About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 50 results price clear search

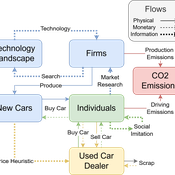

Driving in the wrong direction? A co-evolutionary model of electric vehicle adoption and innovation

Daniel Torren-Peraire | Published Friday, July 11, 2025Car-centric societies face substantial challenges in moving towards sustainable

mobility systems, with internal combustion engine vehicles remaining a major

source of emissions. Electric vehicles play a critical role in addressing this challenge, yet their diffusion depends on the interaction of consumer behaviour, firm

innovation, and policy incentives. This paper develops an agent-based model to

examine these dynamics, calibrated on the data for the state of California over

2001-2023. In the model, heterogeneous car users influenced by their social peers

…

Soy2Grow-ABM-V1

Siavash Farahbakhsh | Published Monday, January 20, 2025The Soy2Grow ABM aims to simulate the adoption of soybean production in Flanders, Belgium. The model primarily considers two types of agents as farmers: 1) arable and 2) dairy farmers. Each farmer, based on its type, assesses the feasibility of adopting soybean cultivation. The feasibility assessment depends on many interrelated factors, including price, production costs, yield, disease, drought (i.e., environmental stress), social pressure, group formations, learning and skills, risk-taking, subsidies, target profit margins, tolerance to bad experiences, etc. Moreover, after adopting soybean production, agents will reassess their performance. If their performance is unsatisfactory, an agent may opt out of soy production. Therefore, one of the main outcomes to look for in the model is the number of adopters over time.

The main agents are farmers. Generally, factors influencing farmers’ decision-making are divided into seven main areas: 1) external environmental factors, 2) cooperation and learning (with slight differences depending on whether they are arable or dairy farmers), 3) crop-specific factors, 4) economics, 5) support frameworks, 6) behavioral factors, and 7) the role of mobile toasters (applicable only to dairy farmers).

Moreover, factors not only influence decision-making but also interact with each other. Specifically, external environmental factors (i.e., stress) will result in lower yield and quality (protein content). The reducing effect, identified during participatory workshops, can reach 50 %. Skills can grow and improve yield; however, their growth has a limit and follows different learning curves depending on how individualistic a farmer is. During participatory workshops, it was identified that, contrary to cooperative farmers, individualistic farmers may learn faster and reach their limits more quickly. Furthermore, subsidies directly affect revenues and profit margins; however, their impact may disappear when they are removed. In the case of dairy farmers, mobile toasters play an important role, adding toasting and processing costs to those producing soy for their animal feed consumption.

Last but not least, behavioral factors directly influence the final adoption decision. For example, high risk-taking farmers may adopt faster, whereas more conservative farmers may wait for their neighbors to adopt first. Farmers may evaluate their success based on their own targets and may also consider other crops rather than soy.

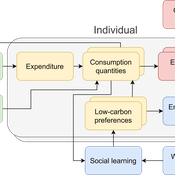

The cultural multiplier of climate policy

Daniel Torren-Peraire | Published Thursday, October 31, 2024For deep decarbonisation, the design of climate policy needs to account for consumption choices being influenced not only by pricing but also by social learning. This involves changes that pertain to the whole spectrum of consumption, possibly involving shifts in lifestyles. In this regard, it is crucial to consider not just short-term social learning processes but also slower, longer-term, cultural change. Against this background, we analyse the interaction between climate policy and cultural change, focusing on carbon taxation. We extend the notion of “social multiplier” of environmental policy derived in an earlier study to the context of multiple consumer needs while allowing for behavioural spillovers between these, giving rise to a “cultural multiplier”. We develop a model to assess how this cultural multiplier contributes to the effectiveness of carbon taxation. Our results show that the cultural multiplier stimulates greater low-carbon consumption compared to fixed preferences. The model results are of particular relevance for policy acceptance due to the cultural multiplier being most effective at low-carbon tax values, relative to a counter-case of short-term social interactions. Notably, at high carbon tax levels, the distinction between social and cultural multiplier effects diminishes, as the strong price signal drives even resistant individuals toward low-carbon consumption. By varying socio-economic conditions, such as substitutability between low- and high-carbon goods, social network structure, proximity of like-minded individuals and the richness of consumption lifestyles, the model provides insight into how cultural change can be leveraged to induce maximum effectiveness of climate policy.

Agent-Based Model of a Circular Food Packaging Ecosystem to assess Packaging Waste Dynamics

Annoek Reitsema | Published Friday, October 11, 2024Reducing packaging waste is a critical challenge that requires organizations to collaborate within circular ecosystems, considering social, economic, and technical variables like decision-making behavior, material prices, and available technologies. Agent-Based Modeling (ABM) offers a valuable methodology for understanding these complex dynamics. In our research, we have developed an ABM to explore circular ecosystems’ potential in reducing packaging waste, using a case study of the Dutch food packaging ecosystem. The model incorporates three types of agents—beverage producers, packaging producers, and waste treaters—who can form closed-loop recycling systems.

Beverage Producer Agents: These agents represent the beverage company divided into five types based on packaging formats: cans, PET bottles, glass bottles, cartons, and bag-in-boxes. Each producer has specific packaging demands based on product volume, type, weight, and reuse potential. They select packaging suppliers annually, guided by deterministic decision styles: bargaining (seeking the lowest price) or problem-solving (prioritizing high recycled content).

Packaging Producer Agents: These agents are responsible for creating packaging using either recycled or virgin materials. The model assumes a mix of monopolistic and competitive market situations, with agents calculating annual material needs. Decision styles influence their choices: bargaining agents compare recycled and virgin material costs, while problem-solving agents prioritize maximum recycled content. They calculate recycled content in packaging and set prices accordingly, ensuring all produced packaging is sold within or outside the model.

…

Peer reviewed NoD-Neg: A Non-Deterministic model of affordable housing Negotiations

Aya Badawy Nuno Pinto Richard Kingston | Published Sunday, September 08, 2024The Non-Deterministic model of affordable housing Negotiations (NoD-Neg) is designed for generating hypotheses about the possible outcomes of negotiating affordable housing obligations in new developments in England. By outcomes we mean, the probabilities of failing the negotiation and/or the different possibilities of agreement.

The model focuses on two negotiations which are key in the provision of affordable housing. The first is between a developer (DEV) who is submitting a planning application for approval and the relevant Local Planning Authority (LPA) who is responsible for reviewing the application and enforcing the affordable housing obligations. The second negotiation is between the developer and a Registered Social Landlord (RSL) who buys the affordable units from the developer and rents them out. They can negotiate the price of selling the affordable units to the RSL.

The model runs the two negotiations on the same development project several times to enable agents representing stakeholders to apply different negotiation tactics (different agendas and concession-making tactics), hence, explore the different possibilities of outcomes.

The model produces three types of outputs: (i) histograms showing the distribution of the negotiation outcomes in all the simulation runs and the probability of each outcome; (ii) a data file with the exact values shown in the histograms; and (iii) a conversation log detailing the exchange of messages between agents in each simulation run.

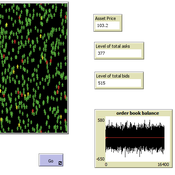

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

Opinion dynamics model for prediction markets

Valerio Restocchi | Published Monday, July 31, 2023We introduce a model of prediction markets that uses opinion dynamics as its underlying mechanism for price formation. We base the opinion dynamics on the Deffuant model of bounded rationality. We have used this model to show that price formation in prediction markets can be robustly explained by opinion dynamics, and that the model can also explain phase transitions depending on just two parameters.

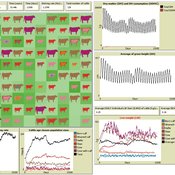

Peer reviewed SequiaBasalto model

Marco Janssen Irene Perez Ibarra Pierre Bommel Diego J. Soler-Navarro Alicia Tenza Peral Francisco Dieguez Cameroni | Published Friday, May 26, 2023This is a replication of the SequiaBasalto model, originally built in Cormas by Dieguez Cameroni et al. (2012, 2014, Bommel et al. 2014 and Morales et al. 2015). The model aimed to test various adaptations of livestock producers to the drought phenomenon provoked by climate change. For that purpose, it simulates the behavior of one livestock farm in the Basaltic Region of Uruguay. The model incorporates the price of livestock, fodder and paddocks, as well as the growth of grass as a function of climate and seasons (environmental submodel), the life cycle of animals feeding on the pasture (livestock submodel), and the different strategies used by farmers to manage their livestock (management submodel). The purpose of the model is to analyze to what degree the common management practices used by farmers (i.e., proactive and reactive) to cope with seasonal and interannual climate variations allow to maintain a sustainable livestock production without depleting the natural resources (i.e., pasture). Here, we replicate the environmental and livestock submodel using NetLogo.

One year is 368 days. Seasons change every 92 days. Each day begins with the growth of grass as a function of climate and season. This is followed by updating the live weight of cows according to the grass height of their patch, and grass consumption, which is determined based on the updated live weight. After consumption, cows grow and reproduce, and a new grass height is calculated. Cows then move to the patch with less cows and with the highest grass height. This updated grass height value will be the initial grass height for the next day.

Peer reviewed Viable North Sea (ViNoS): A NetLogo Agent-based Model of German Small-scale Fisheries

Wolfgang Nikolaus Probst Jieun Seo Jürgen Scheffran Carsten Lemmen Sascha Hokamp Verena Mühlberger Serra Örey | Published Thursday, May 25, 2023 | Last modified Tuesday, December 05, 2023Viable North Sea (ViNoS) is an Agent-based Model of the German North Sea Small-scale Fisheries in a Social-Ecological Systems framework focussing on the adaptive behaviour of fishers facing regulatory, economic, and resource changes. Small-scale fisheries are an important part both of the cultural perception of the German North Sea coast and of its fishing industry. These fisheries are typically family-run operations that use smaller boats and traditional fishing methods to catch a variety of bottom-dwelling species, including plaice, sole, and brown shrimp. Fisheries in the North Sea face area competition with other uses of the sea – long practiced ones like shipping, gas exploration and sand extractions, and currently increasing ones like marine protection and offshore wind farming. German authorities have just released a new maritime spatial plan implementing the need for 30% of protection areas demanded by the United Nations High Seas Treaty and aiming at up to 70 GW of offshore wind power generation by 2045. Fisheries in the North Sea also have to adjust to the northward migration of their established resources following the climate heating of the water. And they have to re-evaluate their economic balance by figuring in the foreseeable rise in oil price and the need for re-investing into their aged fleet.

Perspectives on the Information-Based Economy

Vladimir Gazda Jana Zausinova Marcel Volosin | Published Monday, October 24, 2022This is the agent-based model of information market evolution. It simulates the influences of the transition from material to electronic carriers of information, which is modelled by the falling price of variable production factor. It demonstrates that due to zero marginal production costs, the competition increases, the market becomes unstable, and experience various phases of evolution leading to market monopolization.

Displaying 10 of 50 results price clear search