community. The community of farmers passes information about this risk perception through a social network. The user (observer) of the model can control the importance of the social network on the individual perception of risk.

Artificial Long House Valley-Black Mesa

Amy Warren Lisa Sattenspiel | Published Thursday, March 19, 2020This model is an extension of the Artificial Long House Valley (ALHV) model developed by the authors (Swedlund et al. 2016; Warren and Sattenspiel 2020). The ALHV model simulates the population dynamics of individuals within the Long House Valley of Arizona from AD 800 to 1350. Individuals are aggregated into households that participate in annual agricultural and demographic cycles. The present version of the model incorporates features of the ALHV model including realistic age-specific fertility and mortality and, in addition, it adds the Black Mesa environment and population, as well as additional methods to allow migration between the two regions.

As is the case for previous versions of the ALHV model as well as the Artificial Anasazi (AA) model from which the ALHV model was derived (Axtell et al. 2002; Janssen 2009), this version makes use of detailed archaeological and paleoenvironmental data from the Long House Valley and the adjacent areas in Arizona. It also uses the same methods as the original AA model to estimate annual maize productivity of various agricultural zones within the Long House Valley. A new environment and associated methods have been developed for Black Mesa. Productivity estimates from both regions are used to determine suitable locations for households and farms during each year of the simulation.

NarcoLogic

Nicholas Magliocca | Published Thursday, August 29, 2019Investigate spatial adaptive behaviors of narco-trafficking networks in response to various counterdrug interdiction strategies within the cocaine transit zone of Central America and associated maritime areas. Through the novel application of the ‘complex adaptive systems’ paradigm, we implement a potentially transformative coupled agent-based and interdiction optimization modeling approach to compellingly demonstrate: (a) how current efforts to disrupt narco-trafficking networks are in fact making them more widespread, resilient, and economically powerful; (b) the potential for alternative interdiction approaches to weaken and contain traffickers.

Coupled Housing and Land Markets (CHALMS)

Nicholas Magliocca | Published Thursday, August 29, 2019An economic agent-based model of Coupled Housing and Land Markets (CHALMS) simulates the location choices, insurance purchasing decisions, and risk perceptions of coastal residents, and how coastal risks are capitalized (or not) into coastal housing and land markets.

Displaying 10 of 29 results for 'Nicholas Mark Gotts'