Macroprudential Policy in a Heterogeneous Environment - An Application of Agent-Based Approach in Systemic Risk Modelling 1.0.0

One of the most important examples of the use of dynamic stochastic general equilibrium (DSGE)

models in research on macro-prudential policies is the DSGE model with 3 layers of default (3D) used by the European Systemic Risk Board and European Central Bank. The main goal of the 3D model was to create a framework for analysing positive and normative effects of macro-prudential policies as well as to analyse welfare effects within the social planner framework. However, this framework does not include the heterogeneity of agents that would change the optimal values of macroprudential tools and the conclusions about distributional effects of these policies. We present an alternative tool to DSGE, namely agent-based simulation (ABM), that can be used to carry out counterfactual simulation of the impact of macroprudential policies on the economy, financial system and society. By developing a sophisticated database of agents’ attributes and an agent-based simulation, we contribute to the existing literature of agent-based modelling through detailed and relatively broad insight into heterogeneity of agents. We show the stabilizing effects of macroprudential policies on an unstable heterogeneous economy and financial system, as well as we analyse the distributional effects of these policies in the approach that goes beyond the social planner framework.

Release Notes

Presented is an ABM model suitable for performing simulations that provide detailed insight into the nature of the relationship between the financial system and the real part of the economy. One of application of this ABM simulation is the study of effects of macroprudential policies on the heterogeneous economy, financial system and the society (welfare analysis). This application was presented in the paper “Macroprudential policies in Heterogeneous Environment - An Application of Agent-Based Approach in Systemic Risk Modelling”.

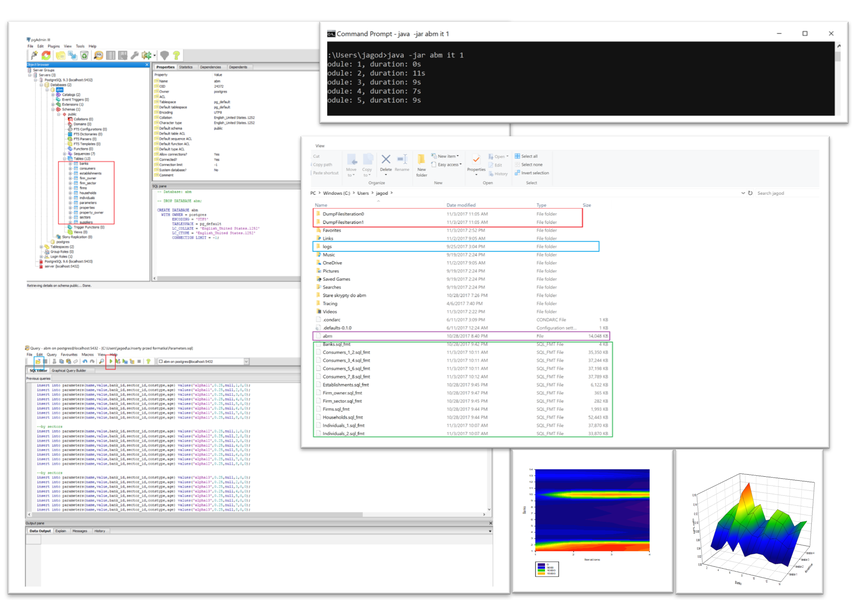

The simulation was developed using object-oriented programming in Java-NetBeans and Eclipse environments. Statistical data to determine the attributes of system agents were grouped in a relational database (PostGreSQLpgAdmin III). The simulation was linked to the database using Hibernate and SQL queries. In the model, 9 objects are distinguished: Banks, Individuals, Households, Consumers, Firms, Establishments, Suppliers, Properties, and Industries. All Parameters in a separate object are also defined. The relations between agents in the model are presented in the Figure “Schema” (cf. Narrative documentation files). The attributes of the agents can be found on the following Figure in the file “Attributes” (cf. Narrative documentation files). The description of how to use the simulation can be found in the file “Description how to use” (cf. Narrative documentation files).

In order to run simulation, the user need to install: Java (9 or higher), PostGreSQL-PgAdminIII, NotepadC++, glogg (to open the simulation results).

Then the user should upload data for each of agents (e.g. empirical data for all attrubutes of all household, banks, firms etc. in the system). Please note that all agents are interrelated so data need to be consistent for all of them (e.g. each individual belongs to one of the households, lives in one of the properties etc.). The simulation can be run using the file “ABM” following the description (“Description how to use”, cf. Narrative documentation file).