About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 62 results household clear search

Geospatial Agent-Based Model of Immigrant Settlement Dynamics in Metro Vancouver

Liliana Perez Navid Mahdizadeh Gharakhanlou Maryam Yousefi | Published Wednesday, December 03, 2025This agent-based model simulates how new immigrant households choose where to live in Metro Vancouver under the origins diversity scenario. The model begins with 16,000 household agents, reflecting an expected annual population increase of about 42,500 people based on an average household size of 2.56. Each agent is assigned four characteristics: one of ten origin categories, income level (adjusted using NOC data and recent immigrant earnings), likelihood of having children, and preferred mode of commuting. The ten origin groups are drawn from Census patterns, including six subgroups within the broader Asian category (China, India, the Philippines, Iran, South Korea, and Other Asian countries) and two categories for immigrants from the Americas. This refined classification better captures the diversity of newcomers arriving in the region.

Multi-Agent Socio-Ecological Hani Terrace Model

Lei Dong Yunnan University | Published Saturday, March 29, 2025This model is to explore the changes of paddy field landscape and household livelihood structure in the village under different policy scenarios, evaluate the eco-social effects of different policies, and provide decision support tools for proposing effective and feasible policies.

Peer reviewed WaDemEsT-Water Demand Estimation Tool for Residential Areas

Kamil Aybuğa | Published Tuesday, February 18, 2025This model simulates household water consumption patterns in an urban environment. Its current setup compares monthly water consumption data, and the results of a daily heuristic water demand model with the simulation results produced by household demographics that is fine tuned via some base demand model. It’s designed to estimate and analyze water demand based on various factors including household demographics, daily routines of residents (working, weekending, vacation patterns), weather conditions (temperature and precipitation), appliance usage patterns, seasonal variations, and special periods such as weekends and holidays. The model aims to help understand how different factors influence residential water consumption and can be used for water demand forecasting and management.

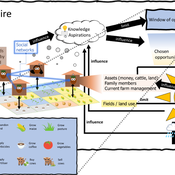

3spire: an agent-based model for exploring aspiration adaptation theory and its implications on smallholder farmers in Ethiopia

ateeuw Yue Dou Markus A Meyer Andrew Nelson | Published Sunday, February 16, 20253spire is an ABM where farming households make management decisions aimed at satisficing along the aspirational dimensions: food self-sufficiency, income, and leisure. Households decision outcomes depend on their social networks, knowledge, assets, household needs, past management, and climate/market trends

The effects of complementary microfinance service on income and lifting poor out of poverty: An agent-based modeling study

Mohammad Reza Sadeghi Moghaddam Mehrdad Hamidi Hedayat | Published Thursday, June 27, 2024This model simulate the process of borrowing from an Microfinance Institute (MFI) and starting a business within a poor household.

The Targeted Subsidies Plan Model

Hassan Bashiri | Published Thursday, September 21, 2023The targeted subsidies plan model is based on the economic concept of targeted subsidies.

The targeted subsidies plan model simulates the distribution of subsidies among households in a community over several years. The model assumes that the government allocates a fixed amount of money each year for the purpose of distributing cash subsidies to eligible households. The eligible households are identified by dividing families into 10 groups based on their income, property, and wealth. The subsidy is distributed to the first four groups, with the first group receiving the highest subsidy amount. The model simulates the impact of the subsidy distribution process on the income and property of households in the community over time.

The model simulates a community of 230 households, each with a household income and wealth that follows a power-law distribution. The number of household members is modeled by a normal distribution. The model allocates a fixed amount of money each year for the purpose of distributing cash subsidies among eligible households. The eligible households are identified by dividing families into 10 groups based on their income, property, and wealth. The subsidy is distributed to the first four groups, with the first group receiving the highest subsidy amount.

The model runs for a period of 10 years, with the subsidy distribution process occurring every month. The subsidy received by each household is assumed to be spent, and a small portion may be saved and added to the household’s property. At the end of each year, the grouping of households based on income and assets is redone, and a number of families may be moved from one group to another based on changes in their income and property.

…

Peer reviewed Co-adoption of low-carbon household energy technologies

Mart van der Kam Maria Lagomarsino Elie Azar Ulf Hahnel David Parra | Published Tuesday, August 29, 2023 | Last modified Friday, February 23, 2024The model simulates the diffusion of four low-carbon energy technologies among households: photovoltaic (PV) solar panels, electric vehicles (EVs), heat pumps, and home batteries. We model household decision making as the decision marking of one person, the agent. The agent decides whether to adopt these technologies. Hereby, the model can be used to study co-adoption behaviour, thereby going beyond traditional diffusion models that focus on the adop-tion of single technologies. The combination of these technologies is of particular interest be-cause (1) using the energy generated by PV solar panels for EVs and heat pumps can reduce emissions associated with transport and heating, respectively, and (2) EVs, heat pumps, and home batteries can help to integrate PV solar panels in local electricity grids by offering flexible demand (EVs and heat pumps) and energy storage (home batteries and EVs), thereby reducing grid impacts and associated upgrading costs.

The purpose of the model is to represent realistic adoption and co-adoption behaviour. This is achieved by grounding the decision model on the risks-as-feelings model (Loewenstein et al., 2001), theory from environmental and social psychology, and empirically informing agent be-haviour by survey-data among 1469 people in the Swiss region Romandie.

The model can be used to construct scenarios for the diffusion of the four low-carbon energy technologies depending on different contexts, and as a virtual experimentation environment for ex ante evaluation of policy interventions to stimulate adoption and co-adoption.

Learning Extension - RAGE RAngeland Grazing Model

Nikita Strelkovskii Cristina I. Apetrei Nikolay Khabarov Valeria Javalera Rincón | Published Saturday, July 22, 2023This is an extension of the original RAGE model (Dressler et al. 2018), where we add learning capabilities to agents, specifically learning-by-doing and social learning (two processes central to adaptive (co-)management).

The extension module is applied to smallholder farmers’ decision-making - here, a pasture (patch) is the private property of the household (agent) placed on it and there is no movement of the households. Households observe the state of the pasture and their neighrbours to make decisions on how many livestock to place on their pasture every year. Three new behavioural types are created (which cannot be combined with the original ones): E-RO (baseline behaviour), E-LBD (learning-by-doing) and E-RO-SL1 (social learning). Similarly to the original model, these three types can be compared regarding long-term social-ecological performance. In addition, a global strategy switching option (corresponding to double-loop learning) allows users to study how behavioural strategies diffuse in a heterogeneous population of learning and non-learning agents.

An important modification of the original model is that extension agents are heterogeneous in how they deal with uncertainty. This is represented by an agent property, called the r-parameter (household-risk-att in the code). The r-parameter is catch-all for various factors that form an agent’s disposition to act in a certain way, such as: uncertainty in the sensing (partial observability of the resource system), noise in the information received, or an inherent characteristic of the agent, for instance, their risk attitude.

Peer reviewed LUCID: Land Use Competition In Drylands

Birgit Müller Gunnar Dressler Lance Robinson | Published Wednesday, April 12, 2023The Land Use Competition in Drylands (LUCID) model is a stylized agent-based model of a smallholder farming system. Its main purpose is to illustrate how competition between pastoralism and crop cultivation can affect livelihoods of households, specifically their food security. In particular, the model analyzes whether the expansion of crop cultivation may contribute to a vicious circle where an increase in cultivated area leads to higher grazing pressure on the remaining pastureland, which in turn may cause forage shortages and livestock loss for households which are then forced to further expand their cultivated area in order to increase their food security. The model does not attempt to replicate a particular case study but to generate a general understanding of mechanisms and drivers of such vicious circles and to identify possible scenarios under which such circles may be prevented.

The model is inspired by observations of the Borana land use system in Southern Ethiopia. The climatic and ecological conditions of the Borana zone favor pastoralism, and traditionally livelihoods have been based mainly on livestock keeping. Recent years, however, have seen an advancement of crop cultivation as a coping strategy, e.g., to compensate the loss of livestock, even though crop yields are low on average and successful harvests are infrequent.

In the model, it is possible to evaluate patterns of individual (single household) as well as overall (across all households) consumption and food security, depending on a range of ecological, climatic and management parameters.

Peer reviewed Coupled demographic dynamics of herd and household in pastoral systems

Mark Moritz Ian M Hamilton Andrew Yoak Abigail Buffington Chelsea E Hunter Daniel C Peart | Published Saturday, April 08, 2023This purpose of this model is to understand how the coupled demographic dynamics of herds and households constrain the growth of livestock populations in pastoral systems.

Displaying 10 of 62 results household clear search