About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 932 results for "Am Vaes - Van De Hulsbeek" clear search

Opinion dynamics and collective risk perception: An ABM model of institutional and media communication about disasters - Code and Datasets

danielevilone | Published Tuesday, October 06, 2020The O.R.E. (Opinions on Risky Events) model describes how a population of interacting individuals process information about a risk of natural catastrophe. The institutional information gives the official evaluation of the risk; the agents receive this communication, process it and also speak to each other processing further the information. The description of the algorithm (as it appears also in the paper) can be found in the attached file OREmodel_description.pdf.

The code (ORE_model.c), written in C, is commented. Also the datasets (inputFACEBOOK.txt and inputEMAILs.txt) of the real networks utilized with this model are available.

For any questions/requests, please write me at [email protected]

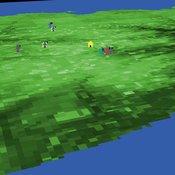

An age and/or gender-based division of labor during the Last Glacial Maximum in Iberia through rabbit hunting

Liliana Perez Samuel Seuru Ariane Burke | Published Friday, July 07, 2023Many archaeological assemblages from the Iberian Peninsula dated to the Last Glacial Maximum contain large quantities of European rabbit (Oryctolagus cuniculus) remains with an anthropic origin. Ethnographic and historic studies report that rabbits may be mass-collected through warren-based harvesting involving the collaborative participation of several persons.

We propose and implement an Agent-Based Model grounded in the Optimal Foraging Theory and the Diet Breadth Model to examine how different warren-based hunting strategies influence the resulting human diets.

Particularly, this model is developed to test the following hypothesis: What if an age and/or gender-based division of labor was adopted, in which adult men focus on large prey hunting, and women, elders and children exploit warrens?

…

An age and/or gender-based division of labor during the Last Glacial Maximum in Iberia through rabbit hunting

Liliana Perez Samuel Seuru Ariane Burke | Published Thursday, February 29, 2024Many archaeological assemblages from the Iberian Peninsula dated to the Last Glacial Maximum contain large quantities of European rabbit (Oryctolagus cuniculus) remains with an anthropic origin. Ethnographic and historic studies report that rabbits may be mass-collected through warren-based harvesting involving the collaborative participation of several persons.

We propose and implement an Agent-Based Model grounded in the Optimal Foraging Theory and the Diet Breadth Model to examine how different warren-based hunting strategies influence the resulting human diets.

…

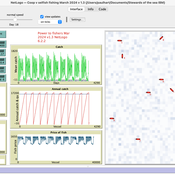

Peer reviewed An IBM of a fishing fleet exploiting a pelagic resource and with a fisher management system. A preliminary version.

Paul Hart | Published Tuesday, March 19, 2024A fisher directed management system was describeded by Hart (2021). It was proposed that fishers should only be allowed to exploit a resource if they collaborated in a resource management system for which they would own and be collectively responsible for. As part of the system fishers would need to follow the rules of exploitation set by the group and provide a central unit with data with which to monitor the fishery. Any fisher not following the rules would at first be fined but eventually expelled from the fishery if he/she continued to act selfishly. This version of the model establishes the dynamics of a fleet of vessels and controls overfishing by imposing fines on fishers whose income is low and who are tempted to keep fishing beyond the set quota which is established each year depending on the abundance of the fish stock. This version will later be elaborated to have interactions between the fishers including pressure to comply with the norms set by the group and which could lead to a stable management system.

The effects of complementary microfinance service on income and lifting poor out of poverty: An agent-based modeling study

Mohammad Reza Sadeghi Moghaddam Mehrdad Hamidi Hedayat | Published Thursday, June 27, 2024This model simulate the process of borrowing from an Microfinance Institute (MFI) and starting a business within a poor household.

WeDiG Sim

Reza Shamsaee | Published Monday, May 14, 2012 | Last modified Saturday, April 27, 2013WeDiG Sim- Weighted Directed Graph Simulator - is an open source application that serves to simulate complex systems. WeDiG Sim reflects the behaviors of those complex systems that put stress on scale-free, weightedness, and directedness. It has been implemented based on “WeDiG model” that is newly presented in this domain. The WeDiG model can be seen as a generalized version of “Barabási-Albert (BA) model”. WeDiG not only deals with weighed directed systems, but also it can handle the […]

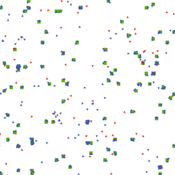

Food Safety Inspection Model - Random Strategy

Sara Mcphee-Knowles | Published Wednesday, March 05, 2014 | Last modified Monday, April 08, 2019The Inspection Model represents a basic food safety system where inspectors, consumers and stores interact. The purpose of the model is to provide insight into an optimal level of inspectors in a food system by comparing three search strategies.

Food Safety Inspection Model - Stores Signal with Errors

Sara Mcphee-Knowles | Published Wednesday, March 05, 2014 | Last modified Monday, April 08, 2019The Inspection Model represents a basic food safety system where inspectors, consumers and stores interact. The purpose of the model is to provide insight into an optimal level of inspectors in a food system by comparing three search strategies.

Food Safety Inspection Model - Stores Signal

Sara Mcphee-Knowles | Published Wednesday, March 05, 2014 | Last modified Monday, August 26, 2019The Inspection Model represents a basic food safety system where inspectors, consumers and stores interact. The purpose of the model is to provide insight into an optimal level of inspectors in a food system by comparing three search strategies.

Walk Away in groups

Athena Aktipis | Published Thursday, March 17, 2016This NetLogo model implements the Walk Away strategy in a spatial public goods game, where individuals have the ability to leave groups with insufficient levels of cooperation.

Displaying 10 of 932 results for "Am Vaes - Van De Hulsbeek" clear search