About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 5 of 15 results for "finance" clear search

Agent-Based Simulation for International Tax Compliance

Peter Gerbrands | Published Tuesday, July 18, 2023Country-by-Country Reporting and Automatic Exchange of Information have recently been implemented in European Union (EU) countries. These international tax reforms increase tax compliance in the short term. In the long run, however, taxpayers will continue looking abroad to avoid taxation and, countries, looking for additional revenues, will provide opportunities. As a result, tax competition intensifies and the initial increase in compliance could reverse. To avoid international tax reforms being counteracted by tax competition, this paper suggests bilateral responsive regulation to maximize compliance. This implies that countries would use different tax policy instruments toward other countries, including tax and secrecy havens.

To assess the effectiveness of fully or partially enforce tax policies, this agent based model has been ran many times under different enforcement rules, which influence the perceived enforced- and voluntary compliance, as the slippery-slope model prescribes. Based on the dynamics of this perception and the extent to which agents influence each other, the annual amounts of tax evasion, tax avoidance and taxes paid are calculated over longer periods of time.

The agent-based simulation finds that a differentiated policy response could increase tax compliance by 6.54 percent, which translates into an annual increase of €105 billion in EU tax revenues on income, profits, and capital gains. Corporate income tax revenues in France, Spain, and the UK alone would already account for €35 billion.

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

TERRoir level Organic matter Interactions and Recycling model

Myriam Grillot | Published Wednesday, April 19, 2017 | Last modified Wednesday, June 17, 2020The TERROIR agent-based model was built for the multi-level analysis of biomass and nutrient flows within agro-sylvo-pastoral villages in West Africa. It explicitly takes into account both human organization and spatial extension of such flows.

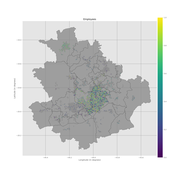

PolicySpace: agent-based modeling

Francisco Miguel Quesada Bernardo Furtado Isaque Daniel Rocha Eberhardt | Published Tuesday, March 06, 2018PolicySpace models public policies within an empirical, spatial environment using data from 46 metropolitan regions in Brazil. The model contains citizens, markets, residences, municipalities, commuting and a the tax scheme. In the associated publications (book in press and https://arxiv.org/abs/1801.00259) we validate the model and demonstrate an application of the fiscal analysis. Besides providing the basics of the platform, our results indicate the relevance of the rules of taxes transfer for cities’ quality of life.

AncientS-ABM: Agent-Based Modeling of Past Societies Social Organization

Angelos Chliaoutakis | Published Thursday, April 09, 2020AncientS-ABM is an agent-based model for simulating and evaluating the potential social organization of an artificial past society, configured by available archaeological data. Unlike most existing agent-based models used in archaeology, our ABM framework includes completely autonomous, utility-based agents. It also incorporates different social organization paradigms, different decision-making processes, and also different cultivation technologies used in ancient societies. Equipped with such paradigms, the model allows us to explore the transition from a simple to a more complex society by focusing on the historical social dynamics; and to assess the influence of social organization on agents’ population growth, agent community numbers, sizes and distribution.

AncientS-ABM also blends ideas from evolutionary game theory with multi-agent systems’ self-organization. We model the evolution of social behaviours in a population of strategically interacting agents in repeated games where they exchange resources (utility) with others. The results of the games contribute to both the continuous re-organization of the social structure, and the progressive adoption of the most successful agent strategies. Agent population is not fixed, but fluctuates over time, while agents in stage games also receive non-static payoffs, in contrast to most games studied in the literature. To tackle this, we defined a novel formulation of the evolutionary dynamics via assessing agents’ rather than strategies’ fitness.

As a case study, we employ AncientS-ABM to evaluate the impact of the implemented social organization paradigms on an artificial Bronze Age “Minoan” society, located at different geographical parts of the island of Crete, Greece. Model parameter choices are based on archaeological evidence and studies, but are not biased towards any specific assumption. Results over a number of different simulation scenarios demonstrate better sustainability for settlements consisting of and adopting a socio-economic organization model based on self-organization, where a “heterarchical” social structure emerges. Results also demonstrate that successful agent societies adopt an evolutionary approach where cooperation is an emergent strategic behaviour. In simulation scenarios where the natural disaster module was enabled, we observe noticeable changes in the settlements’ distribution, relating to significantly higher migration rates immediately after the modeled Theran eruption. In addition, the initially cooperative behaviour is transformed to a non-cooperative one, thus providing support for archaeological theories suggesting that the volcanic eruption led to a clear breakdown of the Minoan socio-economic system.

…

Displaying 5 of 15 results for "finance" clear search