About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 3 of 3 results carbon tax clear search

This agent-based model (ABM), developed in NetLogo and available on the COMSES repository, simulates a stylized, competitive electricity market to explore the effects of carbon pricing policies under conditions of technological innovation. Unlike traditional models that treat innovation as exogenous, this ABM incorporates endogenous innovation dynamics, allowing clean technology costs to evolve based on cumulative deployment (Wright’s Law) or time (Moore’s Law). Electricity generation companies act as agents, making investment decisions across coal, gas, wind, and solar PV technologies based on expected returns and market conditions. The model evaluates three policy scenarios—No Policy, Emissions Trading System (ETS), and Carbon Tax—within a merit-order market framework. It is partially empirically grounded, using real-world data for technology costs and emissions caps. By capturing emergent system behavior, this model offers a flexible and transparent tool for analyzing the transition to low-carbon electricity systems.

Protein 2.0: An Agent-Based Model for Simulating Norway’s Protein Sector Under Carbon Pricing and the Emergence of Cultivated Proteins

Gary Polhill Nick Roxburgh Rob J.F. Burton Klaus Mittenzwei | Published Thursday, May 08, 2025Protein 2.0 is a systems model of the Norwegian protein sector designed to explore the potential impacts of carbon taxation and the emergence of cultivated meat and dairy technologies. The model simulates production, pricing, and consumption dynamics across conventional and cultivated protein sources, accounting for emissions intensity, technological learning, economies of scale, and agent behaviour. It assesses how carbon pricing could alter the competitiveness of conventional beef, lamb, pork, chicken, milk, and egg production relative to emerging cultivated alternatives, and evaluates the implications for domestic production, emissions, and food system resilience. The model provides a flexible platform for exploring policy scenarios and transition pathways in protein supply. Further details can be found in the associated publication.

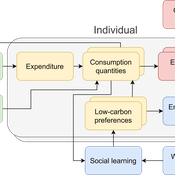

The cultural multiplier of climate policy

Daniel Torren-Peraire | Published Thursday, October 31, 2024For deep decarbonisation, the design of climate policy needs to account for consumption choices being influenced not only by pricing but also by social learning. This involves changes that pertain to the whole spectrum of consumption, possibly involving shifts in lifestyles. In this regard, it is crucial to consider not just short-term social learning processes but also slower, longer-term, cultural change. Against this background, we analyse the interaction between climate policy and cultural change, focusing on carbon taxation. We extend the notion of “social multiplier” of environmental policy derived in an earlier study to the context of multiple consumer needs while allowing for behavioural spillovers between these, giving rise to a “cultural multiplier”. We develop a model to assess how this cultural multiplier contributes to the effectiveness of carbon taxation. Our results show that the cultural multiplier stimulates greater low-carbon consumption compared to fixed preferences. The model results are of particular relevance for policy acceptance due to the cultural multiplier being most effective at low-carbon tax values, relative to a counter-case of short-term social interactions. Notably, at high carbon tax levels, the distinction between social and cultural multiplier effects diminishes, as the strong price signal drives even resistant individuals toward low-carbon consumption. By varying socio-economic conditions, such as substitutability between low- and high-carbon goods, social network structure, proximity of like-minded individuals and the richness of consumption lifestyles, the model provides insight into how cultural change can be leveraged to induce maximum effectiveness of climate policy.